- United States

- /

- Food

- /

- NasdaqCM:JVA

HeartBeam And 2 Other US Penny Stocks With Promising Potential

Reviewed by Simply Wall St

As the U.S. stock market reaches record highs, driven by strong tech earnings and anticipation of Federal Reserve insights, investors are exploring diverse opportunities across various sectors. Penny stocks, though often associated with speculative trading, remain a compelling area for those seeking potential value in smaller or newer companies. By focusing on penny stocks with robust financials and growth potential, investors can uncover promising opportunities that might otherwise go unnoticed in the broader market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.46 | $2B | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.83 | $5.94M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $145.16M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.99 | $91.9M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.24 | $8.91M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.88 | $2.51B | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9381 | $86.31M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.81 | $401.48M | ★★★★☆☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

HeartBeam (NasdaqCM:BEAT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: HeartBeam, Inc. is a medical technology company that develops and commercializes ambulatory electrocardiogram solutions for detecting and monitoring cardiac disease both inside and outside healthcare facilities, with a market cap of $78.40 million.

Operations: There are no revenue segments reported for HeartBeam, Inc.

Market Cap: $78.4M

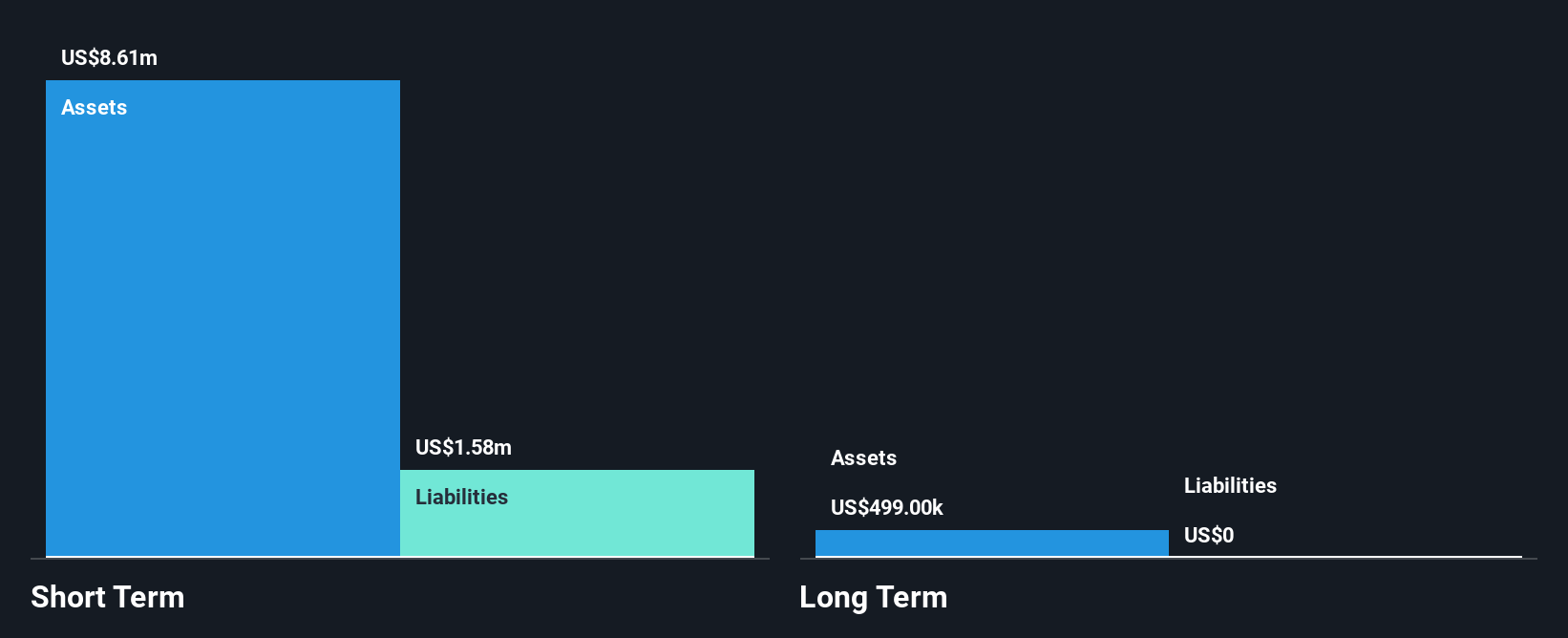

HeartBeam, Inc., a pre-revenue medical technology company with a market cap of US$78.40 million, focuses on developing innovative cardiac monitoring solutions. Recent presentations at the American Heart Association highlighted promising study results for its vector-based ECG technology, which could enhance arrhythmia and heart attack detection. Despite these advancements, HeartBeam remains unprofitable with increasing losses and is not expected to achieve profitability in the near term. The company has less than one year of cash runway and no long-term liabilities but benefits from an experienced new CEO poised to guide it through FDA reviews and potential commercialization efforts.

- Click here and access our complete financial health analysis report to understand the dynamics of HeartBeam.

- Examine HeartBeam's earnings growth report to understand how analysts expect it to perform.

Cheer Holding (NasdaqCM:CHR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cheer Holding, Inc., with a market cap of $27.67 million, operates through its subsidiaries to offer advertisement and content production services in the People’s Republic of China.

Operations: The company generates revenue from two primary segments: $15.04 million from the Traditional Media Business and $140.90 million from the Cheers App Internet Business.

Market Cap: $27.67M

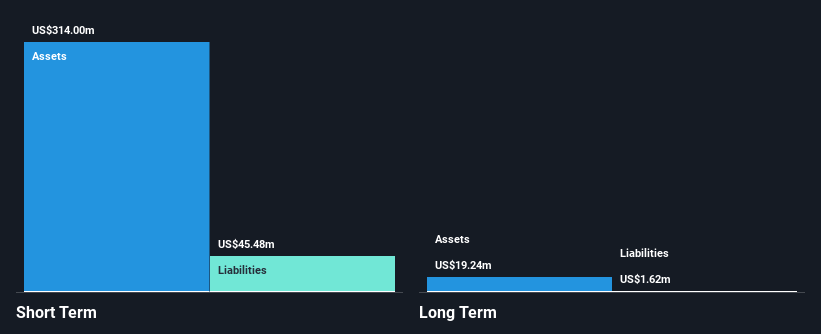

Cheer Holding, Inc., with a market cap of US$27.67 million, operates in the advertising and content production sector in China. The company has announced a significant share repurchase program worth up to US$50 million over 36 months, potentially enhancing shareholder value. Its financial health is underscored by short-term assets of US$314 million exceeding liabilities and debt being well-covered by cash flow. While earnings grew by 37.5% last year, outperforming industry averages, long-term profit growth remains challenged with a decline over five years. Recent dilution and low return on equity are areas for investor consideration amidst its strategic initiatives.

- Click here to discover the nuances of Cheer Holding with our detailed analytical financial health report.

- Gain insights into Cheer Holding's past trends and performance with our report on the company's historical track record.

Coffee Holding (NasdaqCM:JVA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Coffee Holding Co., Inc. is involved in the manufacturing, roasting, packaging, marketing, and distribution of roasted and blended coffees across the United States, Australia, Canada, England, and China with a market cap of $22.95 million.

Operations: The company generates revenue of $76.11 million from its wholesale grocery segment.

Market Cap: $22.95M

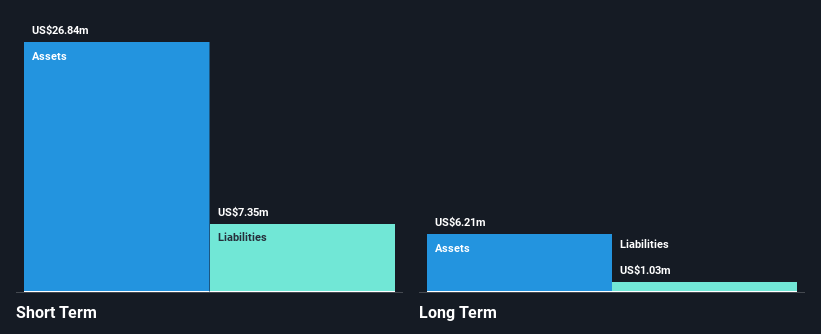

Coffee Holding Co., Inc. has recently achieved profitability, reporting net income of US$0.63 million for Q3 2024, a turnaround from a loss the previous year. With revenues of US$18.81 million this quarter, up from US$15.76 million last year, the company's financial health is bolstered by short-term assets exceeding both short- and long-term liabilities significantly. Despite its low return on equity at 4.6%, Coffee Holding's debt levels are well-managed with cash exceeding total debt and interest payments covered by EBIT multiple times over, supporting stability amidst high share price volatility in recent months.

- Take a closer look at Coffee Holding's potential here in our financial health report.

- Gain insights into Coffee Holding's historical outcomes by reviewing our past performance report.

Taking Advantage

- Take a closer look at our US Penny Stocks list of 709 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:JVA

Coffee Holding

Engages in manufacturing, roasting, packaging, marketing, and distributing roasted and blended coffees in the United States, Australia, Canada, England, and China.

Flawless balance sheet and fair value.