- United Kingdom

- /

- Biotech

- /

- LSE:GNS

Top Undervalued Small Caps With Insider Action For September 2024

Reviewed by Simply Wall St

As global markets navigate a period of recovery and anticipation of rate cuts, small-cap stocks have shown resilience, with indices like the S&P 600 reflecting this trend. With economic indicators such as core inflation slightly higher than expected and Treasury yields at year-to-date lows, investors are keenly observing opportunities in undervalued small caps with insider action. In these market conditions, a good stock is often characterized by strong fundamentals and favorable insider activity, suggesting confidence from those closest to the company.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Orion Group Holdings | NA | 0.3x | 27.34% | ★★★★★★ |

| Bytes Technology Group | 23.5x | 5.3x | 16.36% | ★★★★★☆ |

| Hanover Bancorp | 9.1x | 2.1x | 49.95% | ★★★★★☆ |

| Citizens & Northern | 13.2x | 3.0x | 43.00% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -57.10% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -36.95% | ★★★★☆☆ |

| CVS Group | 23.3x | 1.3x | 38.89% | ★★★★☆☆ |

| Hemisphere Energy | 5.9x | 2.3x | -203.55% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -51.03% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

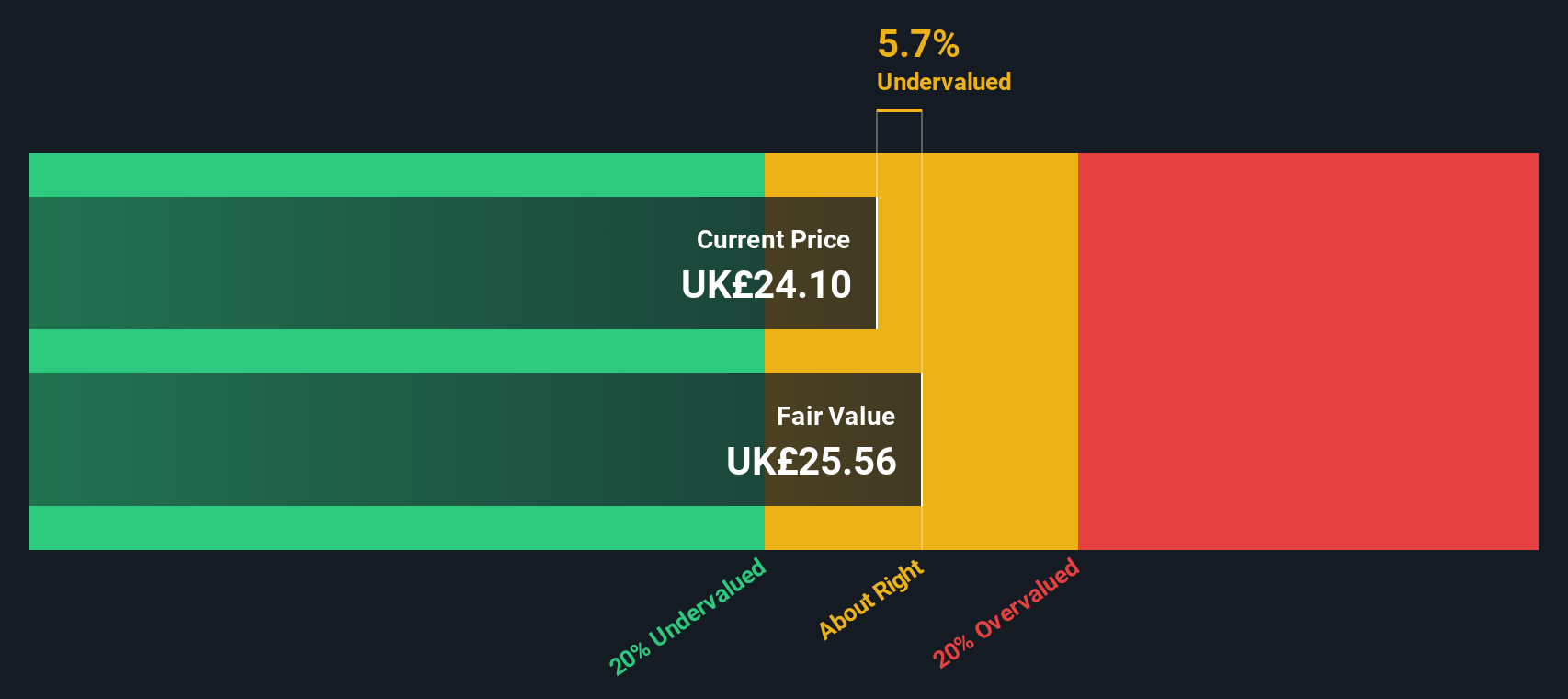

Genus (LSE:GNS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Genus is a biotechnology company specializing in animal genetics, with operations in bovine and porcine breeding, and a market cap of approximately £2.35 billion.

Operations: Genus generates revenue primarily from its Genus ABS and Genus PIC segments, with recent quarterly revenues reaching £668.80 million. The company's net income margin has fluctuated, most recently at 1.18% as of June 2024. Operating expenses have varied significantly, impacting profitability metrics across different periods.

PE: 164.8x

Genus plc, a smaller company in the agricultural sector, recently reported full-year sales of £668.8 million, down from £689.7 million last year. Net income dropped to £7.9 million from £33.3 million a year ago, with diluted EPS falling to £0.119 from £0.505. Despite these challenges, insider confidence is evident with recent share purchases between July and August 2024 indicating potential future value growth as earnings are forecasted to grow by 39% annually.

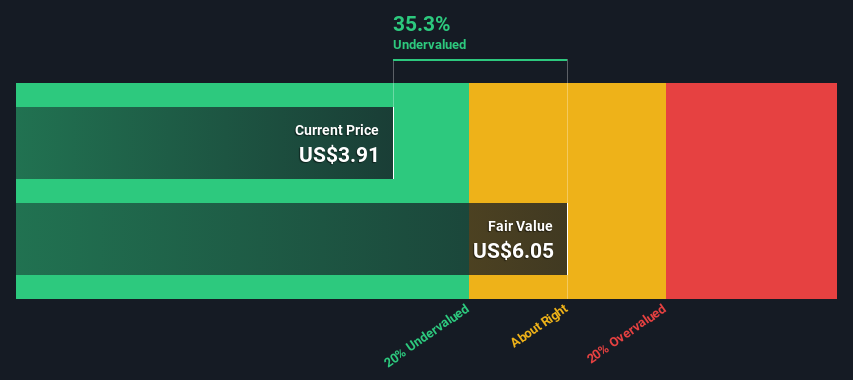

Advantage Solutions (NasdaqGS:ADV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Advantage Solutions provides outsourced sales and marketing services to consumer goods companies, with a market cap of approximately $1.28 billion.

Operations: Advantage Solutions generates revenue primarily through its sales and marketing services, with a significant portion of costs attributed to COGS. The company's gross profit margin has shown variability, with recent figures around 13.79% as of June 2024. Operating expenses have been substantial, including general and administrative expenses which reached $211.69 million in the same period.

PE: -7.1x

Advantage Solutions, a provider of sales and omnichannel marketing solutions, recently unveiled a new brand identity to reflect its transition into a unified retail solutions company. Despite reporting a net loss of US$100.84 million for Q2 2024, the company has shown insider confidence with significant share repurchases totaling 6 million shares from April to July 2024. The rebranding effort aims to streamline operations and enhance service delivery across its five core solution areas, positioning it for potential future growth in the CPG and retail sectors.

Sabre (NasdaqGS:SABR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sabre is a technology solutions provider for the global travel and hospitality industry with a market cap of approximately $1.65 billion.

Operations: Sabre's revenue primarily comes from Travel Solutions ($2.70 billion) and Hospitality Solutions ($315.74 million). The company has experienced varying gross profit margins, with recent figures around 59.47%. Operating expenses have been significant, often surpassing $1 billion annually, driven largely by R&D costs.

PE: -2.8x

Sabre Corporation, a travel technology company, has been experiencing insider confidence with recent purchases by executives. The company reported second-quarter sales of US$767.24 million, up from US$737.53 million the previous year. Despite a net loss of US$69.76 million for the quarter, this was an improvement from the prior year's loss of US$123.93 million. Recent strategic partnerships with Priceline and Hawaiian Airlines aim to bolster its travel retailing capabilities and expand market reach, indicating potential for future growth in a competitive industry space.

- Click here to discover the nuances of Sabre with our detailed analytical valuation report.

Gain insights into Sabre's past trends and performance with our Past report.

Seize The Opportunity

- Unlock more gems! Our Undervalued Small Caps With Insider Buying screener has unearthed 171 more companies for you to explore.Click here to unveil our expertly curated list of 174 Undervalued Small Caps With Insider Buying.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GNS

Genus

Operates as an animal genetics company in North America, Latin America, the United Kingdom, rest of Europe, the Middle East, Russia, Africa, and Asia.

Reasonable growth potential and slightly overvalued.