- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BIDU

Baidu (NasdaqGS:BIDU): Assessing Valuation After Q2 Earnings Highlight Profitability Growth

Reviewed by Simply Wall St

Most Popular Narrative: 4% Undervalued

According to community narrative, Baidu is currently trading below its estimated fair value. Analysts see the stock as undervalued due to sector leadership and expected future growth, despite current headwinds.

“The rapid rise in digitalization and urbanization across China is fueling increased engagement with online platforms and services. This is creating a larger addressable market for Baidu's AI-powered products. This secular shift supports continued growth potential in core search, cloud, and new digital services. As AI monetization progresses, these areas could see revenue upside.”

Why do analysts set the target price above today's market value, even with reserved growth outlooks? Discover the underlying projections and confidence factors that shape this positive consensus. Explore details of Baidu’s changing earnings profile, and consider what factors could potentially spark the next surge if expectations are met.

Result: Fair Value of $99.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, delays in scaling AI-powered search or margin pressure from costly investments could challenge Baidu’s growth trajectory and create uncertainty around the positive outlook.

Find out about the key risks to this Baidu narrative.Another View: Discounted Cash Flow Perspective

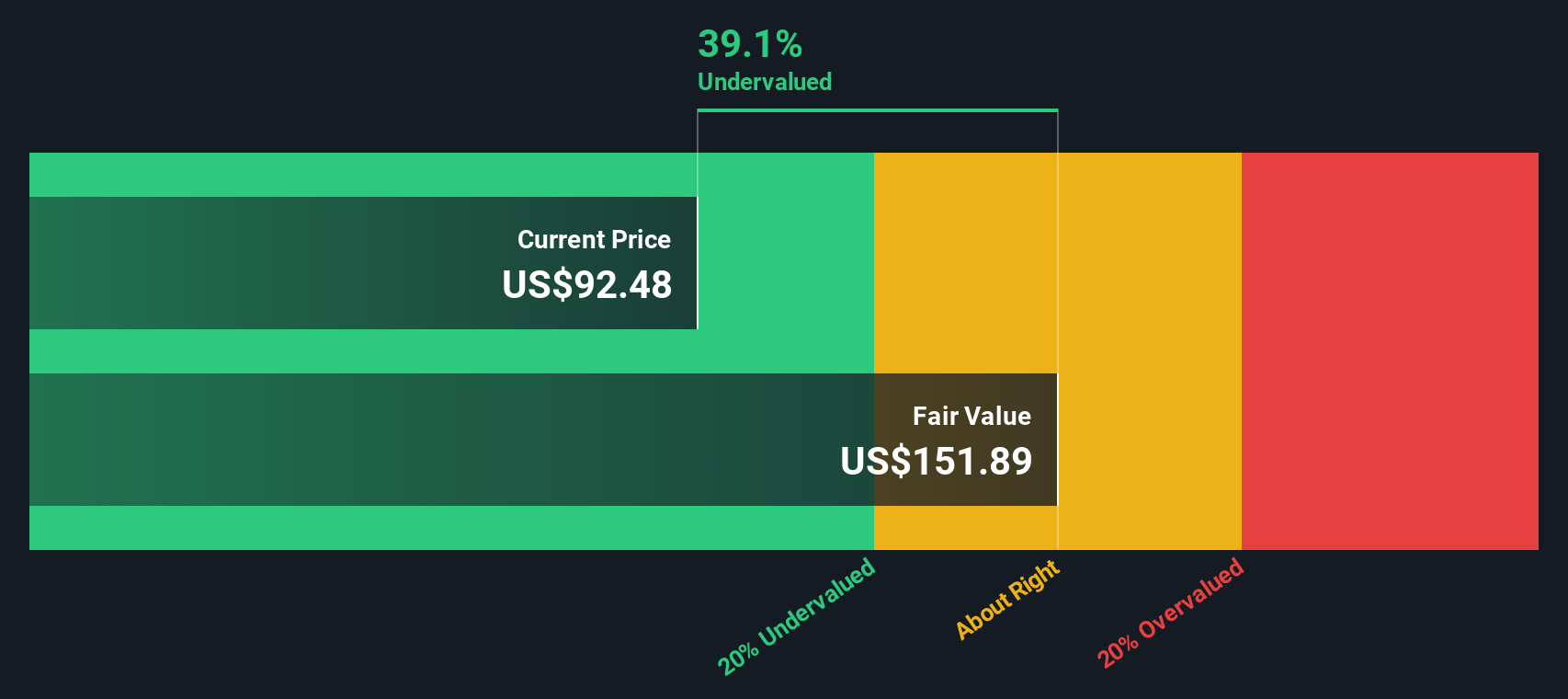

Our DCF model looks at Baidu from a different angle, focusing on its future cash flows instead of solely relying on market multiples. This approach also suggests the company may be undervalued. However, it raises the question of whether both perspectives are too conservative or if they might be overlooking hidden risks.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Baidu Narrative

If you have a different perspective or prefer your own independent analysis, you can build your narrative based on the data in just a few minutes. Do it your way.

A great starting point for your Baidu research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Seeking Your Next Investment Opportunity?

Smart investing means never settling for just one angle. Take charge of your financial future and uncover exceptional prospects tailored to your goals. If you stop here, you could miss out on tomorrow’s winners. Here are three unique pathways to broaden your watchlist and energize your research today:

- Pounce on income potential and cash flow reliability by checking out dividend stocks with yields > 3%, which is ideal for those aiming to build stability and enjoy consistent returns.

- Fuel your curiosity about the next tech disruptors and tap into AI penny stocks for companies leading breakthroughs in artificial intelligence and automation.

- Set your sights on stocks flying under the radar by starting with undervalued stocks based on cash flows. This can help you find value-packed shares the market might be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:BIDU

Baidu

Provides online marketing and non-marketing value added services through an internet platform in the People’s Republic of China.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives