- United States

- /

- Metals and Mining

- /

- NYSEAM:UAMY

A Look at United States Antimony’s Valuation as It Secures $245M Defense Contract and New Financing

Reviewed by Kshitija Bhandaru

United States Antimony has landed a five-year, $245 million contract with the U.S. Defense Logistics Agency, highlighting its strategic importance as a domestic antimony supplier for government needs.

In addition, the company completed a $26.25 million equity offering, providing additional resources to fund upcoming projects and expansion plans.

See our latest analysis for United States Antimony.

Riding a wave of momentum after locking in the DLA contract and bolstering its balance sheet, United States Antimony has captured investor attention with a 135.5% one-month share price return, propelling year-to-date share gains above 500%. Over the longer term, its 1-year total shareholder return of nearly 1,500% stands out even in a strong market, signaling that investor optimism is surging as the company's growth narrative gains traction. However, the pace of recent gains also introduces fresh risks alongside the opportunity.

If you’re curious what other fast-rising companies investors are watching, now is a perfect time to broaden your approach and discover fast growing stocks with high insider ownership

With UAMY’s stock surging more than 500% year-to-date and trading well above recent equity offering levels, the question now is whether further upside remains or if the market has already priced in the potential growth story.

Most Popular Narrative: 45.1% Overvalued

United States Antimony's most popular narrative sets its fair value well below the closing price of $10.88, suggesting exuberance has outpaced consensus expectations. Investors chasing this rally may want to pause and compare the narrative's detailed assumptions driving its price target.

*"Vertical integration, resource diversification, and institutional engagement could boost revenue potential, valuation, and support strong end-market demand amid secular industry tailwinds. Ongoing property acquisitions and vertical integration (new mining leases in Alaska, Montana, and Ontario for antimony, gold, and tungsten) provide optionality and resource security. Successful development and permitted production from these assets would further increase revenue potential, diversify supply risk, and bolster long-term earnings growth."*

Wondering what makes this valuation so ambitious? Find out which future revenue explosions, profitability shifts, and strategic milestones underpin the analysts' case for long-term returns. Why do their bold projections split from the current market frenzy? Unlock the full story behind the fair value call.

Result: Fair Value of $7.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant permitting delays and regulatory scrutiny could derail expansion plans. These factors pose real threats to both production growth and future earnings stability.

Find out about the key risks to this United States Antimony narrative.

Another View: Discounted Cash Flow Points to Undervaluation

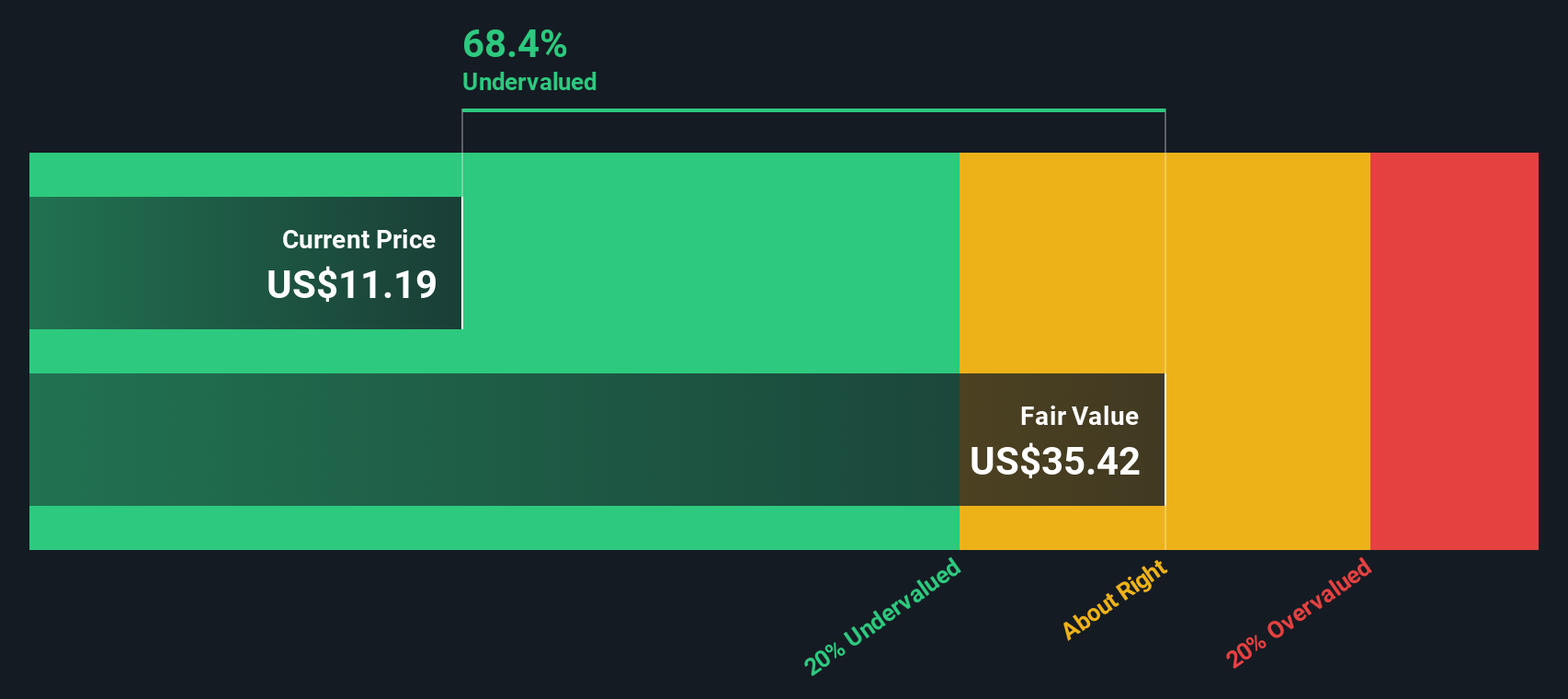

Interestingly, our DCF model paints a dramatically different picture. It suggests United States Antimony could be deeply undervalued, with a fair value estimate of $34.95, which is well above the current share price. Does this mean the market has not yet fully recognized the company's long-term cash flow potential, or is the model overlooking key risks? The debate remains unsettled.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out United States Antimony for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own United States Antimony Narrative

If you see things differently, or want to dig into the numbers and craft your own view, you can build a personalized thesis in under three minutes. Do it your way

A great starting point for your United States Antimony research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the next breakout story to pass you by. Get ahead by handpicking stocks positioned for growth, value, or innovation right now.

- Target steady income streams by reviewing these 18 dividend stocks with yields > 3% with yields over 3% and consistent payout histories.

- Spot emerging trends in AI and tech by scanning these 25 AI penny stocks leading advancements in artificial intelligence.

- Boost your portfolio's upside with these 897 undervalued stocks based on cash flows trading below fair value based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:UAMY

United States Antimony

Produces and sells antimony, zeolite, and precious metals in the United States and Canada.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives