- United States

- /

- Media

- /

- NasdaqGS:CMCSA

Comcast (NasdaqGS:CMCSA) Expands Fiber Network To Westlake Florida For Faster Internet Access

Reviewed by Simply Wall St

Comcast (NasdaqGS:CMCSA) recently announced the development of a new fiber Internet network in Westlake, Florida, contributing to enhanced service reach and potential growth. Over the last quarter, Comcast's stock rose by 8%, which aligned closely with broader market movements where the market itself increased by 2%. During this period, the company's efforts in expanding its network in various locations and the launch of a community-focused Xfinity Store in Georgia likely added to investor confidence. Meanwhile, executive appointments and shareholder proposals, while part of the company’s corporate activities, didn't divert significantly from overall positive market trends.

The recent development of Comcast's new fiber Internet network in Westlake, Florida could provide a modest boost to its revenue projections by enhancing service reach, although challenges in its broadband segment persist due to stiff competition. The launch of the community-focused Xfinity Store in Georgia may fortify customer relationships, potentially impacting earnings stability positively in the long term.

Over the past five years, Comcast's total shareholder return was 4.75%, indicating limited growth over this extended period. This performance highlights the company's consistent, albeit moderate, returns, contrasting with more recent fluctuations in share price such as the 8% rise over the last quarter. Compared to the media industry, Comcast underperformed in the past year, not reaching the same levels of return that the sector experienced.

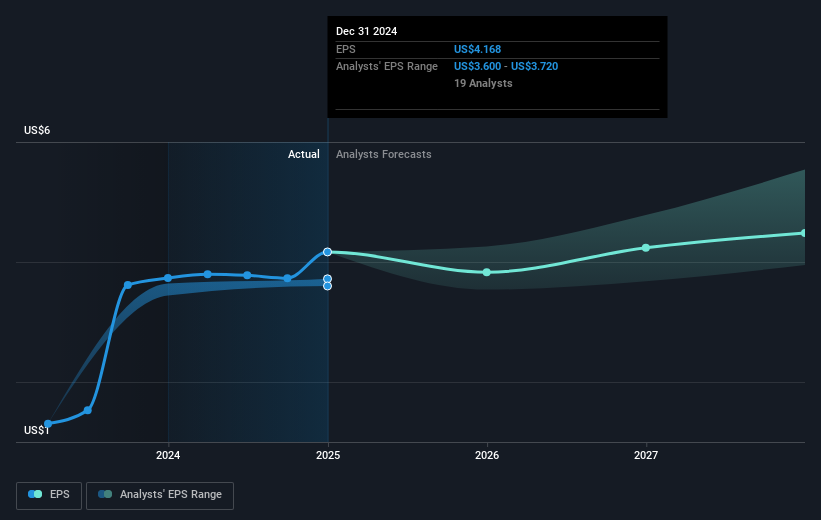

In light of the recent news, Comcast's efforts might not immediately alter revenue or earnings forecasts significantly given the outlined operational challenges and competitive pressures. The consensus analyst price target of US$39.99 suggests some upside potential from the current share price of US$34.49, indicating that there might be room for stock appreciation if the company successfully capitalizes on its growth initiatives. However, with the price still trailing behind estimates, market participants appear cautious, reflecting the broader skepticism among analysts regarding future revenue and earnings trajectory amid intense industry competition and economic pressures.

Click here to discover the nuances of Comcast with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCSA

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives