- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BILI

Why Bilibili (BILI) Is Up 8.9% After Breakout Success of In-House Game Release

Reviewed by Sasha Jovanovic

- Earlier this month, Bilibili's in-house game "Escape from Yakefu" surpassed one million sales within a week of its October 16 launch, signaling a major achievement for the company's gaming division.

- This rapid success in gaming reflects Bilibili's growing capability to produce hit proprietary titles, strengthening its position in the digital entertainment landscape.

- We’ll explore how this milestone in Bilibili’s in-house gaming business influences its investment narrative and future growth prospects.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Bilibili Investment Narrative Recap

To be optimistic about Bilibili as a shareholder, one must believe that the company can convert its deep engagement with Gen Z+ users in China into sustained growth, especially by expanding its proprietary IP and games pipeline. The breakout success of "Escape from Yakefu" gives a boost to Bilibili’s gaming credentials, yet it does not fully offset near-term execution risks tied to a limited slate of upcoming releases and regulatory approval dependencies.

In this context, Bilibili’s announcement to report its third quarter 2025 results on November 13, 2025, draws heightened attention as investors look for signs that recent game launches are reflected in revenue and margin trends, key short-term catalysts for sentiment around the stock. These financial results could offer clearer evidence of whether headline gaming wins are translating into broader business momentum and sustained profitability.

But offsetting the excitement from gaming hits is the persistent risk of regulatory hurdles, particularly as Bilibili...

Read the full narrative on Bilibili (it's free!)

Bilibili's narrative projects CN¥38.4 billion in revenue and CN¥3.4 billion in earnings by 2028. This requires 9.3% yearly revenue growth and a CN¥3.18 billion earnings increase from the current earnings of CN¥220.3 million.

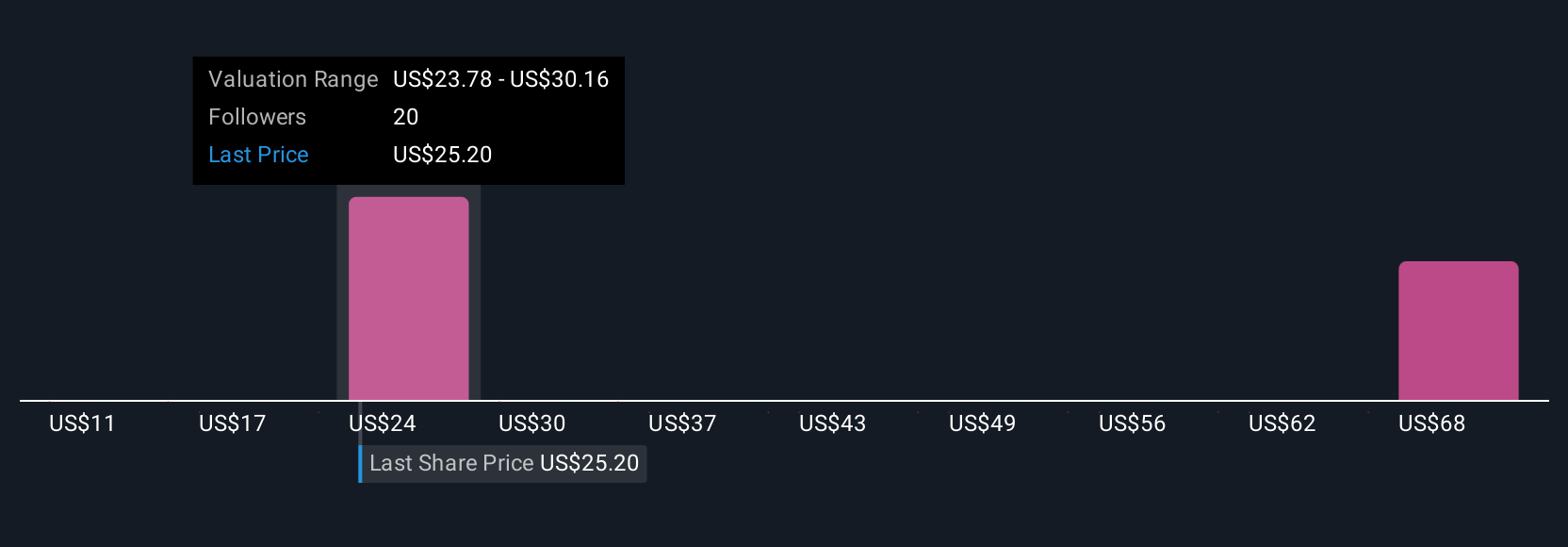

Uncover how Bilibili's forecasts yield a $28.51 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community range from CN¥22.18 to CN¥34.81 per share. With execution risk tied to dependence on blockbuster titles and new pipeline uncertainty, it is clear that perspectives on Bilibili’s trajectory can vary widely, take a look and see how your view compares.

Explore 6 other fair value estimates on Bilibili - why the stock might be worth as much as 18% more than the current price!

Build Your Own Bilibili Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bilibili research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bilibili research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bilibili's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives