- United States

- /

- Energy Services

- /

- NYSE:TTI

Undervalued Opportunities: US Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

As of early February 2025, U.S. stock markets have experienced a downturn following reports of weaker-than-expected job growth and declining consumer sentiment, leading to weekly losses across major indexes. For investors willing to explore beyond the usual large-cap stocks, penny stocks—typically representing smaller or newer companies—can still present intriguing opportunities despite their somewhat outdated label. These stocks may offer potential value when supported by strong financial health and resilience, making them worth considering for those seeking diversification in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.88875 | $6.46M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $125.23M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.94 | $89.18M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.71 | $43.29M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.42 | $46.86M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.69 | $46.67M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.41 | $25.01M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8834 | $79.45M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.60 | $384.4M | ★★★★☆☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Cango (NYSE:CANG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cango Inc. operates an automotive transaction service platform in the People’s Republic of China, facilitating connections among dealers, original equipment manufacturers, financial institutions, car buyers, insurance brokers, and companies; it has a market cap of $506.17 million.

Operations: The company's revenue is primarily derived from its Retail - Gasoline & Auto Dealers segment, which generated CN¥266.69 million.

Market Cap: $506.17M

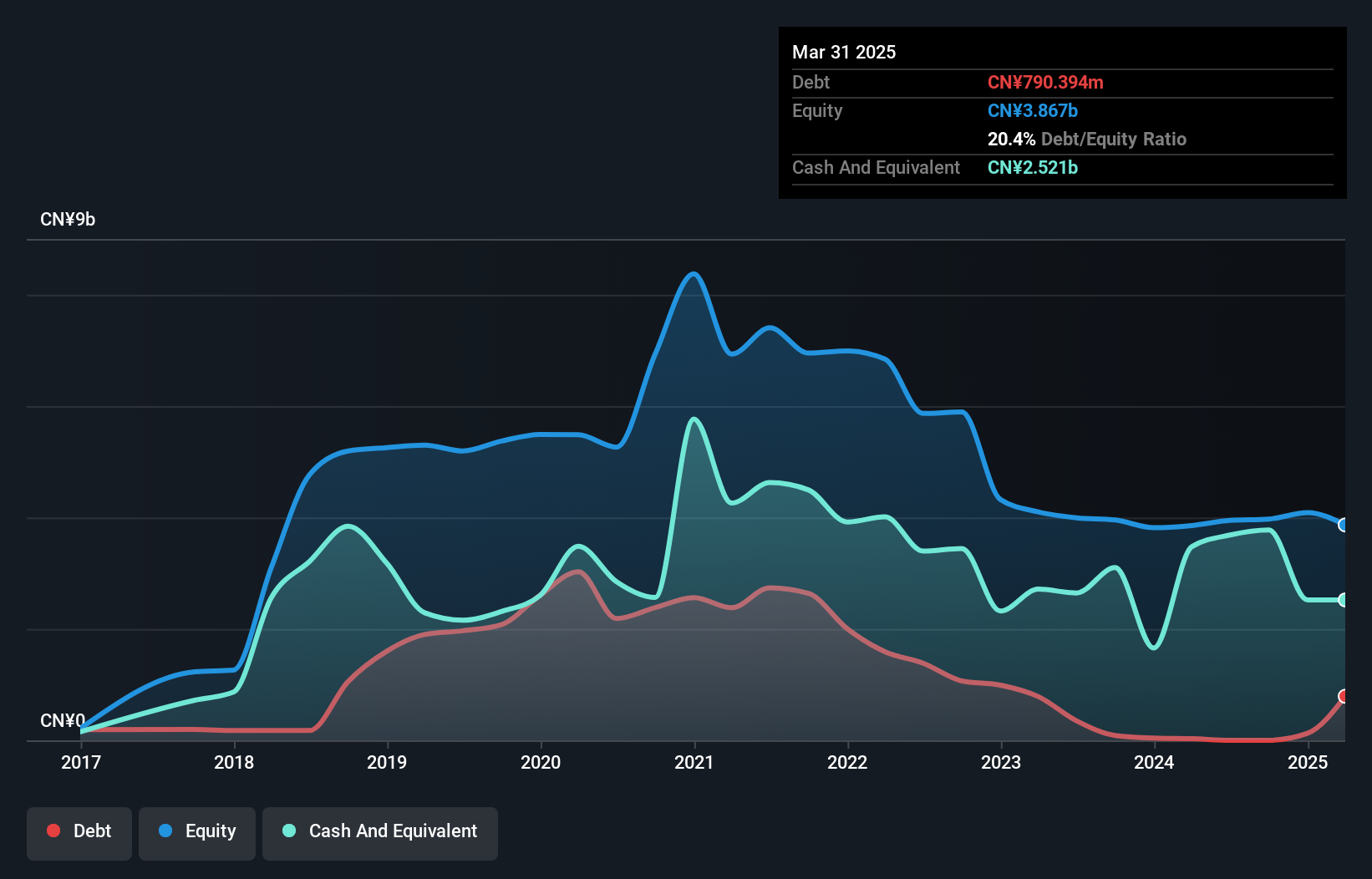

Cango Inc. has shown a significant turnaround by becoming profitable in the last year, despite its earnings having declined by 44.4% annually over the past five years. The company has reduced its debt to equity ratio significantly from 38.7% to 0.03% over five years and maintains more cash than total debt, indicating strong financial health. While Cango's share price has been highly volatile recently, it trades at a substantial discount to estimated fair value and possesses high-quality earnings with well-covered interest payments and short-term liabilities exceeded by assets worth CN¥4 billion. Recent auditor changes were amicable and strategic rather than due to disagreements.

- Unlock comprehensive insights into our analysis of Cango stock in this financial health report.

- Assess Cango's previous results with our detailed historical performance reports.

TETRA Technologies (NYSE:TTI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TETRA Technologies, Inc. operates as an energy services and solutions company with a market cap of $560.19 million.

Operations: The company generates revenue through two main segments: Water & Flowback Services, which contributed $302.75 million, and Completion Fluids & Products, accounting for $314.99 million.

Market Cap: $560.19M

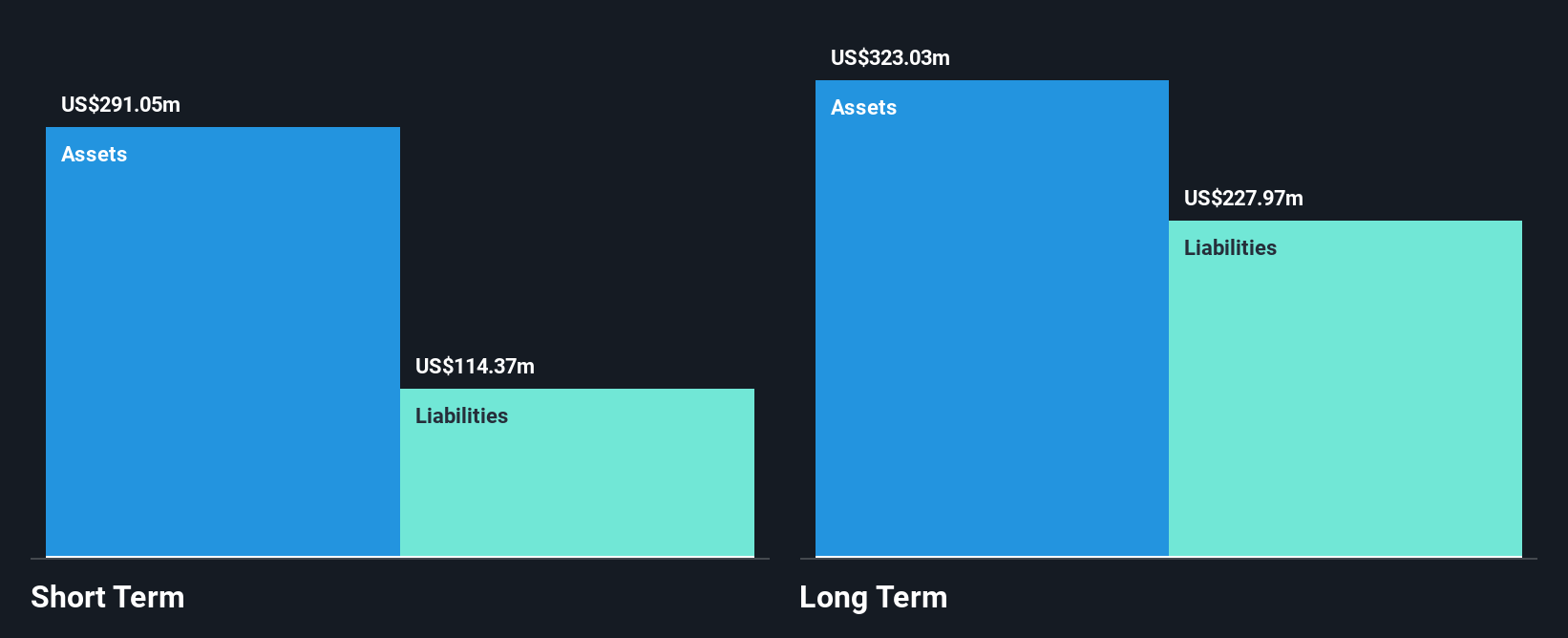

TETRA Technologies, Inc. has launched the TETRA Oasis TDS, a promising water treatment technology for oil and gas applications, showcasing its innovation in desalination and mineral extraction. Despite a challenging year with negative earnings growth of 74.4%, the company maintains strong liquidity with short-term assets surpassing liabilities by US$278.5M to US$119.4M and long-term liabilities also covered. While profitability has declined recently, TETRA's debt reduction from 313.8% to 115.6% over five years highlights improved financial management amidst high net debt levels (84.5%). Analysts expect earnings to grow significantly by 56.31% annually moving forward.

- Navigate through the intricacies of TETRA Technologies with our comprehensive balance sheet health report here.

- Learn about TETRA Technologies' future growth trajectory here.

Verde Resources (OTCPK:VRDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Verde Resources, Inc., with a market cap of $198.60 million, operates through its subsidiaries to produce biochar from waste materials in the dairy, palm, and other natural resource industries in the United States and Malaysia.

Operations: The company's revenue segments include the production of biochar from waste materials in the dairy, palm, and other natural resource industries across the United States and Malaysia.

Market Cap: $198.6M

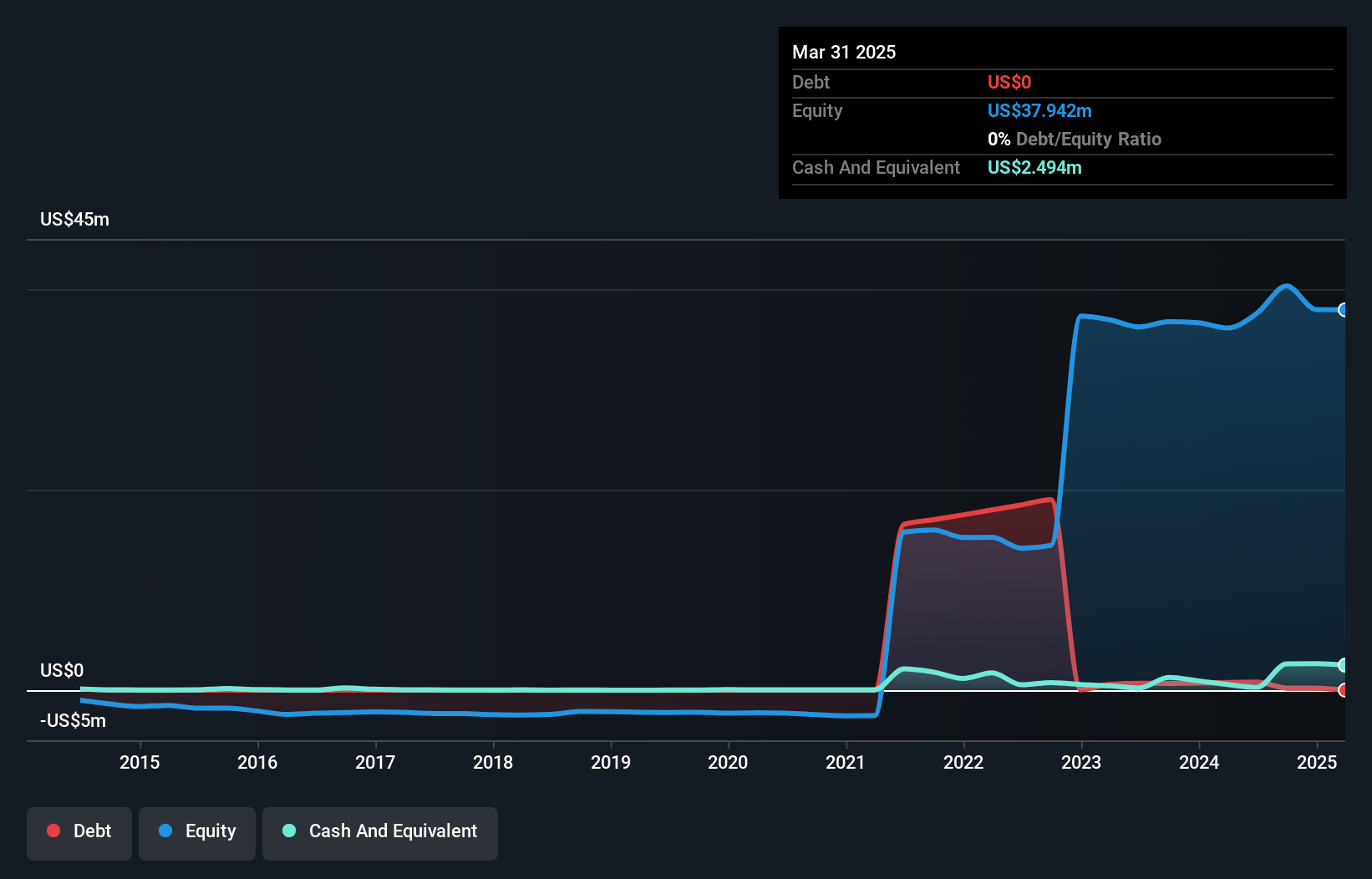

Verde Resources, Inc. presents a mixed picture for penny stock investors. Operating with a market cap of US$198.60 million, the company is pre-revenue with earnings below US$1 million and has shown increased losses over the past five years at 35.7% annually. Despite this, Verde's short-term assets of US$4.5 million comfortably cover both short-term and long-term liabilities, indicating financial stability in the near term. Recent management changes aim to bolster strategic growth initiatives in eco-friendly technologies, yet volatility remains high with weekly fluctuations exceeding most U.S stocks and an unstable share price over recent months.

- Jump into the full analysis health report here for a deeper understanding of Verde Resources.

- Examine Verde Resources' past performance report to understand how it has performed in prior years.

Make It Happen

- Click here to access our complete index of 709 US Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TETRA Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TTI

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives