- United States

- /

- Entertainment

- /

- NasdaqGS:BILI

### 3 US Stocks Estimated To Be Trading At Discounts Between 34.9% And 47.8% ###

Reviewed by Simply Wall St

As the U.S. stock market grapples with a downturn in major indices and concerns over economic health, investors are increasingly on the lookout for undervalued opportunities. In this environment, identifying stocks trading at significant discounts can offer potential value plays amid broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Kaspi.kz (NasdaqGS:KSPI) | $126.66 | $249.53 | 49.2% |

| Amdocs (NasdaqGS:DOX) | $87.01 | $173.82 | 49.9% |

| Owens Corning (NYSE:OC) | $159.98 | $315.85 | 49.3% |

| EQT (NYSE:EQT) | $32.66 | $65.31 | 50% |

| Afya (NasdaqGS:AFYA) | $16.80 | $33.46 | 49.8% |

| Associated Banc-Corp (NYSE:ASB) | $22.18 | $43.71 | 49.3% |

| Sociedad Química y Minera de Chile (NYSE:SQM) | $36.45 | $72.88 | 50% |

| Progress Software (NasdaqGS:PRGS) | $58.18 | $115.29 | 49.5% |

| Zscaler (NasdaqGS:ZS) | $157.13 | $311.52 | 49.6% |

| Enphase Energy (NasdaqGM:ENPH) | $112.91 | $225.41 | 49.9% |

Let's explore several standout options from the results in the screener.

Bilibili (NasdaqGS:BILI)

Overview: Bilibili Inc. offers online entertainment services targeting young generations in China and has a market cap of $6.05 billion.

Operations: Bilibili generates CN¥23.95 billion from its Internet Information Providers segment.

Estimated Discount To Fair Value: 47.8%

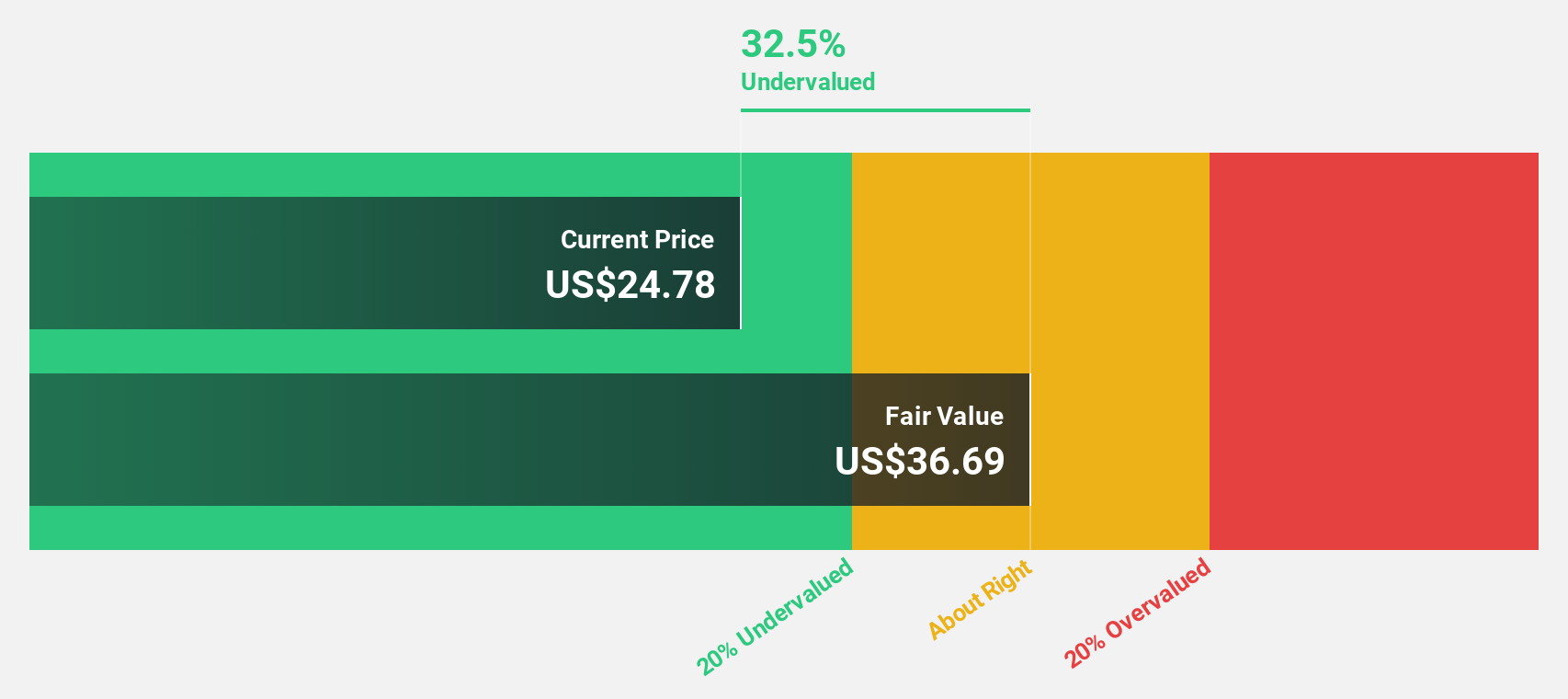

Bilibili Inc. appears undervalued based on cash flows, trading at US$15.03, which is 47.8% below its estimated fair value of US$28.81. Recent earnings showed a significant reduction in net loss from CNY 1,546.71 million to CNY 608.7 million year-over-year for Q2 2024, highlighting improved financial health despite slower revenue growth (11.5% annually). The company is forecasted to become profitable within three years and grow earnings by 80.49% per year.

- Our comprehensive growth report raises the possibility that Bilibili is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Bilibili stock in this financial health report.

Li Auto (NasdaqGS:LI)

Overview: Li Auto Inc., with a market cap of $20.16 billion, operates in the energy vehicle market in the People’s Republic of China.

Operations: The company generates revenue of CN¥133.72 billion from its Auto Manufacturers segment.

Estimated Discount To Fair Value: 42.6%

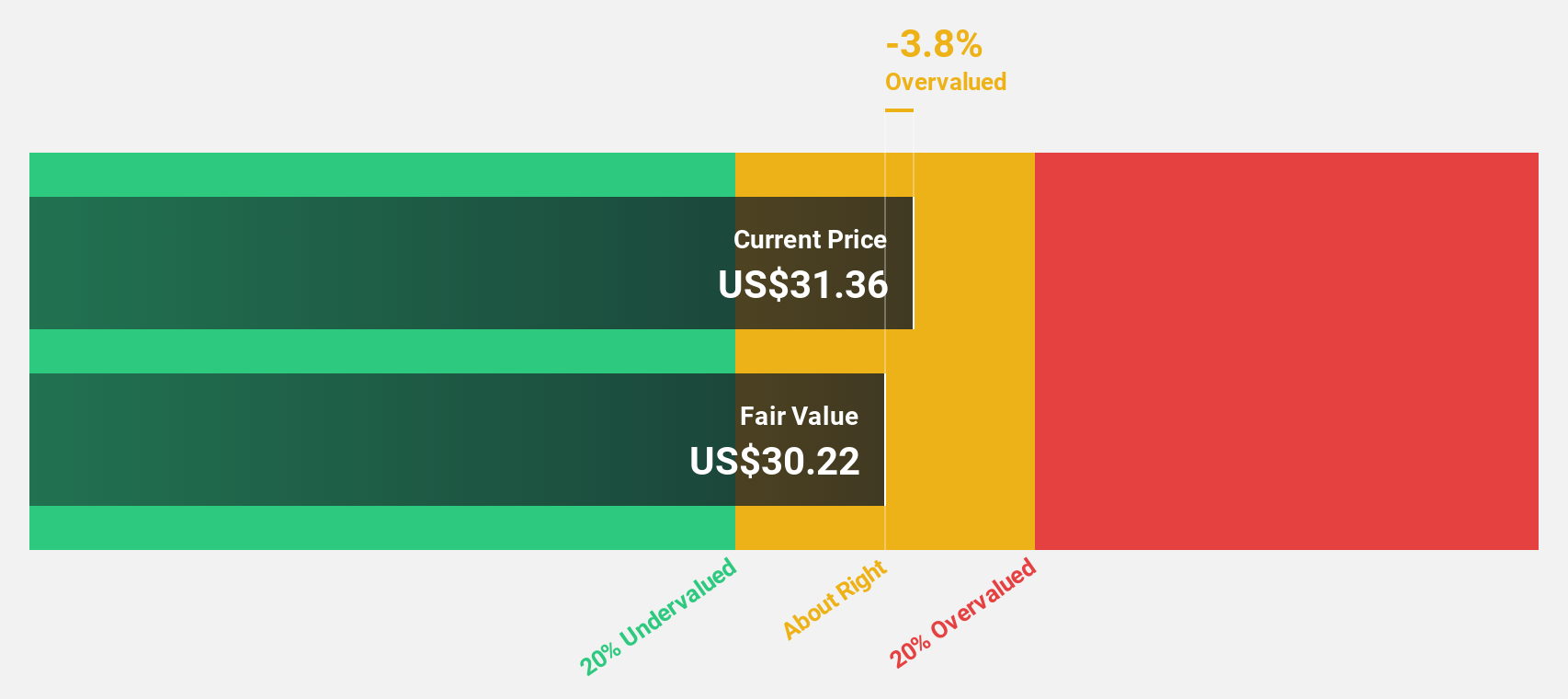

Li Auto is trading at US$18.77, significantly below its estimated fair value of US$32.68, suggesting it may be undervalued based on cash flows. Despite a 453.2% earnings growth last year and forecasted annual revenue growth of 19.6%, the company has faced shareholder dilution and legal issues affecting investor sentiment. Recent sales data show strong performance with 48,122 vehicles delivered in August 2024, a year-over-year increase of 37.8%.

- Upon reviewing our latest growth report, Li Auto's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Li Auto with our comprehensive financial health report here.

Clorox (NYSE:CLX)

Overview: The Clorox Company manufactures and markets consumer and professional products globally, with a market cap of approximately $19.96 billion.

Operations: The company's revenue segments include Household ($1.95 billion), Lifestyle ($1.28 billion), International ($1.16 billion), and Health and Wellness ($2.49 billion).

Estimated Discount To Fair Value: 34.9%

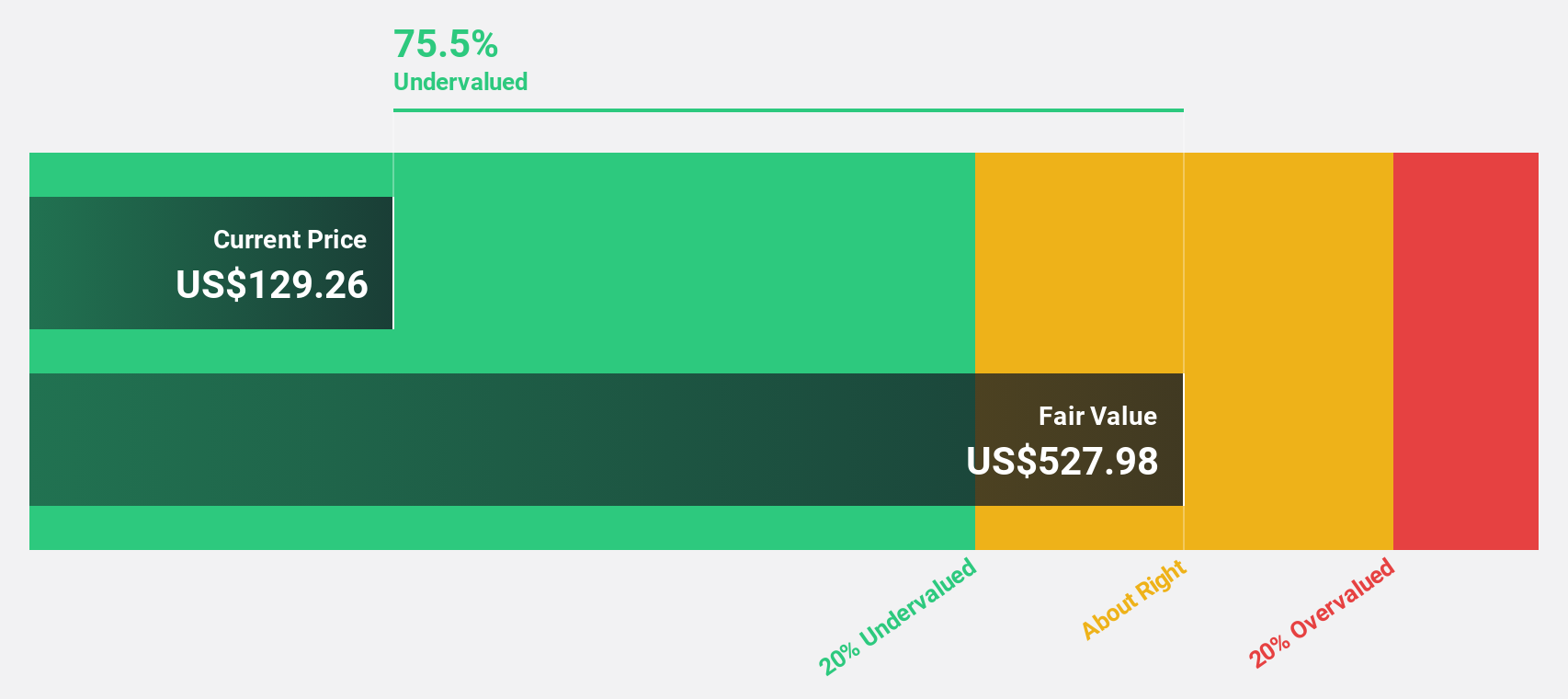

Clorox is trading at US$164.18, significantly below its estimated fair value of US$252.08, indicating it may be undervalued based on cash flows. Despite high debt levels, earnings grew by 87.9% over the past year and are forecasted to grow 21.6% annually, outpacing the US market's growth rate of 14.9%. However, Clorox faces challenges with dividend sustainability and slower revenue growth compared to the broader market.

- Our earnings growth report unveils the potential for significant increases in Clorox's future results.

- Delve into the full analysis health report here for a deeper understanding of Clorox.

Turning Ideas Into Actions

- Discover the full array of 190 Undervalued US Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.