- United States

- /

- Media

- /

- NasdaqGS:CRTO

How DoorDash Partnership Is Shaping Criteo’s (CRTO) Role in Retail Media Expansion

Reviewed by Sasha Jovanovic

- Criteo and DoorDash recently announced a multi-year partnership to scale advertising across DoorDash's marketplace with grocery, convenience, and non-restaurant retailers, with Criteo acting as an extension of DoorDash’s U.S. ad sales team and integrating new ad technologies over time.

- This collaboration gives agencies and brands broader access to DoorDash’s unique ad formats on-site and on off-site channels, aligning with the expanding potential of retail media as a fast-growing area within digital advertising.

- We’ll explore how Criteo’s expanded access to DoorDash’s retail media inventory could influence the company’s broader investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Criteo Investment Narrative Recap

To own shares of Criteo, investors should believe in the company's ability to capture a greater share of digital ad spend through AI-driven retail media, as consumer brands increasingly seek data-rich, privacy-compliant channels. The DoorDash partnership expands Criteo’s retail media footprint, but this alone may not quickly address the short-term catalyst, revitalizing top-line growth, nor offset the ongoing risk of client concentration and weak overall ad spend trends, which remain central to near-term results.

Among Criteo’s recent announcements, the integration with Google as its first onsite retail media partner stands out as most relevant, adding both diversity and scale to its product offering. This move, together with the DoorDash agreement, reinforces Criteo’s push into high-visibility inventory for agencies and brands, aligning with catalysts around the rapid adoption of AI-powered retail media and positioning the company for cross-channel ad growth.

However, for investors, it’s important not to overlook the elevated risk that comes if a few key clients reduce spend or if ad trading volumes stagnate...

Read the full narrative on Criteo (it's free!)

Criteo's outlook projects $1.0 billion in revenue and $147.8 million in earnings by 2028. This reflects a yearly revenue decline of 19.2% and an earnings increase of $11.3 million from current earnings of $136.5 million.

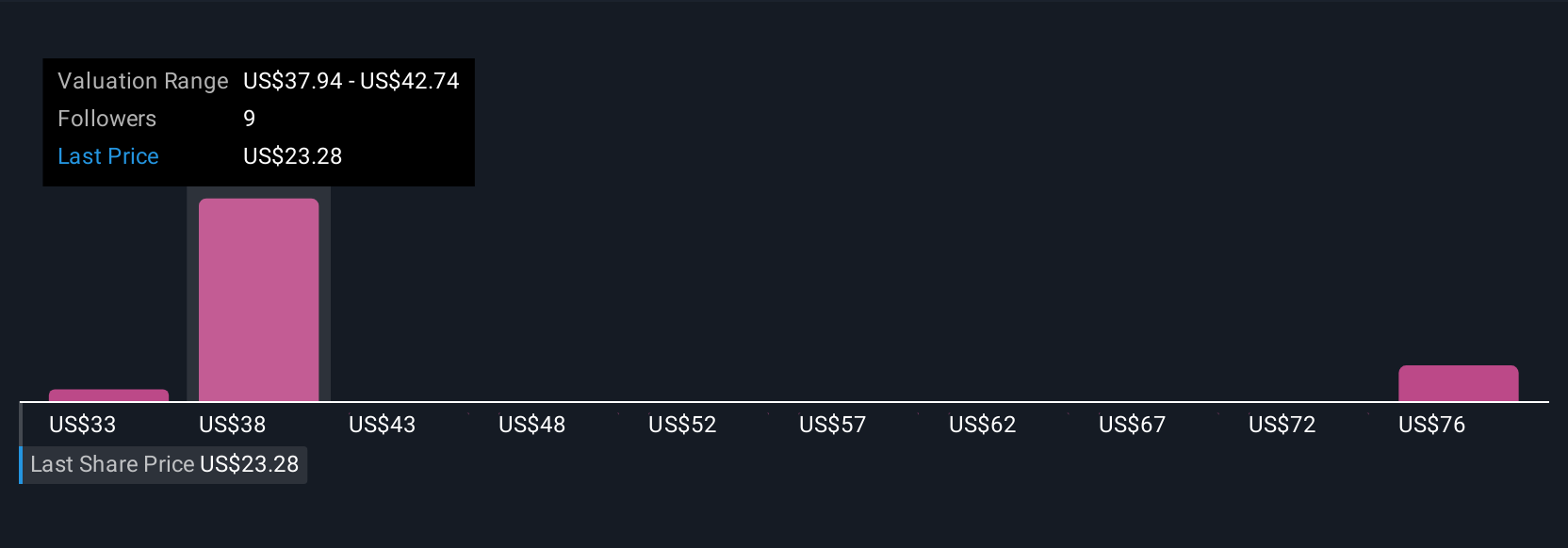

Uncover how Criteo's forecasts yield a $38.17 fair value, a 93% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range widely, from US$33.14 to as high as US$96.84 based on four individual perspectives. While views differ, competition and market share pressures from major tech platforms also weigh on Criteo’s efforts to scale its innovations and drive growth, pushing you to consider several angles for the company’s outlook.

Explore 4 other fair value estimates on Criteo - why the stock might be worth just $33.14!

Build Your Own Criteo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Criteo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Criteo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Criteo's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRTO

Criteo

A technology company, provides marketing and monetization services and infrastructure on the open internet in North and South America, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives