- United States

- /

- Media

- /

- NasdaqGS:CMCSA

Has Comcast’s 2025 Slide Created Opportunity After 2026 Super Bowl Ad Sellout?

Reviewed by Simply Wall St

If you have ever found yourself refreshing your brokerage app and hesitating over Comcast, you are not alone. The name is everywhere, from Super Bowl commercials to courtroom headlines, and lately, the stock price has left plenty of investors second-guessing themselves. In the past week alone, Comcast shares dipped by 4.1%, capping off a 30-day slide of 3.5%. Stretch that out to the year, and we are looking at a 13.7% decline, with a 15% drop over twelve months. For many, this string of red numbers raises the obvious question: is Comcast falling out of favor, or could it be an overlooked bargain?

Take a closer look, though, and the story gets more interesting. Despite that bumpy ride, Comcast’s underlying business keeps grabbing headlines for both big wins and bold moves. For example, NBCUniversal’s sold-out NFL ad slots and a blockbuster bid for MLB rights have attracted attention, not to mention those high-profile legal battles with Disney and Warner Bros. The stock’s five-year record still trends negative, down 20.1%, but there has been a glimmer of resilience, with shares eking out a 4.8% gain since 2022.

But how do you put all these numbers in perspective? Enter valuation. Across six widely-used “undervalued” checks, Comcast scores a perfect 6 out of 6. On paper, that is a rare sign of real long-term potential hiding beneath the headlines and volatility. So, how do these valuation checks actually work, and what can they miss? Let us dig into the numbers, and at the end, we will explore a smarter way to look past the spreadsheets and see what truly matters for this stock.

Why Comcast is lagging behind its peersApproach 1: Comcast Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation approach that estimates a company’s intrinsic worth by projecting its future cash flows and then discounting those numbers back to their present value. This method gives investors a way to look past short-term volatility and headlines to focus on what the business could actually be worth based on its ability to generate cash.

For Comcast, the DCF model uses a two-stage Free Cash Flow to Equity approach. The company’s current Free Cash Flow stands at $15.8 billion, providing a robust foundation in the media sector. Analyst estimates extend through 2029, with expectations that Free Cash Flow will climb to just under $16.8 billion by the end of that period. After considering ongoing analyst input for the next five years, future projections gradually rely more on carefully modeled extrapolations. All figures are in US dollars.

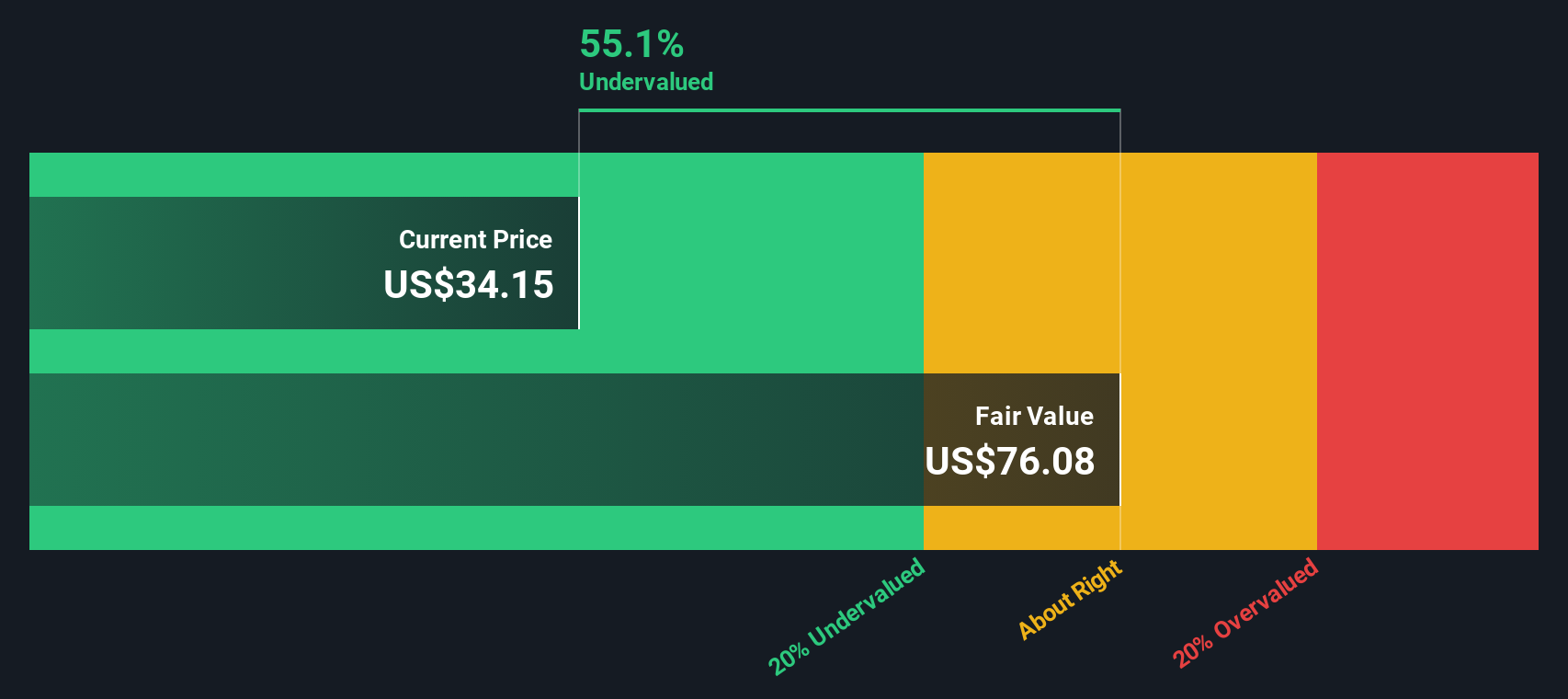

This process yields an intrinsic value of $80.02 per share. With Comcast’s current price reflecting a 59.6% discount to that calculated value, the DCF model suggests the stock is significantly undervalued relative to what its long-term cash generation potential implies.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Comcast.

Approach 2: Comcast Price vs Earnings

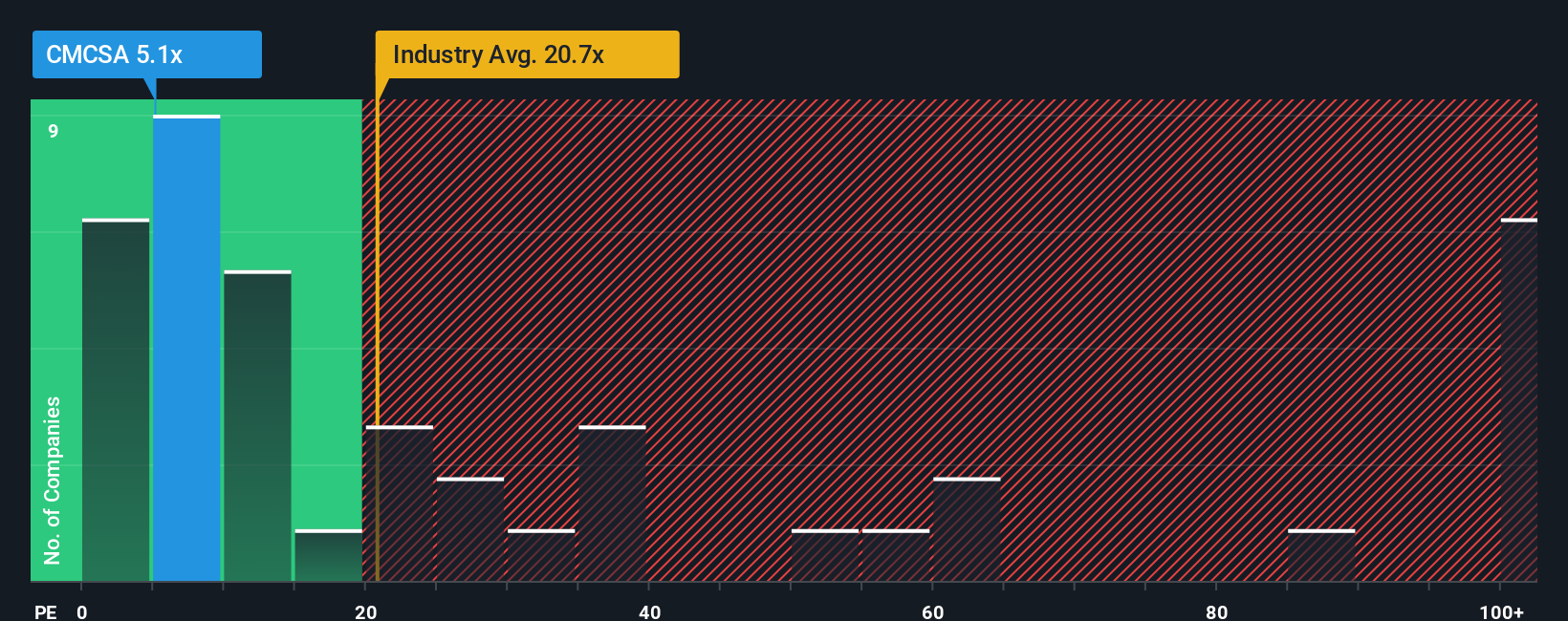

For established, profitable companies like Comcast, the price-to-earnings (PE) ratio is a tried-and-true valuation tool. It measures the price investors are willing to pay today for one dollar of current earnings, giving a snapshot of market sentiment and perceived future prospects.

The “right” PE ratio depends on more than just recent profits. Companies with stronger earnings growth and lower risks tend to deserve higher multiples, while slower-growing or riskier businesses are often assigned lower ones. Investors typically look at industry averages and peer comparisons as a baseline, but these numbers do not always capture the full picture.

Comcast currently trades at a PE ratio of 5.2x, which is substantially below its industry average of 20.1x and the peer group average of 46.1x. However, Simply Wall St’s proprietary Fair Ratio blends deeper factors such as Comcast’s earnings growth outlook, profit margins, risks, industry, and market cap. According to this holistic framework, Comcast’s Fair Ratio stands at 17.8x. This approach is more actionable than basic peer or industry comparisons because it directly adjusts for company-specific strengths and risks, rather than assuming one-size-fits-all benchmarks.

With Comcast’s actual PE far below its Fair Ratio, the stock appears undervalued by this measure. This suggests the market may be overlooking its underlying fundamentals.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Comcast Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a structured way to connect your perspective on a company’s story, such as Comcast’s broadband innovation or intensifying competition, directly to your own forecasted numbers for revenue, earnings, margins and ultimately, fair value.

Think of Narratives as a bridge between the numbers on a spreadsheet and the real-world events that drive those numbers. This approach helps you clearly link what you believe about Comcast’s business to a specific financial outcome. It is accessible and transparent for investors of all skill levels and is available to millions of users right now within the Community page on Simply Wall St’s platform.

With Narratives, you can monitor your assumptions as new earnings or news emerge. The platform dynamically updates them, making it easier to know when your story still holds up or needs tweaking. Most importantly, Narratives help you identify smart entry or exit points. If your Fair Value is above the current Price, it might be a buy; whereas if it drops below, that could be a red flag.

For example, bullish investors using Narratives see Comcast’s Fair Value as high as $49.43, while the most bearish put it at just $31.00. This shows exactly how much perspectives and potential outcomes can differ.

For Comcast, we'll make it really easy for you with previews of two leading Comcast Narratives:

Fair Value: $39.75

Undervalued by approximately 18.8%

Analyst Revenue Growth Assumption: 1.2%

- Ongoing investments in broadband (DOCSIS 4.0), streaming (Peacock), and theme parks are expected to drive growth, improve margins, and enhance cash flow visibility.

- Expansion of theme parks and favorable tax changes are anticipated to strengthen earnings resilience and support higher shareholder returns and reinvestment.

- Risks include rising competition in broadband, pressure on advertising and content costs, and potential margin headwinds. However, analysts believe the long-term value is above current pricing.

Fair Value: $31.00

Overvalued by approximately 4.2%

Bearish Analyst Revenue Growth Assumption: -0.1%

- Stagnant broadband growth and ongoing cord-cutting are expected to place sustained pressure on Comcast's largest business lines and margins.

- Rising costs for content, sports rights, and capital expenditures, combined with regulatory headwinds, may erode free cash flow and constrain shareholder returns.

- While strategic pivots in streaming and theme parks offer some adaptation, risks of negative earnings surprises and lower fair value remain prominent in this outlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCSA

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives