- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:CARG

Why CarGurus (CARG) Is Up 11.3% After Exiting CarOffer and Expanding Share Buybacks

Reviewed by Simply Wall St

- CarGurus, Inc. reported strong second-quarter 2025 results, marking a swing to profitability with US$22.34 million in net income and increased revenue, while announcing it will wind down its CarOffer wholesale business before the end of 2025 and expand its share buyback program by US$150 million.

- This move signals a shift in CarGurus’ strategy, emphasizing higher-margin AI-powered analytics and marketplace operations, and ending efforts in the more volatile transaction facilitation segment.

- We’ll examine how the exit from CarOffer may reshape CarGurus’ long-term investment thesis and future profitability potential.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

CarGurus Investment Narrative Recap

To be a shareholder in CarGurus, you need to believe in the company’s ability to drive sustainable growth from its core AI-powered marketplace and analytics platform, even as it adapts to changes in the automotive retail space. The recent exit from CarOffer, while reducing exposure to volatile wholesale transactions, is not likely to materially change the biggest near-term catalyst, expanding dealer adoption of its technology, or the main risk, which centers around intensifying competition and market share pressures.

Among the recent announcements, CarGurus' decision to wind down CarOffer stands out. This move directly addresses the risk of operating within lower-margin, volatile segments of the auto industry and allows the company to focus on its strengths in data-driven insights, which ties back to its main growth catalyst of strengthening its marketplace position through technology innovation.

However, investors should be aware that, by narrowing its focus to higher-margin operations, CarGurus still faces growing challenges from new digital retail competitors and...

Read the full narrative on CarGurus (it's free!)

CarGurus' narrative projects $1.1 billion revenue and $310.9 million earnings by 2028. This requires 6.2% yearly revenue growth and a $181.1 million earnings increase from $129.8 million today.

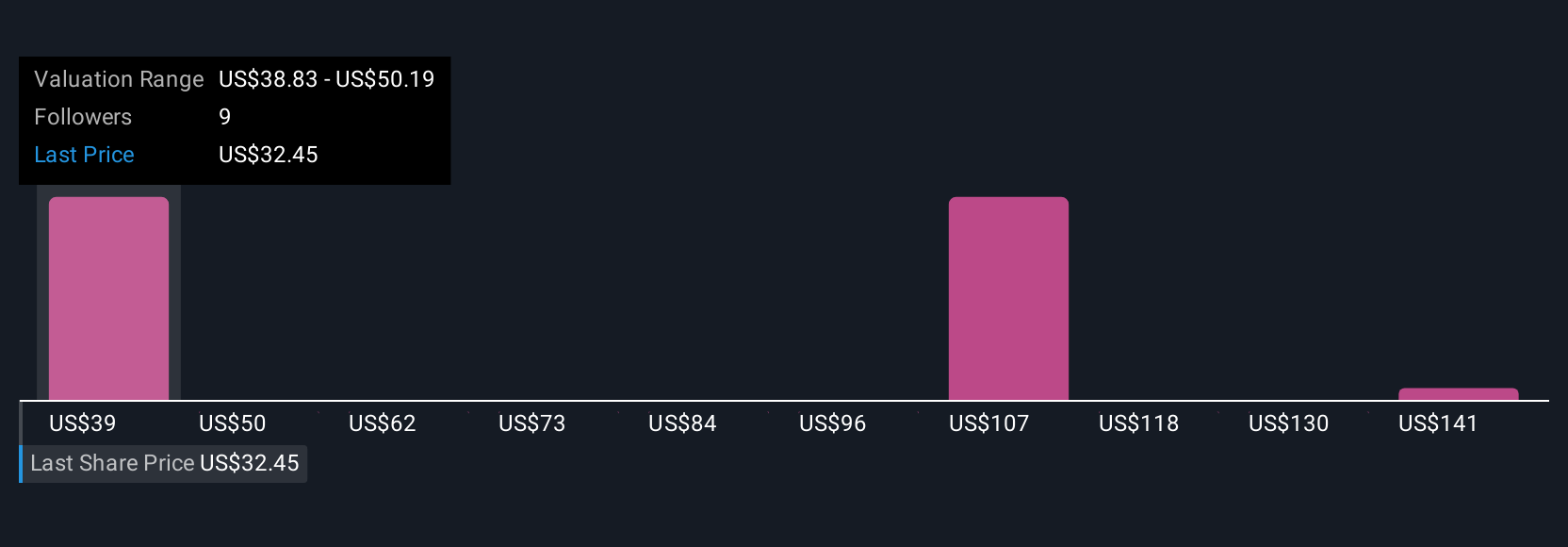

Uncover how CarGurus' forecasts yield a $38.83 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Five individual fair value estimates from the Simply Wall St Community range widely from US$38.83 to US$152.39 per share. While you will see broad disagreement on value, each perspective must weigh how CarGurus’ renewed focus on AI-powered analytics may affect its ability to defend margin and market share.

Explore 5 other fair value estimates on CarGurus - why the stock might be worth over 4x more than the current price!

Build Your Own CarGurus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CarGurus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CarGurus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CarGurus' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CARG

CarGurus

Operates an online automotive platform for buying and selling vehicles in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives