- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BILI

Bilibili (NasdaqGS:BILI): Evaluating Valuation After Breakout Success of Team Soda’s Blockbuster Game Launch

Reviewed by Simply Wall St

Bilibili (BILI) drew fresh attention this week after Team Soda’s latest single-player game, published by the company, quickly sold over half a million copies and received enthusiastic player feedback.

See our latest analysis for Bilibili.

Bilibili’s recent momentum has been impressive, with the 1-day share price return of 1.76% and a 7-day gain of nearly 9% supported by news of the blockbuster game launch. These gains contribute to a robust year-to-date share price return of nearly 72%, while the 1-year total shareholder return stands at 43%. The strong response to Team Soda’s new title and anticipation ahead of quarterly results suggest investors are warming to Bilibili’s growth narrative for both the short and long term.

If the buzz around Bilibili’s hit game release has you curious about what else is gaining traction, this could be your chance to uncover fast growing stocks with high insider ownership.

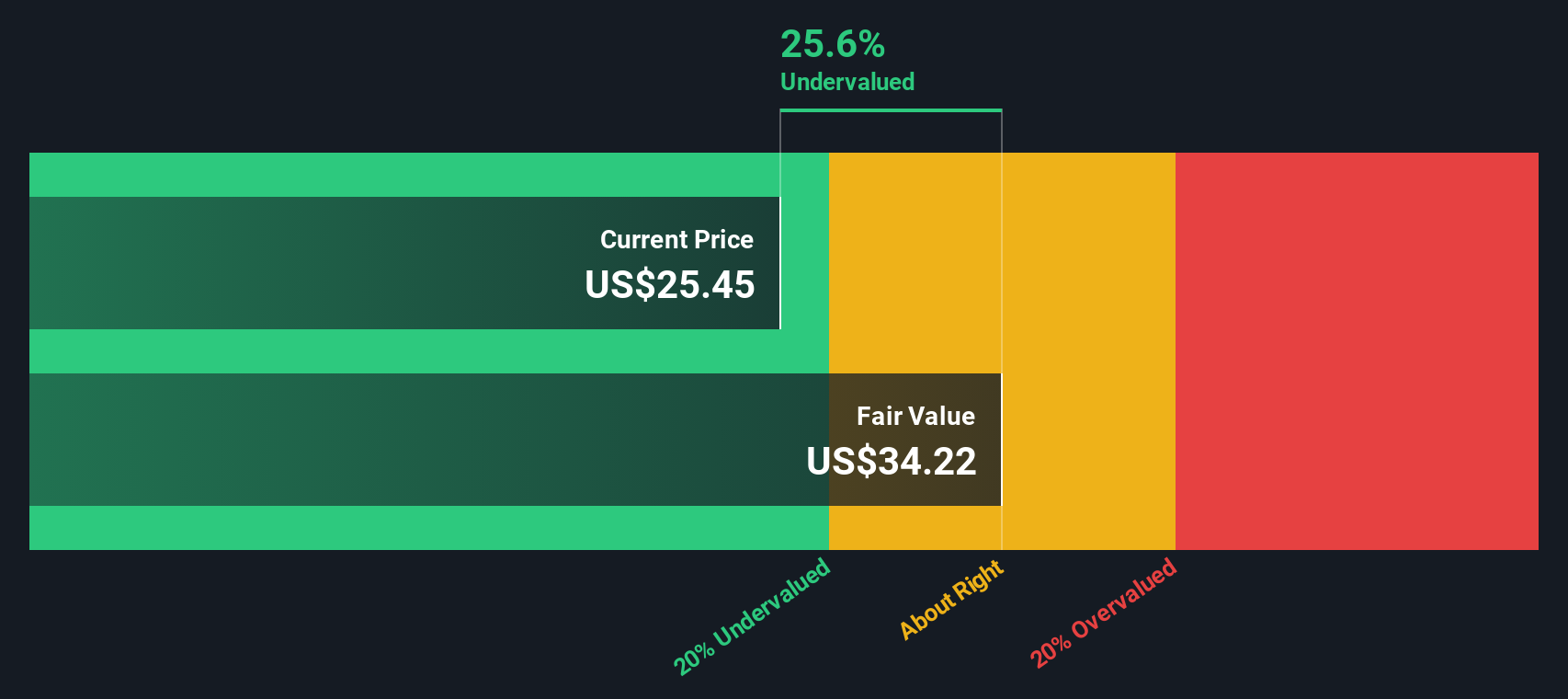

With shares surging after the blockbuster game launch, the big question now is whether Bilibili’s stock is still undervalued or if the recent rally means the market has already priced in future growth expectations.

Most Popular Narrative: 3% Overvalued

Bilibili’s widely followed narrative points to a fair value just below its last close, suggesting market optimism may be outpacing what analysts expect. The focus now shifts to whether fundamental momentum can keep up with elevated expectations.

Strengthening proprietary content, rapid AI adoption, and disciplined cost control are driving operational efficiency, higher margins, and improving overall profitability. Ongoing improvements in operational efficiency and disciplined cost control, underpinned by economies of scale and AI-driven automation, are resulting in stable or declining operating expenses and a path toward mid-to-high teens operating margins. This positions Bilibili to deliver expanding net margins and growing adjusted net profit.

Want to know the real reason analysts think Bilibili’s valuation has surged lately? There is a hidden formula of soaring engagement, creative ecosystem bets and margin expansion that sets the stage. Curious about which bold profit assumptions drive this punchy price target? Dive in before earnings hit and discover the building blocks of the narrative’s valuation call.

Result: Fair Value of $28.51 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing game revenue or changes in youth engagement trends could quickly challenge the upbeat analyst narrative and force a reset of growth assumptions.

Find out about the key risks to this Bilibili narrative.

Another View: Discounted Cash Flow Perspective

While the popular narrative leans on market multiples and targets, the SWS DCF model offers a different conclusion. According to our cash flow analysis, Bilibili appears undervalued, with a fair value estimate of $34.76, which is well above current prices. Does this hint at untapped upside others are missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bilibili Narrative

If the current views do not match your own, or you would rather investigate directly, you can craft your personal Bilibili narrative in just a few minutes by using Do it your way.

A great starting point for your Bilibili research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Staying ahead in the market means finding opportunities before everyone else. Don’t let your next winning stock slip past you. Get inspired with these high-potential ideas:

- Capitalize on tech breakthroughs by checking out these 27 AI penny stocks poised to transform everything from healthcare to automation with artificial intelligence.

- Kickstart your search for income growth by reviewing these 17 dividend stocks with yields > 3% offering reliable payouts that can boost your portfolio’s resilience.

- Tap into tomorrow’s innovations by scanning these 27 quantum computing stocks that are driving advancements in computation and setting the pace for the next wave of technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives