- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BILI

Bilibili (BILI) Is Up After Q3 Profit Return and Surging User Growth—What's Behind the Rebound?

Reviewed by Sasha Jovanovic

- Bilibili Inc. recently reported its third-quarter 2025 results, highlighting a return to profitability driven by a 9% year-over-year increase in daily active users to 117.3 million, a 23% surge in advertising revenue, and the successful global launch of its new game 'Escape from Duckov.'

- Despite a decline in gaming revenue from previous titles, the company recorded significant improvement in monetization efficiency and disciplined cost control, resulting in enhanced gross margins and stronger net profit performance.

- We'll examine how Bilibili's swing to profitability, supported by robust user growth and ad revenue, impacts the investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Bilibili Investment Narrative Recap

For investors considering Bilibili, the central investment thesis continues to rest on the company's ability to convert its rapidly growing Gen Z user base and deep engagement into sustainable revenue, while increasing operational efficiency through AI-driven monetization. The latest executive board changes, specifically the appointment of Ms. Lai Ying Tung as Joint Company Secretary, do not appear to materially affect Bilibili's largest short term catalyst, ongoing improvements in advertising revenue, nor do they significantly alter exposure to the prevailing regulatory risks facing the Chinese digital content sector.

Among recent developments, the third-quarter earnings release stands out as the most relevant, highlighting record user engagement and a 23% surge in advertising revenues. This momentum reinforces advertising as a critical growth engine for Bilibili, even as it navigates segment-specific gaming revenue volatility and ongoing regulatory hurdles.

However, despite headline profitability, investors should also be aware that persistent regulatory uncertainty in China remains a key consideration...

Read the full narrative on Bilibili (it's free!)

Bilibili's narrative projects CN¥38.4 billion revenue and CN¥3.4 billion earnings by 2028. This requires 9.3% yearly revenue growth and a CN¥3.18 billion increase in earnings from CN¥220.3 million.

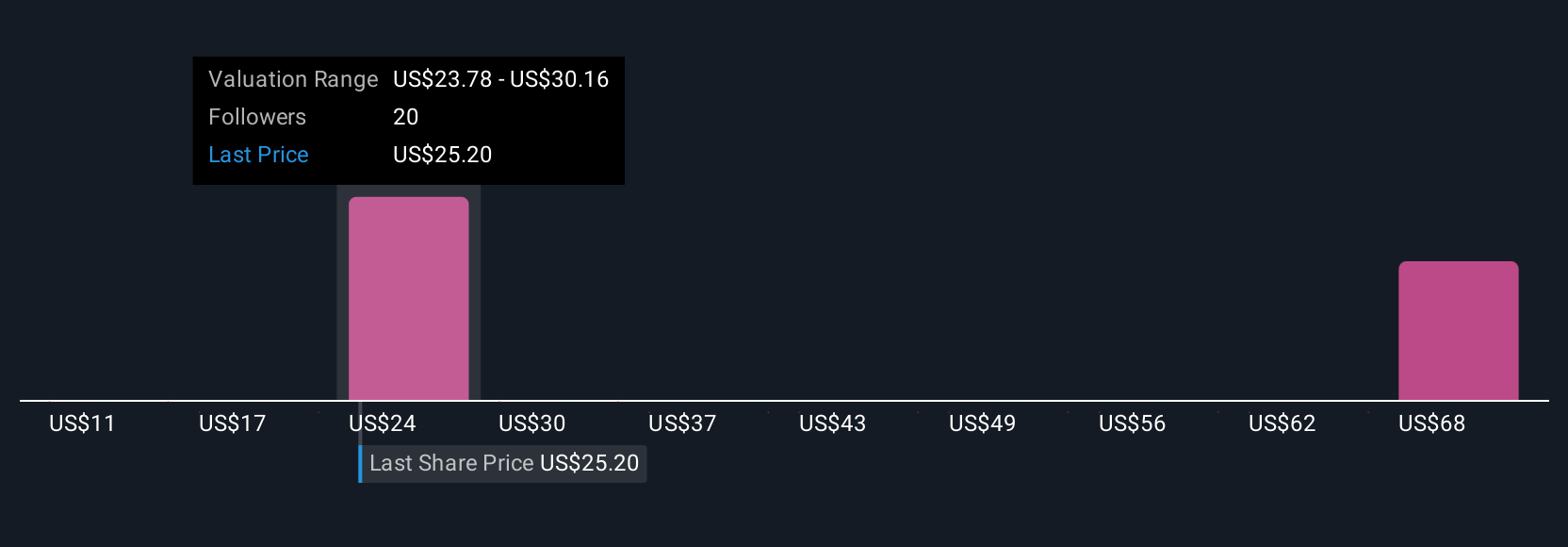

Uncover how Bilibili's forecasts yield a $28.85 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community assessed Bilibili’s fair value estimates, spanning US$22.18 to US$37.05, reflecting widespread opinion differences. While revenue and engagement are seeing strong catalysts, the risks from China’s regulatory environment continue to shape sentiment and could impact long-term outlooks.

Explore 6 other fair value estimates on Bilibili - why the stock might be worth 15% less than the current price!

Build Your Own Bilibili Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bilibili research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bilibili research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bilibili's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives