- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BIDU

Is Baidu’s 46% YTD Rally Justified After Autonomous Driving Expansion?

Reviewed by Bailey Pemberton

Thinking about whether to buy, sell, or simply watch Baidu right now? You are not alone. The last year has been a ride for the stock, and as always, the big question is whether current prices reflect Baidu’s true value, or if there’s still hidden potential (or risk) that the market is missing.

Baidu has seen its share price dip slightly in the past week at -0.3%, and over the past month, it has slid by 4.1%. Yet, zooming out reveals just how dramatically things have shifted: the year-to-date gain is 45.7%, and it is up 34.6% over the last twelve months. This kind of performance has caught the attention of long-term investors, and it prompts a closer look at what’s been pushing the needle. From innovative moves around artificial intelligence to a recent expansion of their autonomous driving projects, recent headlines have given Baidu a new edge in the ever-evolving Chinese tech sector. Even as the company navigates regulatory shifts and fierce competition, the market seems to be warming up to its long-term vision.

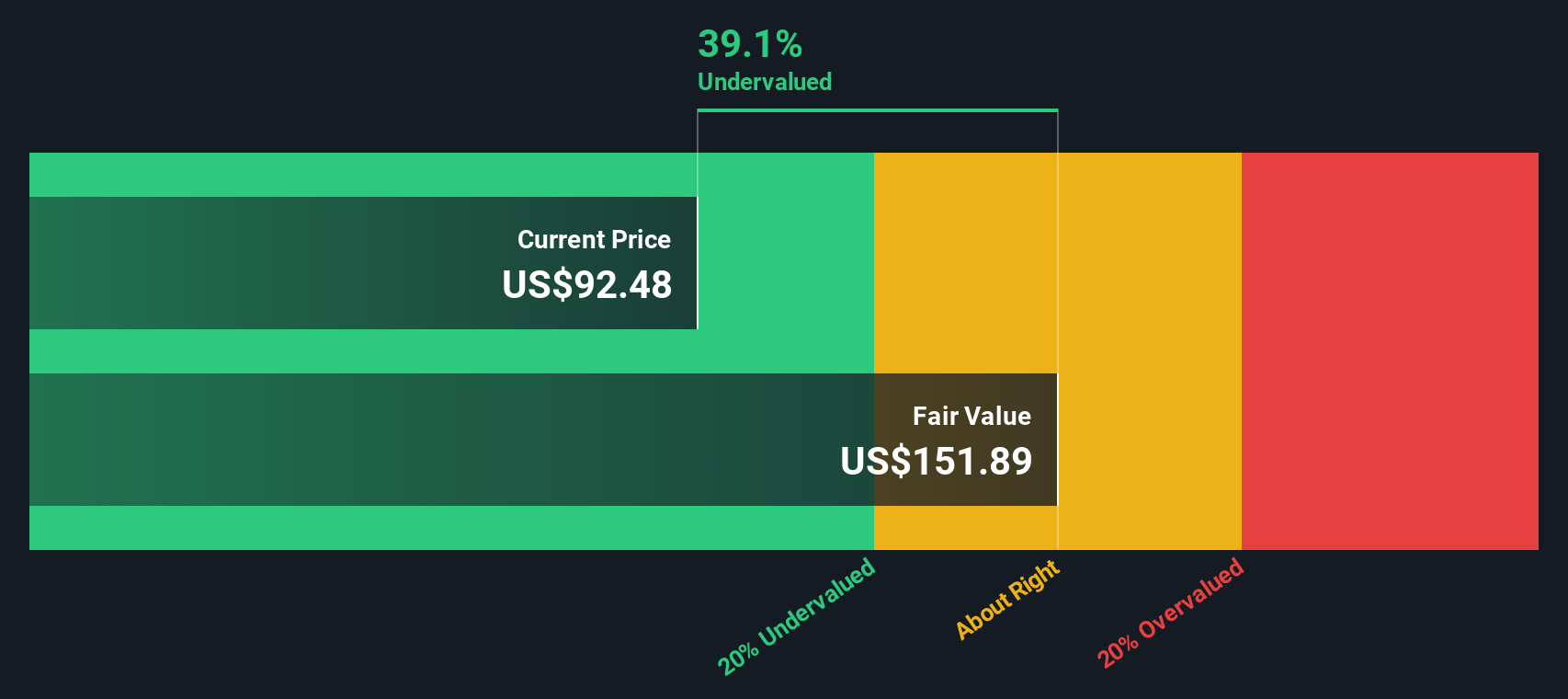

Now, let’s get to the numbers. When we apply a set of six standard valuation checks to Baidu, the company comes in as undervalued on five out of six measures, resulting in a standout value score of 5. But as you will see, the story gets even more interesting when you dig into the details behind each valuation approach. By the end of this article, we will reveal a framework for understanding value that goes beyond just the usual metrics.

Why Baidu is lagging behind its peers

Approach 1: Baidu Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s worth by projecting its future cash flows and discounting them back to today’s value. It essentially asks: what is the company really worth if you consider all the cash it will generate in future years, but expressed at today’s prices?

For Baidu, current Free Cash Flow (FCF) is negative at roughly CN¥10.4 billion. However, analysts project a significant turnaround, forecasting positive cash flows with CN¥22.7 billion in 2026 and rising to a substantial CN¥35.3 billion by 2035. The next five years are based on analyst estimates, while projections further out are extrapolated using industry growth data. All these figures reflect Baidu’s reporting currency of Chinese yuan (CN¥).

Running these numbers through the DCF model puts Baidu’s fair value at $170.49 per share. When compared to the current market price, the model suggests the stock is trading at a 29.3% discount to its intrinsic value. In other words, based on these cash flow projections, the market may be underestimating Baidu’s long-term earnings power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Baidu is undervalued by 29.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Baidu Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for profitable companies like Baidu, because it directly connects the company's market price to its ability to generate earnings. When a company has stable or growing profits, the PE ratio becomes a useful indicator of how the market values those profits relative to other similar businesses.

What constitutes a "fair" PE ratio depends heavily on growth expectations and the risk profile. Companies with higher projected earnings growth, stable profit margins, and lower risk tend to command higher PE multiples, while those facing uncertainty or slower growth trade at lower multiples.

Baidu is currently trading at a PE ratio of 10.81x. For context, the industry average PE ratio for Interactive Media and Services stands at 15.43x, while Baidu’s closest peers average a much loftier 53.84x. This suggests the market prices Baidu’s earnings below both its sector and peer benchmarks.

To refine this comparison, Simply Wall St calculates a “Fair Ratio” for Baidu, which is 19.78x. The Fair Ratio is designed to go beyond basic industry or peer comparisons by factoring in the company’s unique earnings growth outlook, profit margins, market cap, and overall risk. This holistic approach helps to tailor the multiple to what’s most relevant for Baidu, rather than relying solely on broad averages that might miss company-specific strengths or weaknesses.

Given that Baidu's current PE of 10.81x is well below the Fair Ratio of 19.78x, the stock appears undervalued on this measure. Investors may be getting more earnings for each dollar they invest, compared to what might be expected if the market priced Baidu in line with its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Baidu Narrative

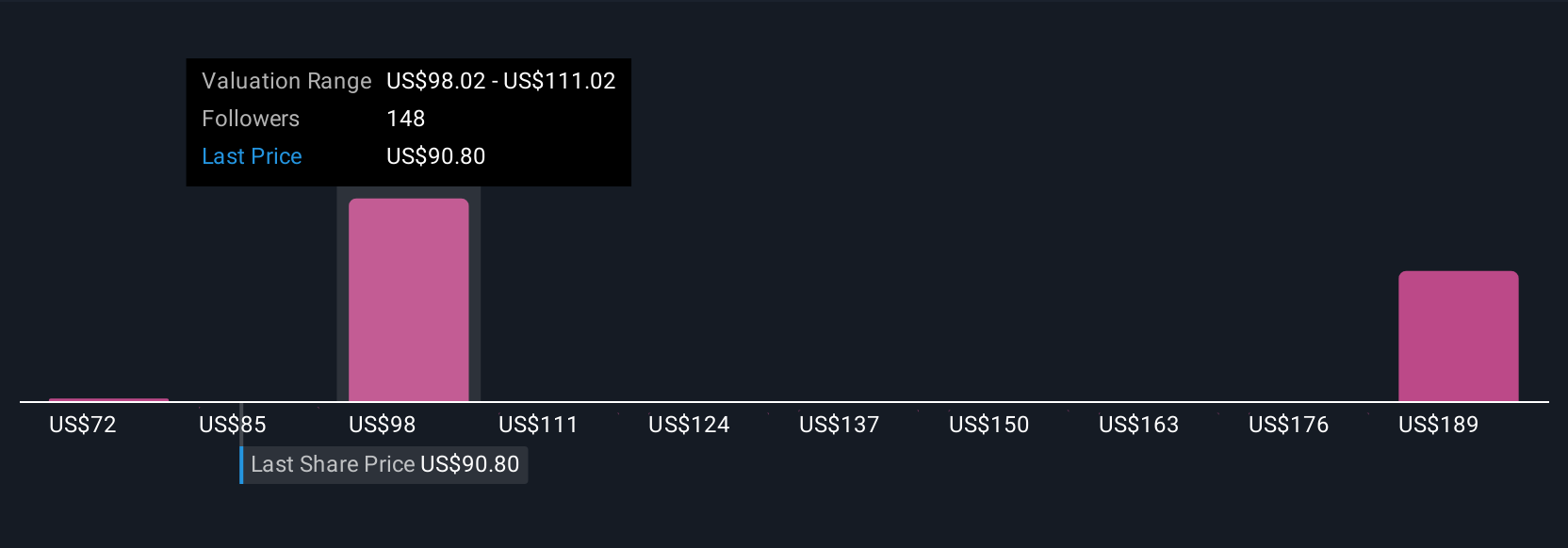

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story behind a stock. It’s the set of beliefs and logic you use to connect what’s happening at a company with its financial future and ultimately, what you think it’s worth. Instead of relying only on traditional metrics, Narratives help you explain why you see Baidu’s fair value, future revenues, and margins unfolding a certain way. This approach turns data into your own actionable investment thesis.

Narratives bridge the company story with a financial forecast and the resulting fair value, making it easy to justify your decision to buy, sell, or hold based on what you think the future will bring. Best of all, Simply Wall St’s Community page gives everyone access to this superpower. It lets millions of investors quickly share, update, and review Narratives as fresh news or earnings come in. By comparing a Narrative’s dynamic fair value against today’s share price, you get a clear snapshot of risk and opportunity that reflects real-world changes, not just static numbers.

For Baidu, the most optimistic Narrative currently assumes robust AI monetization and global cloud expansion driving the stock up to $145.76, while the most cautious expects ongoing advertising headwinds to keep it near $71.14.

Do you think there's more to the story for Baidu? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIDU

Baidu

Provides online marketing and non-marketing value added services through an internet platform in the People’s Republic of China.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives