- United States

- /

- Biotech

- /

- NasdaqCM:GDTC

CytoMed Therapeutics Leads 3 US Penny Stocks To Consider

Reviewed by Simply Wall St

As the U.S. equities market begins 2025 on a challenging note, extending its recent slump, investors are keenly observing potential opportunities amid broader market declines. Penny stocks, despite their vintage moniker, continue to attract attention for those interested in smaller or newer companies with potential value. This article explores three penny stocks that stand out for their financial strength and balance sheet resilience, offering intriguing possibilities for investors seeking stability and growth in less-established firms.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.11 | $1.85B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $110.4M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.838 | $5.59M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.58 | $9.9M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.3267 | $10.67M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.42 | $44.88M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.62 | $42.86M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.45 | $23.24M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.01 | $84.54M | ★★★★★☆ |

Click here to see the full list of 726 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

CytoMed Therapeutics (NasdaqCM:GDTC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CytoMed Therapeutics Limited is a pre-clinical biopharmaceutical company that develops novel cell-based immunotherapies for treating human cancers and degenerative diseases in Malaysia and Singapore, with a market cap of $39.24 million.

Operations: CytoMed Therapeutics generates revenue primarily from its biotechnology startups segment, totaling SGD 0.45 million.

Market Cap: $39.24M

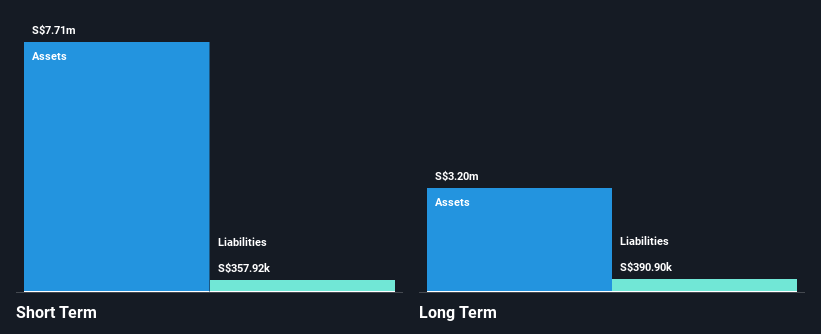

CytoMed Therapeutics is a pre-revenue biopharmaceutical company with a market cap of US$39.24 million, focusing on innovative cell-based immunotherapies. Recent developments include the initiation of its ANGELICA Trial, which explores gamma delta T cells for treating advanced cancers, potentially reducing production costs and improving patient access compared to traditional CAR-T therapies. While the company has stable cash reserves exceeding its liabilities, it remains unprofitable with no significant revenue streams. Leadership changes are underway as Dr. Tan Wee Kiat resigned from key executive roles for personal reasons without affecting operational continuity or strategic direction.

- Dive into the specifics of CytoMed Therapeutics here with our thorough balance sheet health report.

- Explore CytoMed Therapeutics' analyst forecasts in our growth report.

Hyperfine (NasdaqGM:HYPR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hyperfine, Inc. is a medical device company that offers MRI products across the United States, Europe, and Middle Eastern markets, with a market cap of $64.19 million.

Operations: The company's revenue is derived entirely from its Medical Imaging Systems segment, amounting to $13.26 million.

Market Cap: $64.19M

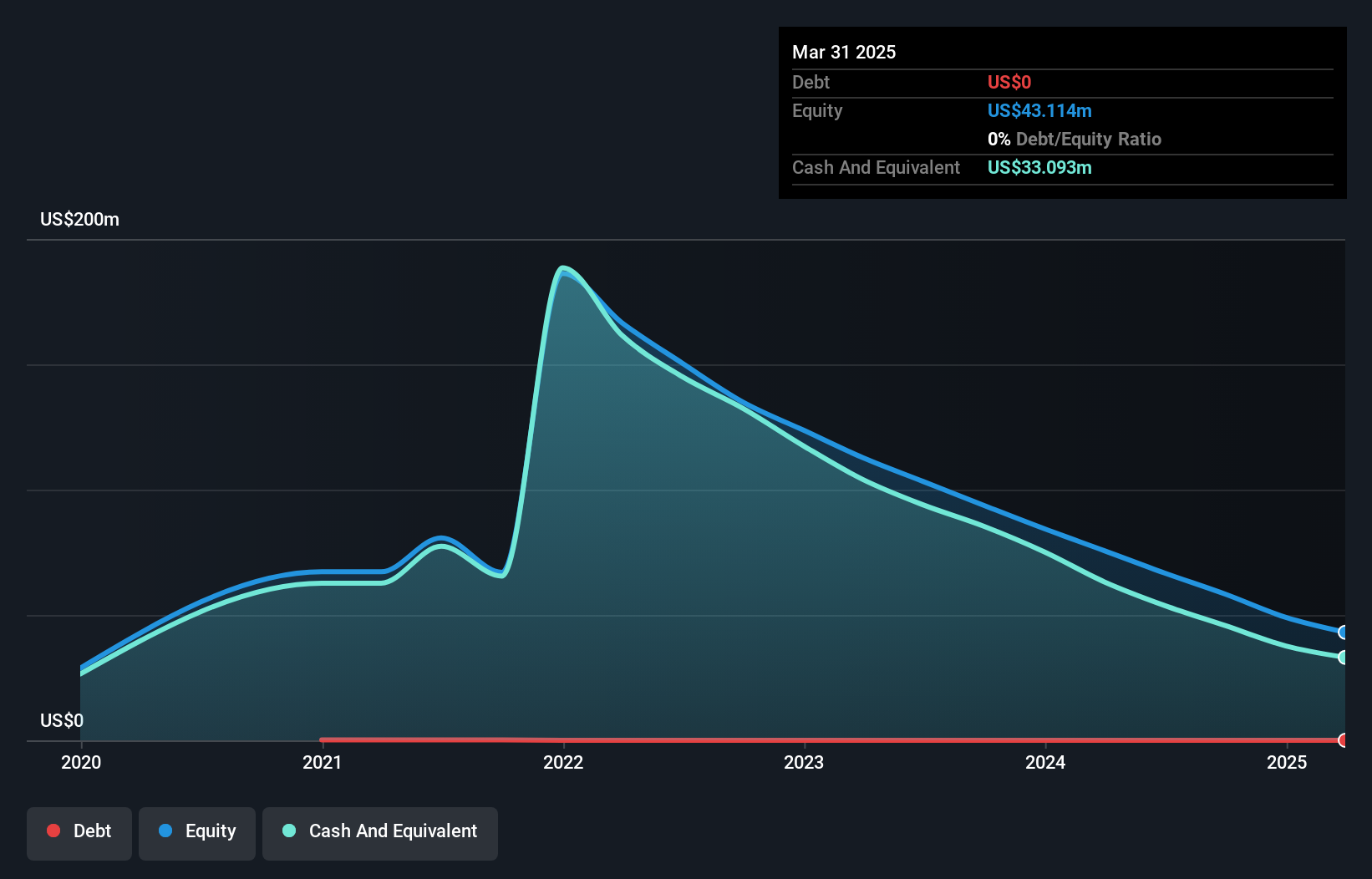

Hyperfine, Inc., with a market cap of US$64.19 million, is expanding its reach through strategic distribution agreements across Turkey, Israel, and Saudi Arabia. These moves align with its goal to enhance access to MR brain imaging in underserved regions. Despite being unprofitable and having experienced increased losses over the past five years, Hyperfine's revenue from its Medical Imaging Systems segment reached US$13.26 million. The company benefits from a stable cash position exceeding both short- and long-term liabilities but faces challenges like high negative return on equity and an inexperienced management team averaging 1.7 years tenure.

- Click here and access our complete financial health analysis report to understand the dynamics of Hyperfine.

- Evaluate Hyperfine's prospects by accessing our earnings growth report.

BioLargo (OTCPK:BLGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BioLargo, Inc. invents, develops, and commercializes various platform technologies and has a market cap of $57.20 million.

Operations: The company's revenue is primarily derived from its ONM Environmental segment, contributing $16.50 million, and the BLEST segment, which adds $3.09 million.

Market Cap: $57.2M

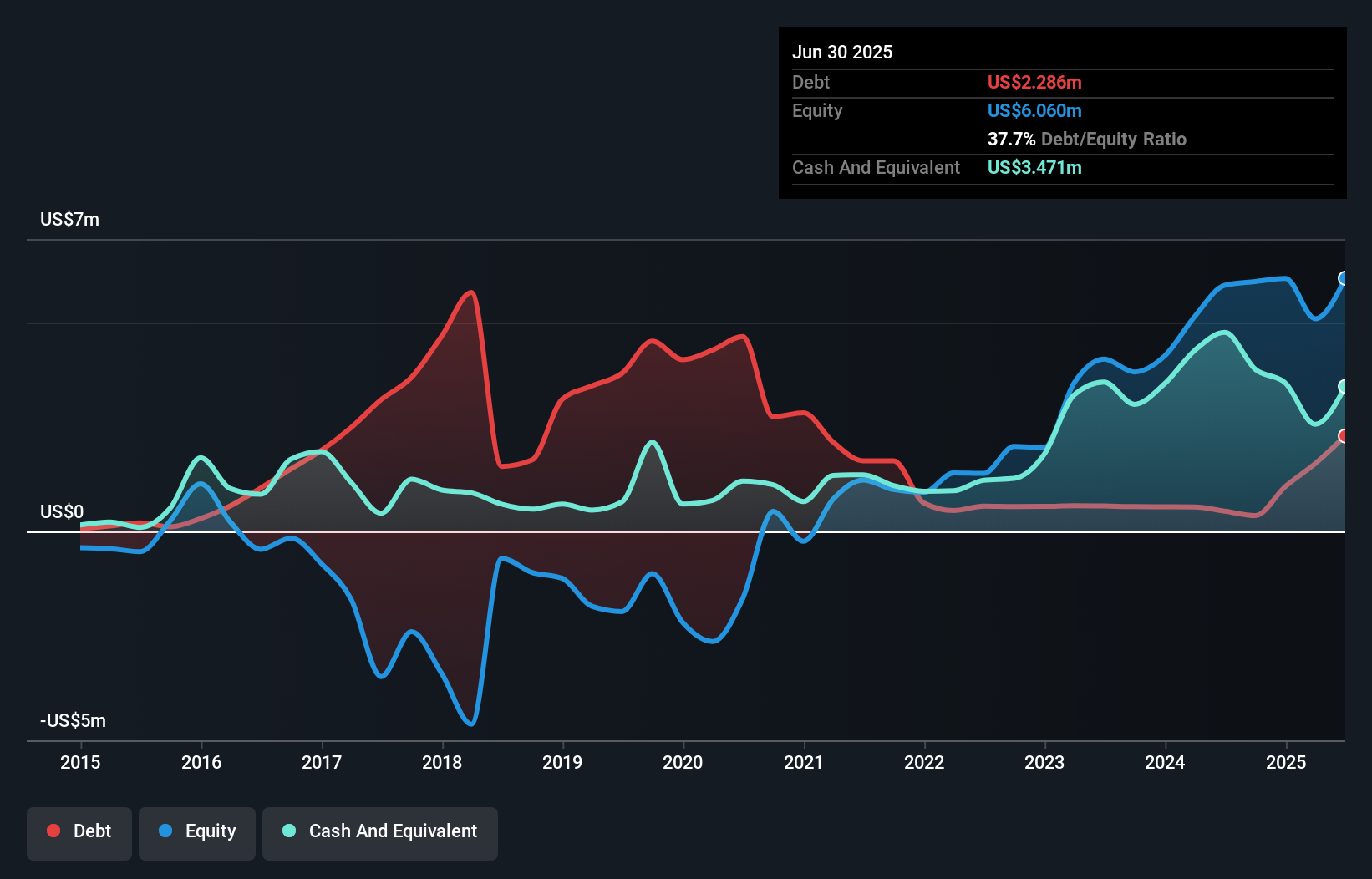

BioLargo, Inc., with a market cap of US$57.20 million, has shown significant revenue growth, reporting US$4.35 million for Q3 2024 compared to US$2.67 million the previous year. Despite being unprofitable and not expected to achieve profitability in the next three years, BioLargo has reduced its losses by 28% annually over five years. The company maintains a solid cash position exceeding both short- and long-term liabilities and benefits from an experienced management team with an average tenure of 19.4 years. Recent executive appointments highlight its active engagement in environmental technologies advisory roles at the national level.

- Click to explore a detailed breakdown of our findings in BioLargo's financial health report.

- Learn about BioLargo's future growth trajectory here.

Next Steps

- Gain an insight into the universe of 726 US Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GDTC

CytoMed Therapeutics

A pre-clinical biopharmaceutical company, focuses on developing novel cell-based immunotherapies for the treatment of human cancers and degenerative diseases in Malaysia and Singapore.

Excellent balance sheet slight.

Market Insights

Community Narratives