- United States

- /

- Media

- /

- NasdaqGS:CHTR

Should You Reconsider Charter After Latest FCC Ruling and Share Price Dip?

Reviewed by Bailey Pemberton

Thinking about what to do with Charter Communications stock? You’re not alone. This is a name that sparks strong opinions among investors, and with so much in flux in the communications sector, it’s no wonder you want to take a closer look. Charter’s share price has had a turbulent ride lately, dropping just 0.3% in the past week but climbing 4.0% over the last month, giving short-term optimists a bit of momentum to point to. Still, step back, and the longer-term picture is more complex, with the stock down 21.5% so far this year and off nearly 57.0% from its five-year high. This dramatic fall has caught the eye of value watchers. Part of this volatility has been fueled by shifts in broadband demand, the evolution of consumer streaming habits, and industry-wide efforts to innovate with new bundled offerings.

With all those moves, where does Charter’s valuation stand today? According to our latest assessment, the company is undervalued in 5 out of 6 key checks, giving it a solid valuation score of 5. That is well above average and suggests real potential for value-oriented investors. But before you jump in, it’s worth breaking down exactly what those scoring methods tell us about the company. And, toward the end of this piece, I’ll share an even smarter way to understand what Charter’s really worth.

Why Charter Communications is lagging behind its peers

Approach 1: Charter Communications Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and discounts them back to their present value to estimate what the business is worth today. For Charter Communications, this model is based on the company’s Free Cash Flow, which reflects the actual cash Charter generates that can be returned to shareholders.

Currently, Charter’s trailing twelve months Free Cash Flow stands at $4.1 Billion. Analysts forecast that by the end of 2029, this annual cash flow could reach $9.8 Billion, more than doubling over a ten-year period. It is worth noting that while analysts provide only the initial five years of projections, future numbers beyond that are calculated using systematic, data-driven estimates.

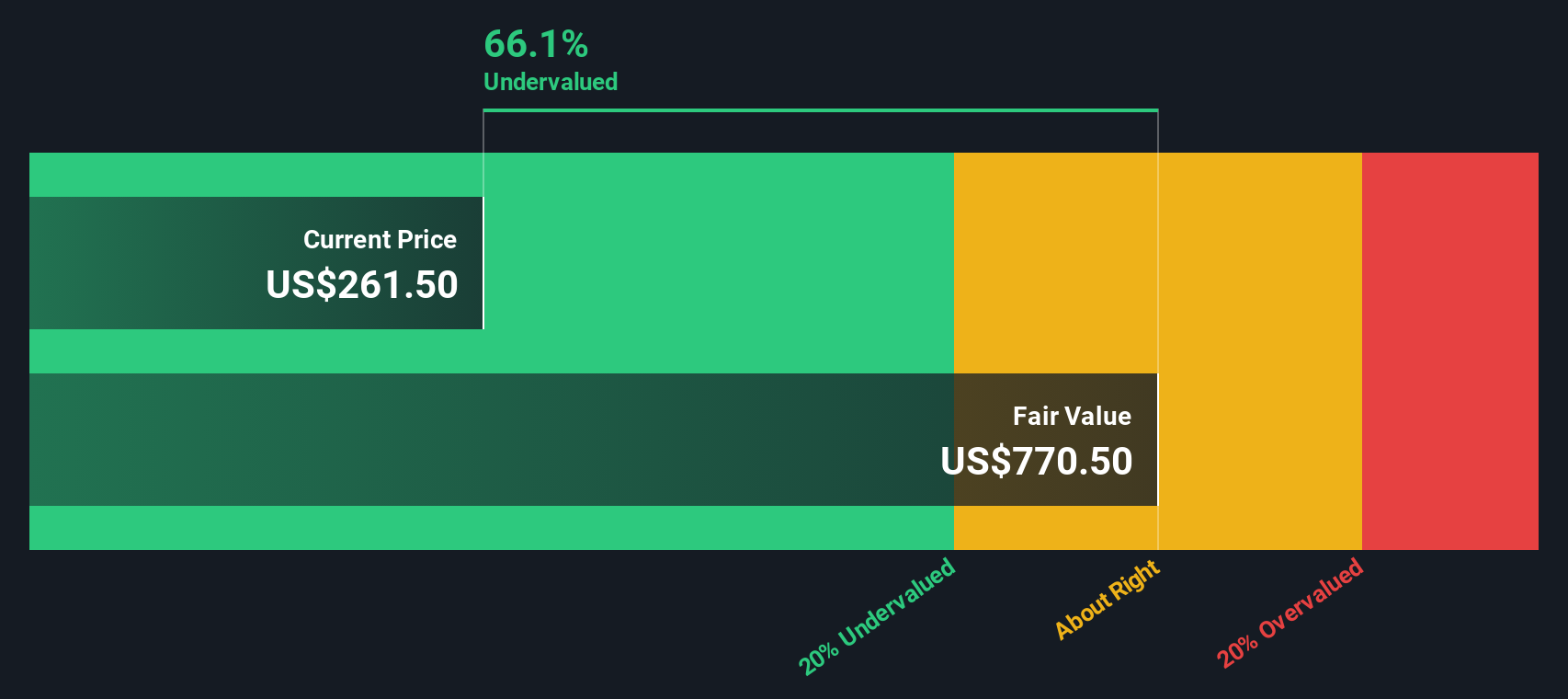

After analyzing this series of projected cash flows and discounting them to reflect their present value, the DCF model estimates Charter’s intrinsic value at $847.10 per share. Compared to the company’s current share price, this suggests Charter is trading at a 67.6% discount. This indicates the stock appears to be significantly undervalued based on the cash the business is expected to generate in the years ahead.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Charter Communications is undervalued by 67.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Charter Communications Price vs Earnings

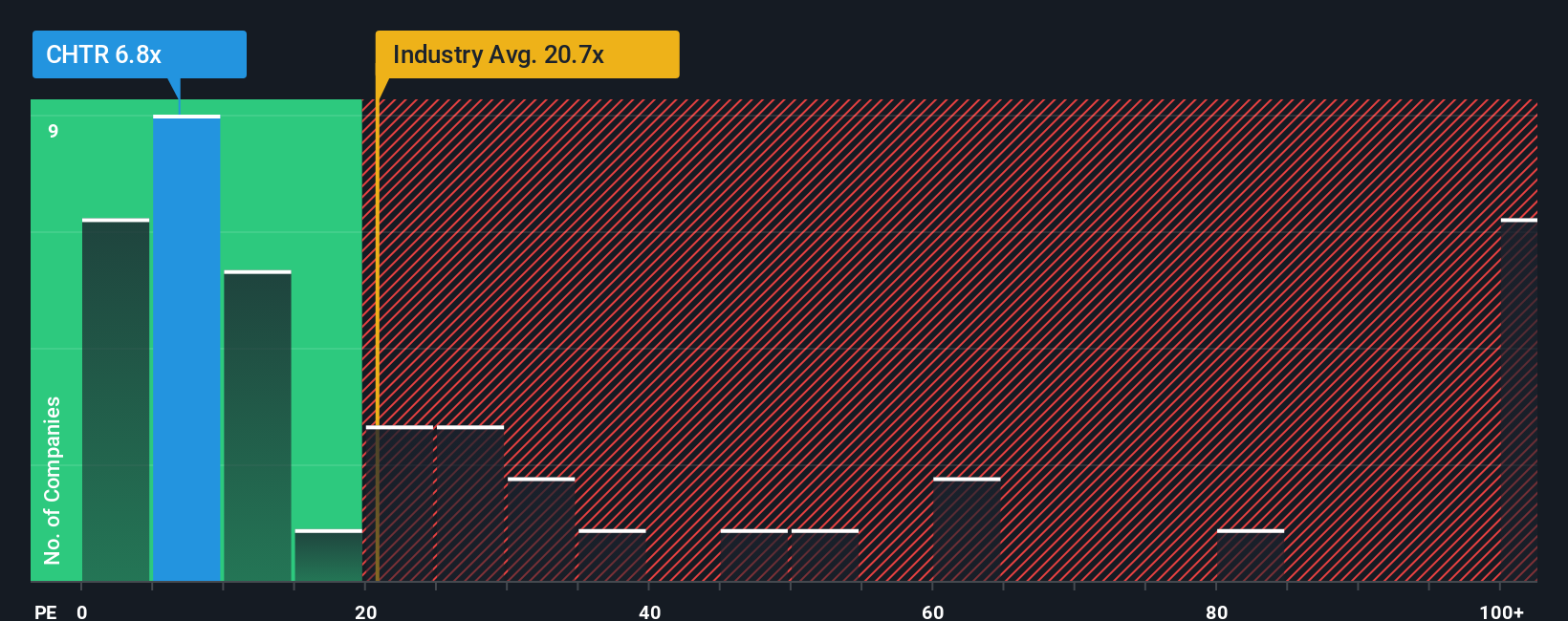

The Price-to-Earnings (PE) ratio is often the go-to valuation metric for profitable companies like Charter Communications, as it directly links a company’s share price to its bottom-line earnings. This makes it a powerful tool for investors who want to compare how much the market is willing to pay for a dollar of the company’s profit.

It is important to remember that a "normal" or "fair" PE ratio is not one-size-fits-all. Investors expect to pay a higher multiple for companies with stronger growth prospects and lower risk, while riskier or slower-growing companies typically trade at a discount. Benchmarks such as the peer group average PE of 25x and the Media industry’s average PE of around 20x provide useful context on how the market values similar stocks.

Currently, Charter trades at a PE ratio of just 7.1x, which is substantially below both its peer average and the industry norm. To get a more tailored view, Simply Wall St’s 'Fair Ratio' model adjusts for Charter’s unique characteristics, including its earnings growth rate, profit margin, industry dynamics, market cap, and risk profile. This model sets Charter’s fair PE ratio at 23.3x. Because this score incorporates factors beyond simple peer comparisons, it gives a much clearer picture of value for the stock.

With Charter’s current PE multiple well below its Fair Ratio, this suggests the market is underappreciating the company’s intrinsic worth and future profit potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Charter Communications Narrative

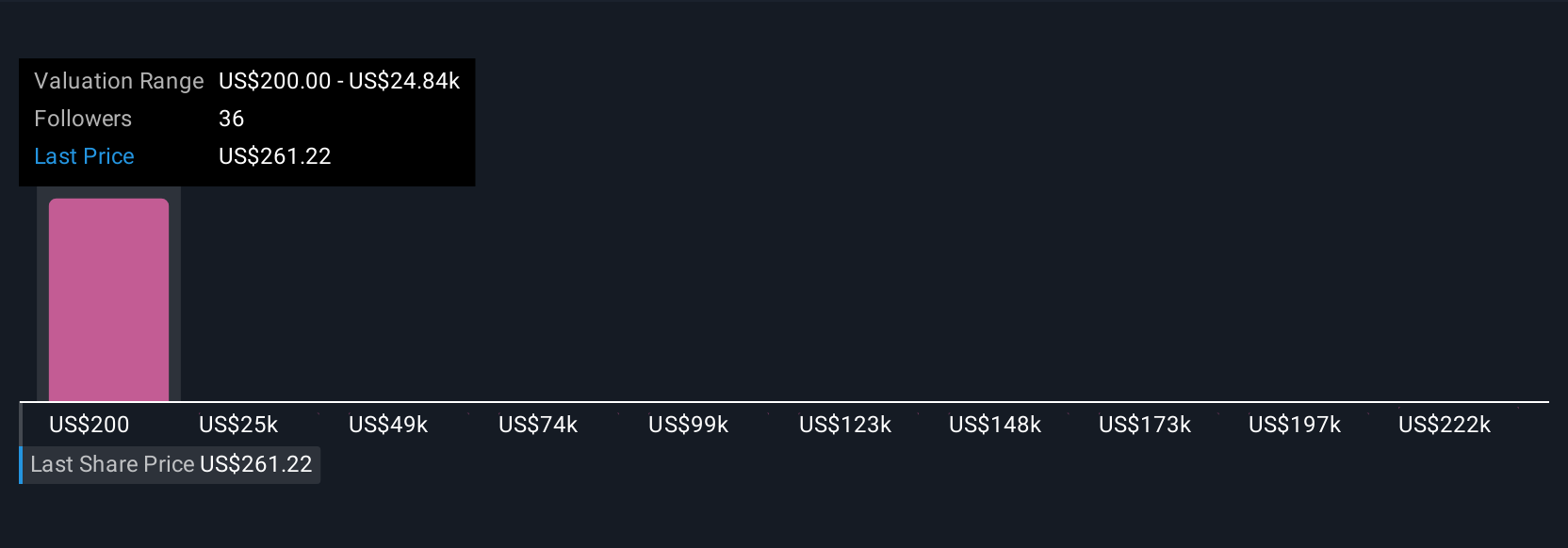

Earlier we mentioned that there is an even better way to understand what a company like Charter Communications is really worth, so let’s introduce you to Narratives. A Narrative connects your unique view of the company’s future—how you think its story will unfold—with a specific financial forecast and a resulting fair value. Rather than just crunching numbers, Narratives let you combine your assumptions about future revenue, profit margins, and risks to build a clear, personalized valuation, all within Simply Wall St’s Community page, where millions of investors share ideas.

This approach is simple and accessible: you outline your perspective, the platform connects it to real financial estimates, and you get a fair value that you can compare with the current share price. This can help you decide if it’s time to buy, sell, or hold. Narratives are automatically updated whenever new company news or earnings reports arrive, so your investment view stays current. For Charter Communications, some investors believe its strategic expansion and cost-cutting could justify a price target as high as $500. Others see increased competition and declining subscribers as signs its fair value is closer to $223, showing just how powerful and dynamic the Narrative approach can be.

Do you think there's more to the story for Charter Communications? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHTR

Charter Communications

Operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026