The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Creative Realities, Inc. (NASDAQ:CREX) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Creative Realities

What Is Creative Realities's Net Debt?

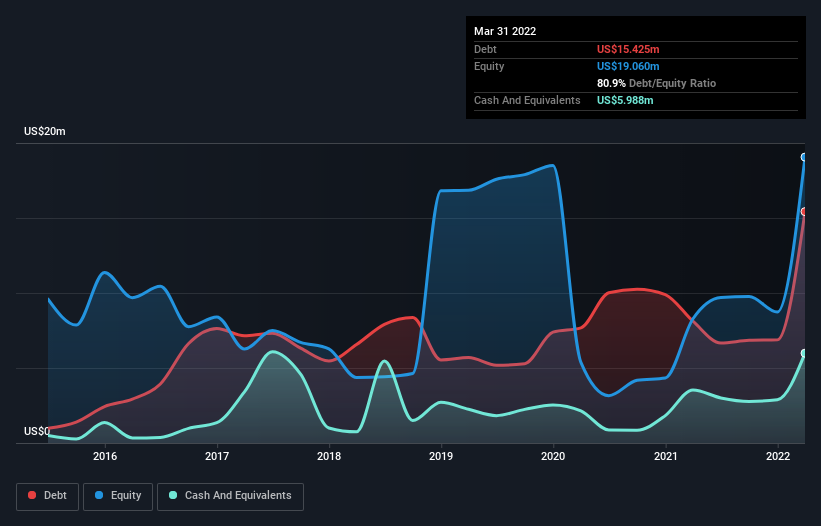

As you can see below, at the end of March 2022, Creative Realities had US$15.4m of debt, up from US$8.12m a year ago. Click the image for more detail. However, it does have US$5.99m in cash offsetting this, leading to net debt of about US$9.44m.

How Strong Is Creative Realities' Balance Sheet?

The latest balance sheet data shows that Creative Realities had liabilities of US$16.9m due within a year, and liabilities of US$27.0m falling due after that. Offsetting this, it had US$5.99m in cash and US$8.81m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$29.0m.

This deficit casts a shadow over the US$16.0m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Creative Realities would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Creative Realities's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Creative Realities wasn't profitable at an EBIT level, but managed to grow its revenue by 29%, to US$24m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Even though Creative Realities managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Its EBIT loss was a whopping US$3.0m. Considering that alongside the liabilities mentioned above make us nervous about the company. It would need to improve its operations quickly for us to be interested in it. Not least because it burned through US$136k in negative free cash flow over the last year. That means it's on the risky side of things. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example Creative Realities has 6 warning signs (and 3 which are a bit unpleasant) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you're looking to trade Creative Realities, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CREX

Creative Realities

Provides digital marketing technology and solutions in the United States and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives