- United States

- /

- Media

- /

- NasdaqGM:CDLX

Cardlytics, Inc.'s (NASDAQ:CDLX) 63% Share Price Plunge Could Signal Some Risk

Cardlytics, Inc. (NASDAQ:CDLX) shareholders that were waiting for something to happen have been dealt a blow with a 63% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 77% share price decline.

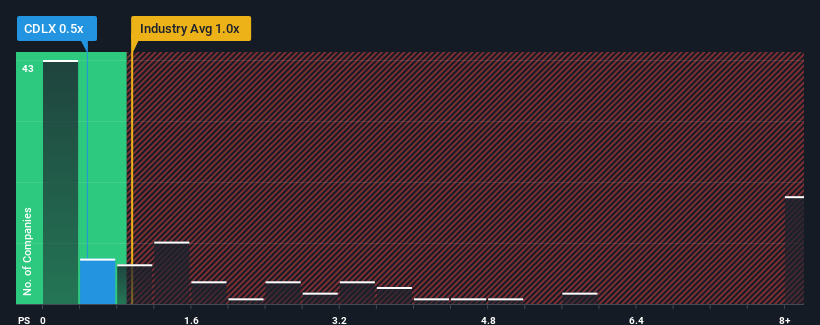

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Cardlytics' P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Media industry in the United States is also close to 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Cardlytics

What Does Cardlytics' Recent Performance Look Like?

There hasn't been much to differentiate Cardlytics' and the industry's revenue growth lately. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on Cardlytics will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Cardlytics will help you uncover what's on the horizon.How Is Cardlytics' Revenue Growth Trending?

In order to justify its P/S ratio, Cardlytics would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.1%. Pleasingly, revenue has also lifted 36% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 0.05% during the coming year according to the five analysts following the company. With the industry predicted to deliver 4.1% growth, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Cardlytics' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

With its share price dropping off a cliff, the P/S for Cardlytics looks to be in line with the rest of the Media industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

While Cardlytics' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Plus, you should also learn about these 3 warning signs we've spotted with Cardlytics (including 1 which is a bit unpleasant).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CDLX

Cardlytics

Operates an advertising platform in the United States and the United Kingdom.

Undervalued with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026