- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BIDU

Baidu (NasdaqGS:BIDU): Exploring Current Valuation and Growth Potential in a Shifting Tech Landscape

Reviewed by Simply Wall St

Baidu (NasdaqGS:BIDU) shares have caught the attention of some investors this month, with movement tracked across technology names. The stock’s performance provides context for those considering opportunities in fast-changing internet sectors.

See our latest analysis for Baidu.

Baidu’s share price has experienced significant volatility, with a strong rally over the past quarter and a 40.68% year-to-date share price return indicating renewed optimism despite a recent pullback. Over the last year, its total shareholder return of 37.16% reflects investors’ shifting appetite for Chinese internet stocks as sentiment alternates between risk and recovery.

Curious about where the next big opportunities may be? Check out the latest wave of innovation in tech and AI stocks with See the full list for free.

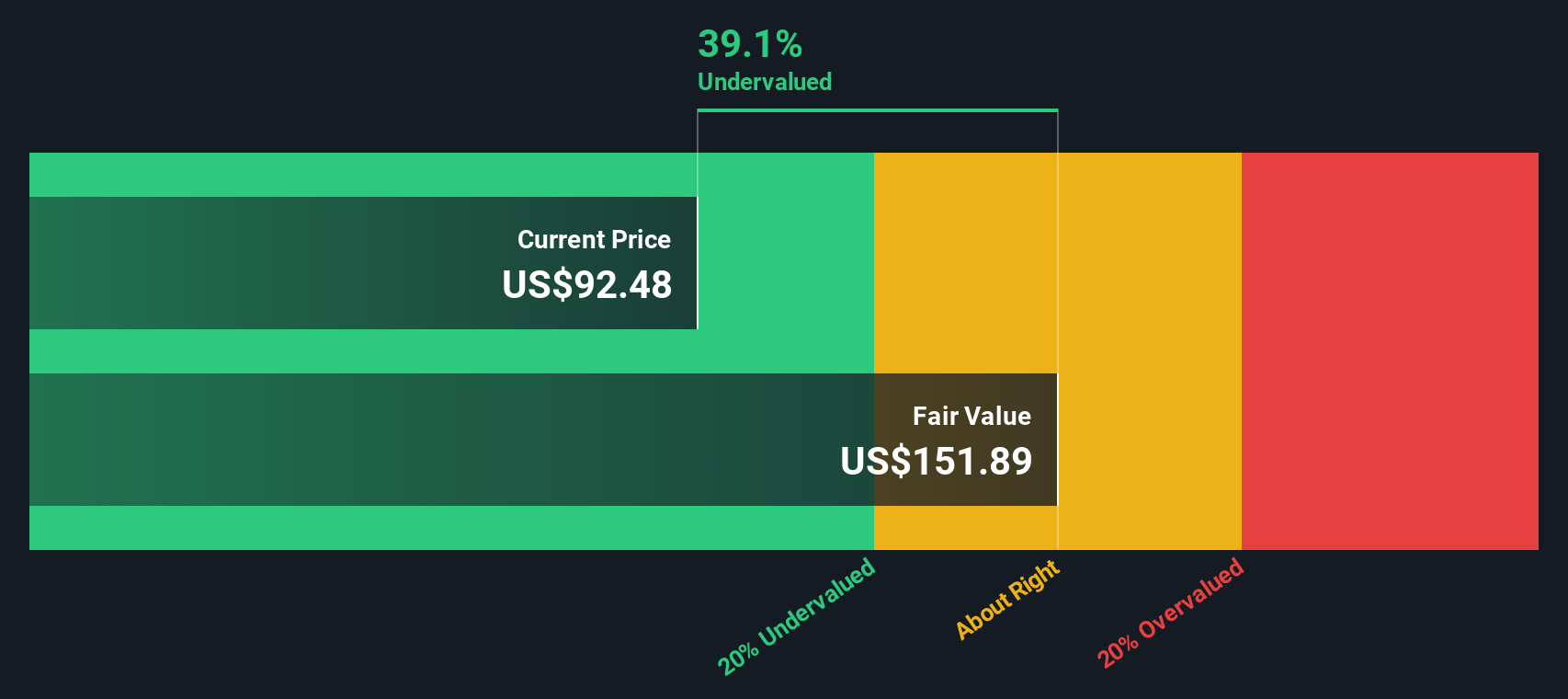

With the stock still trading below analyst price targets but posting notable gains, is Baidu undervalued by the market, or have expectations for its future growth already been fully reflected in the current price?

Most Popular Narrative: 20.9% Undervalued

Baidu’s fair value estimate sits well above the last close, hinting at untapped upside if the narrative’s assumptions prove out. This latest narrative centers on rapid expansion in AI-powered verticals and the company’s ability to leverage technology across new revenue streams, setting up an ambitious outlook.

Bullish analysts highlight the accelerating momentum across Baidu's AI-powered businesses. These segments are now making up a growing share of overall revenue and are expected to drive sustained growth and margin recovery in the coming quarters.

What is the building block of this higher fair value? A future shaped by automation, aggressive investment in cloud and AI, and big shifts in where profits come from. Get the full story, including bold profitability projections and industry-defying assumptions driving this optimistic view, inside the complete narrative.

Result: Fair Value of $147.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in Baidu’s core advertising and ongoing uncertainty around AI search monetization could present challenges to the bullish outlook going forward.

Find out about the key risks to this Baidu narrative.

Another View: Market vs Model

Not all valuation models point in the same direction. Our DCF model suggests Baidu is trading above its estimated fair value right now, which means the current share price looks a bit high if future cash flow projections prove accurate. Does this signal hidden risk, or are consensus forecasts too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Baidu for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Baidu Narrative

Feel like you’re seeing something different in the numbers, or want to explore your own angle? You can build a personalized story for Baidu using your own research in just a few minutes. Do it your way

A great starting point for your Baidu research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Broaden your strategy and take action. Exceptional stocks could be waiting where you least expect them.

- Tap into tomorrow’s tech boom by seeking out these 26 AI penny stocks harnessing artificial intelligence breakthroughs for real-world impact and sustained growth.

- Capture unique yield opportunities when you spot these 14 dividend stocks with yields > 3% offering attractive payouts above 3%. This can be a real advantage in today’s markets.

- Get ahead of the curve and unearth potential with these 3583 penny stocks with strong financials showing financial strength and making waves beyond the mainstream radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIDU

Baidu

Provides online marketing and non-marketing value added services through an internet platform in the People’s Republic of China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success