- United States

- /

- Metals and Mining

- /

- NYSEAM:UAMY

Discover Figure Technology Solutions And 2 More Insider-Favored Growth Stocks

Reviewed by Simply Wall St

In the current U.S. market landscape, major stock indexes have shown resilience with weekly gains despite mixed endings and external pressures such as a government shutdown affecting economic data releases. Amidst this backdrop, growth companies with high insider ownership can offer unique insights into potential value, as insiders often have intimate knowledge of their company's prospects and challenges.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 93.2% |

| Prairie Operating (PROP) | 31.3% | 86.6% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 67.4% |

| Hesai Group (HSAI) | 14.9% | 41.5% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.1% | 33.7% |

| Celsius Holdings (CELH) | 10.8% | 32% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.5% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

Underneath we present a selection of stocks filtered out by our screen.

Figure Technology Solutions (FIGR)

Simply Wall St Growth Rating: ★★★★★☆

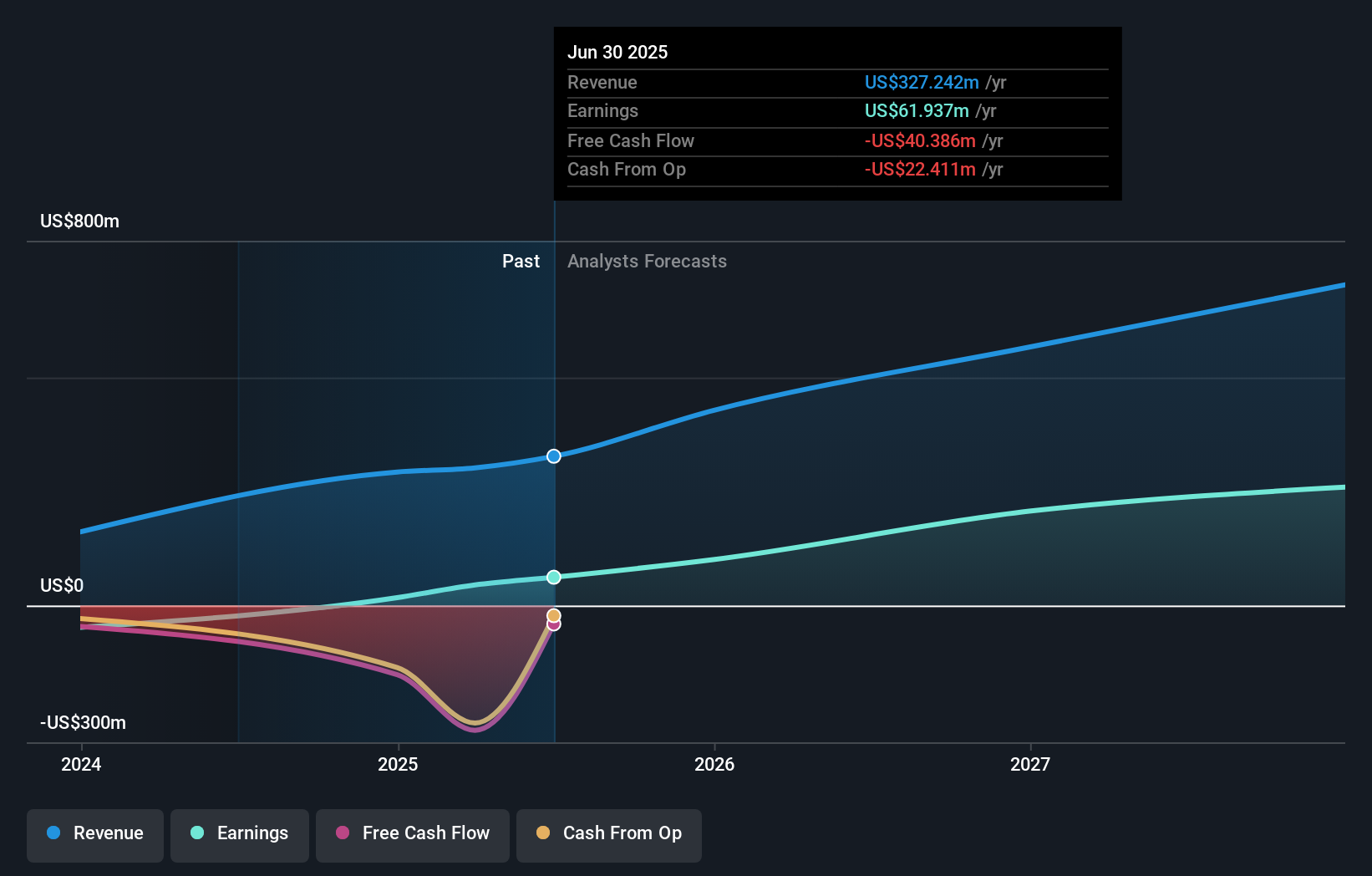

Overview: Figure Technology Solutions, Inc. develops and operates a blockchain-based consumer lending platform, with a market cap of $9.54 billion.

Operations: The company generates revenue primarily from its Figure Technologies Inc segment, amounting to $322.27 million, and its Markets segment, contributing $6.26 million.

Insider Ownership: 23.2%

Earnings Growth Forecast: 52% p.a.

Figure Technology Solutions, recently completing a US$787.5 million IPO, showcases strong growth potential with earnings expected to rise 52% annually, outpacing the market's 15.4%. Despite high illiquidity and limited financial data, insiders have shown confidence by buying more shares than selling recently. The company's innovative products like Intellidebt and platforms such as Democratized Prime highlight its strategic expansion in debt consolidation and corporate treasury solutions, potentially driving future revenue growth of 29.1% annually.

- Click here to discover the nuances of Figure Technology Solutions with our detailed analytical future growth report.

- Our valuation report unveils the possibility Figure Technology Solutions' shares may be trading at a premium.

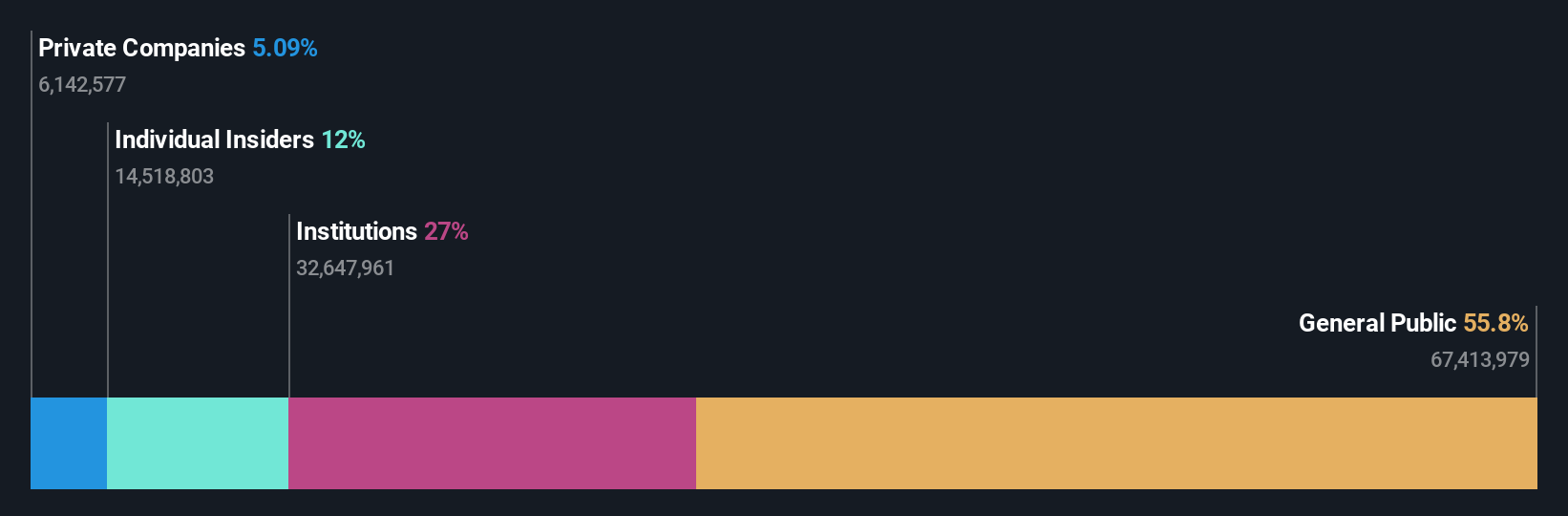

United States Antimony (UAMY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: United States Antimony Corporation produces and sells antimony, zeolite, and precious metals in the United States and Canada, with a market cap of approximately $997.64 million.

Operations: The company generates revenue primarily from antimony at $22.40 million and zeolite at $3.33 million.

Insider Ownership: 11.3%

Earnings Growth Forecast: 69% p.a.

United States Antimony is poised for significant growth, with earnings expected to increase by 69.05% annually and revenue projected to grow at 51% per year, outpacing the US market. Despite recent share dilution and high volatility, insider confidence remains strong with substantial buying activity. The company was recently added to major indices like the S&P/TSX Global Mining Index, indicating increased visibility. However, challenges include processing impurities in Australian ore supplies and navigating regulatory changes following its reincorporation from Montana to Texas.

- Click here and access our complete growth analysis report to understand the dynamics of United States Antimony.

- The valuation report we've compiled suggests that United States Antimony's current price could be inflated.

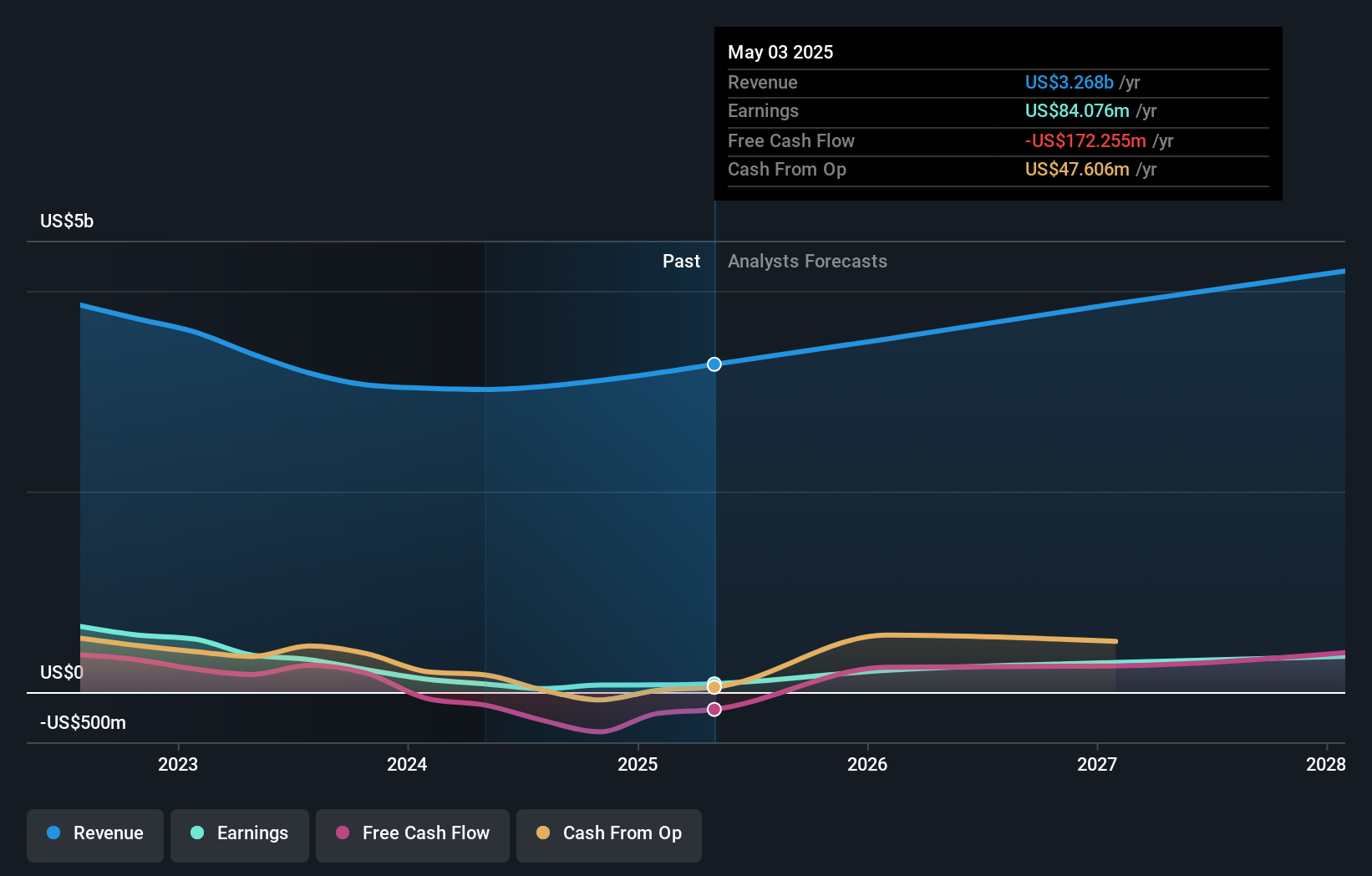

RH (RH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RH, along with its subsidiaries, operates as a retailer and lifestyle brand in the home furnishings market across several countries including the United States, Canada, the United Kingdom, Germany, Belgium, and Spain with a market cap of approximately $3.89 billion.

Operations: The company's revenue segments include $195.70 million from Waterworks and $3.14 billion from Restoration Hardware (RH).

Insider Ownership: 16.6%

Earnings Growth Forecast: 38.5% p.a.

RH's insider ownership aligns with its growth trajectory, as earnings are projected to rise 38.47% annually, surpassing the US market. Despite facing tariff-related uncertainties and delaying a brand extension, RH reported strong Q2 results with net income of US$51.71 million on sales of US$899.15 million. Challenges include interest payments not well-covered by earnings and negative equity, but RH trades at 52% below estimated fair value and has completed a significant share buyback program worth over $2 billion.

- Take a closer look at RH's potential here in our earnings growth report.

- The analysis detailed in our RH valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Click this link to deep-dive into the 201 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Want To Explore Some Alternatives? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:UAMY

United States Antimony

Produces and sells antimony, zeolite, and precious metals in the United States and Canada.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.