- United States

- /

- Media

- /

- NasdaqGS:CRTO

Is Criteo’s (CRTO) Google Partnership a Turning Point for Its Retail Media Strategy?

Reviewed by Simply Wall St

- On September 10, 2025, Criteo announced a new integration with Google, becoming Google's first onsite retail media partner through an initial beta in the Americas via Search Ads 360 and aiming for global expansion.

- This collaboration enables Criteo's network of over 200 retailers to access new demand channels and provides brands with unified campaign measurement across both platforms, supporting broader participation in retail media beyond dominant market players.

- We'll explore how Criteo's role as Google's first onsite retail media partner could impact its investment narrative and growth outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Criteo Investment Narrative Recap

To own Criteo stock, you need to believe the company can scale its retail media and platform partnerships faster than rivals with larger data pools and broader reach. The recent Google integration stands out as a positive catalyst, as it broadens demand channels, but whether it materially boosts Criteo’s near-term revenue growth and margin improvement remains to be seen, client concentration and stagnant ad spend still pose headline risks if not addressed.

Of recent announcements, Criteo’s July partnership with WPP Media to bring commerce intelligence to Connected TV is closely aligned with the latest Google development. Both highlight a focused push to diversify demand and enhance Criteo’s cross-channel capabilities, which is especially relevant as retail media and programmatic solutions are viewed as engines for renewed top-line acceleration.

But on the other hand, investors should keep in mind that if increased competition from tech giants continues to pressure Criteo’s market share and limits the company’s ability to scale innovations...

Read the full narrative on Criteo (it's free!)

Criteo's narrative projects $1.0 billion in revenue and $147.8 million in earnings by 2028. This requires a 19.2% yearly revenue decline and a $11.3 million increase in earnings from the current $136.5 million.

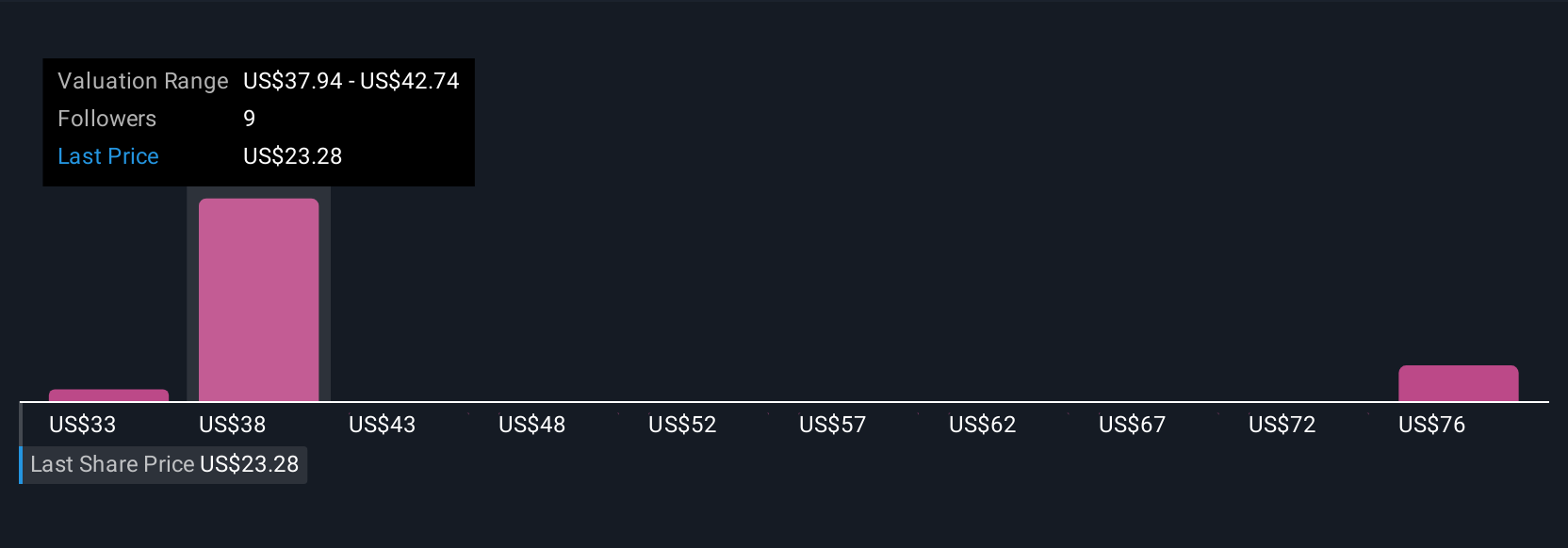

Uncover how Criteo's forecasts yield a $38.17 fair value, a 73% upside to its current price.

Exploring Other Perspectives

Three separate fair value estimates from the Simply Wall St Community cluster between US$33.14 and US$97.21, highlighting a wide spread of investor views. Against this backdrop, ongoing concerns about client concentration and sluggish top-line growth could have broad implications for future performance, so consider reviewing a range of community perspectives.

Explore 3 other fair value estimates on Criteo - why the stock might be worth just $33.14!

Build Your Own Criteo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Criteo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Criteo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Criteo's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRTO

Criteo

A technology company, provides marketing and monetization services and infrastructure on the open internet in North and South America, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives