- United States

- /

- Chemicals

- /

- OTCPK:VRDR

Genenta Science And 2 Other Penny Stocks To Consider

Reviewed by Simply Wall St

As the U.S. stock market shows resilience amidst big bank earnings and ongoing trade tensions with China, investors continue to seek opportunities across various sectors. Penny stocks, though often seen as a relic of past trading days, remain a relevant investment area due to their potential for growth at lower price points. These smaller or newer companies can offer significant upside when they have strong financials and fundamentals, making them an intriguing option for those looking to uncover hidden value in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.85 | $390.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.80 | $665.46M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.82 | $273.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.86 | $55.5M | ✅ 5 ⚠️ 1 View Analysis > |

| Sensus Healthcare (SRTS) | $3.21 | $53.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.91 | $22.88M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.17 | $524.02M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.96255 | $6.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.46 | $80.43M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 365 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Genenta Science (GNTA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Genenta Science S.p.A. is a clinical-stage biotechnology company focused on developing hematopoietic stem cell gene therapies for solid tumors in Italy, with a market cap of $62.23 million.

Operations: As of the latest report, there are no revenue segments reported for this clinical-stage biotechnology company.

Market Cap: $62.23M

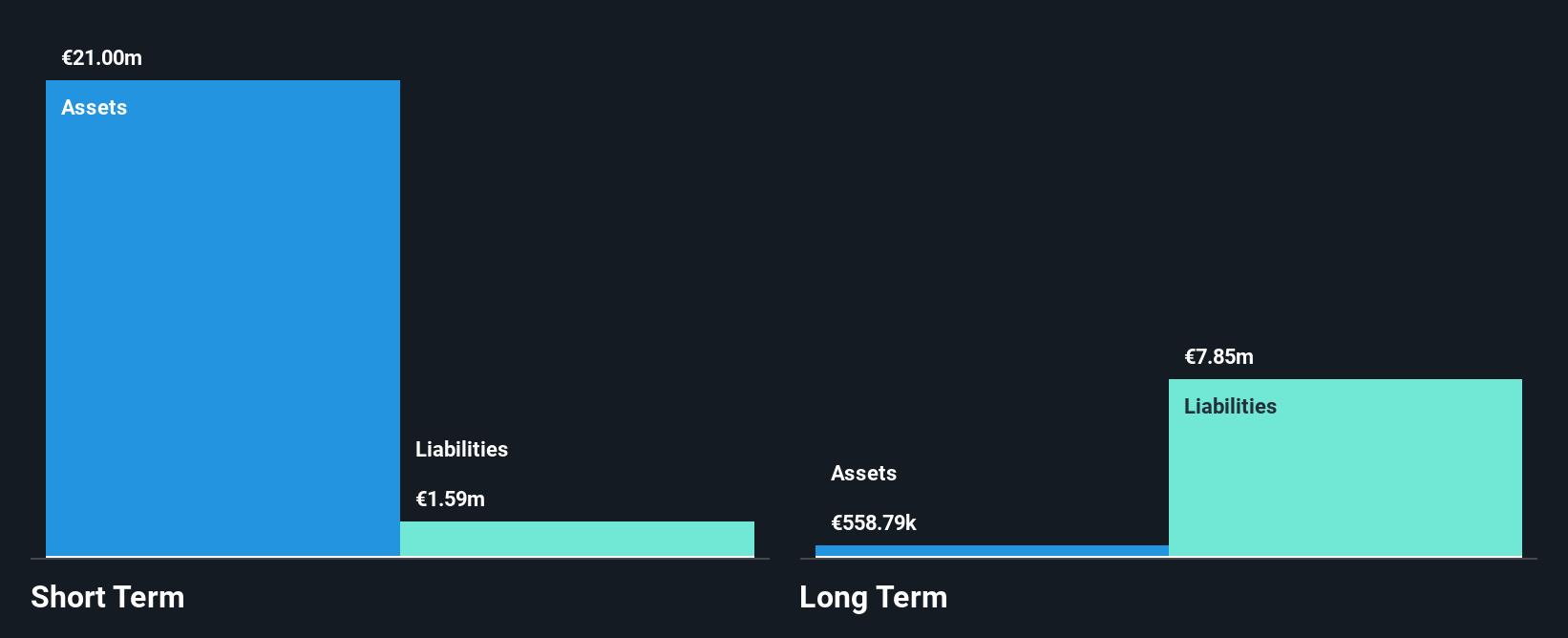

Genenta Science, a clinical-stage biotech firm with a market cap of US$62.23 million, remains pre-revenue and unprofitable. Despite this, the company has managed its finances prudently with short-term assets of €21 million surpassing both short and long-term liabilities. Recent leadership changes include the appointment of Dr. Francesco Galimi as acting Chief Medical Officer following Dr. Carlo Russo's resignation for personal reasons. The board is experienced, averaging 4.4 years in tenure, yet profitability remains elusive with no forecasts indicating a turnaround within three years as losses have grown annually by 13.4%.

- Jump into the full analysis health report here for a deeper understanding of Genenta Science.

- Examine Genenta Science's earnings growth report to understand how analysts expect it to perform.

Koil Energy Solutions (KLNG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Koil Energy Solutions, Inc. is an energy services company that provides equipment and support services to the energy and offshore industries, with a market cap of $33.64 million.

Operations: Koil Energy Solutions generates revenue primarily from its Oil Well Equipment & Services segment, which accounted for $21.60 million.

Market Cap: $33.64M

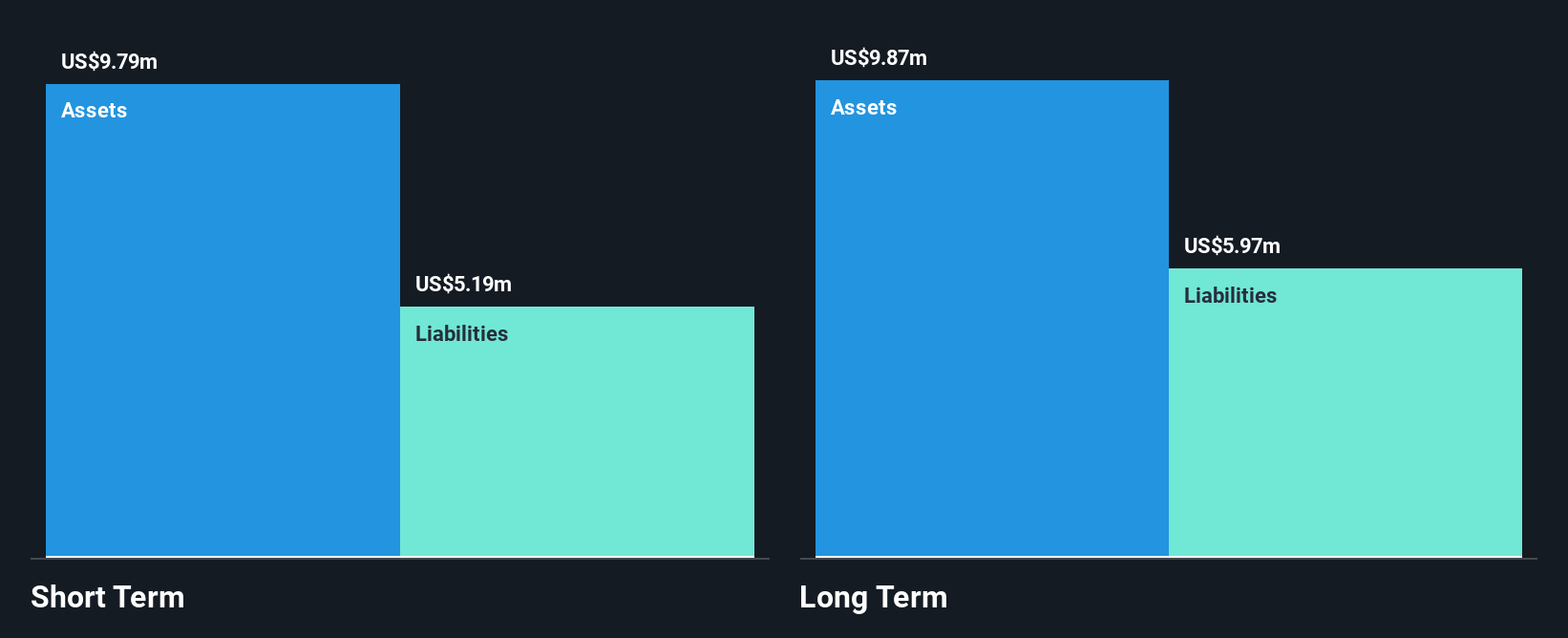

Koil Energy Solutions, with a market cap of US$33.64 million, has demonstrated robust financial health by maintaining short-term assets that exceed both its short and long-term liabilities, while also having more cash than total debt. The company's earnings growth over the past year was substantial at 103.7%, surpassing industry averages despite recent volatility in share price. Recent contracts for subsea equipment in the Gulf of America highlight Koil's competitive edge in delivering high-performance systems efficiently. However, significant insider selling and reduced net income suggest potential challenges ahead despite stable operational performance and strategic project wins.

- Dive into the specifics of Koil Energy Solutions here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Koil Energy Solutions' track record.

Verde Resources (VRDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Verde Resources, Inc. operates through its subsidiaries in the production of biochar from waste materials in the dairy, palm, and other natural resource industries across the United States and Malaysia, with a market cap of $111.22 million.

Operations: Verde Resources generates revenue through its subsidiaries by producing biochar from waste materials in the dairy, palm, and other natural resource sectors across the United States and Malaysia.

Market Cap: $111.22M

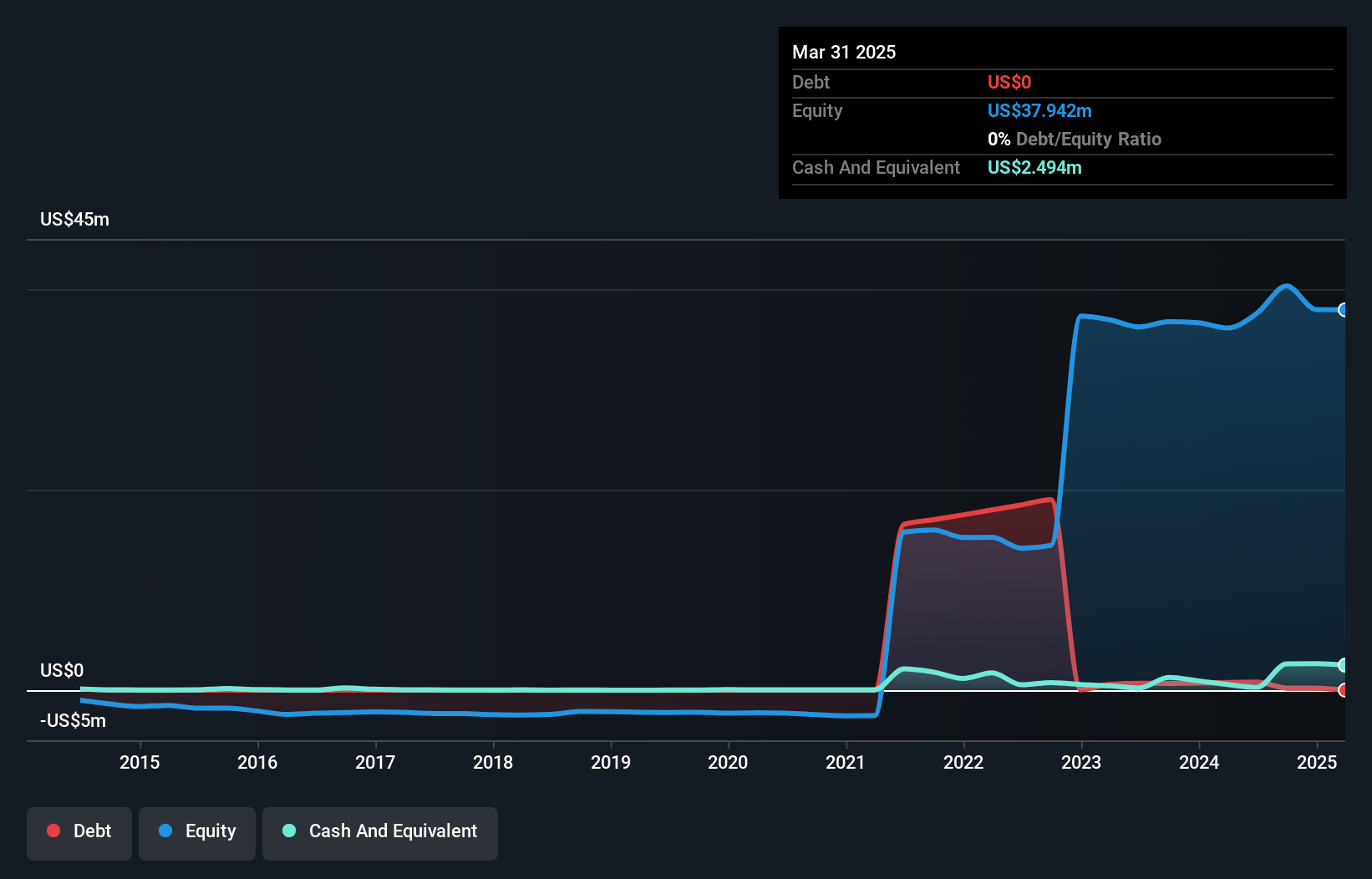

Verde Resources, with a market cap of US$111.22 million, is pre-revenue and currently unprofitable, facing challenges such as a volatile share price and a cash runway of less than one year. Despite these hurdles, the company shows promise through its innovative Biochar-Asphalt technology, which has demonstrated early success in carbon sequestration and durability tests. Verde's partnership efforts with Ergon Asphalt & Emulsions aim to accelerate commercialization across the U.S., potentially transforming road infrastructure into carbon sinks. However, delayed SEC filings could pose risks to investor confidence while negotiations for an exclusive license agreement are ongoing.

- Click here to discover the nuances of Verde Resources with our detailed analytical financial health report.

- Assess Verde Resources' previous results with our detailed historical performance reports.

Make It Happen

- Unlock our comprehensive list of 365 US Penny Stocks by clicking here.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:VRDR

Verde Resources

Produces and sells biochar and related products in the United States and Malaysia.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026