- United States

- /

- Metals and Mining

- /

- NYSEAM:CMCL

Caledonia Mining (NYSEAM:CMCL): Valuation Insights Following Inclusion in Global Mining Index

Reviewed by Kshitija Bhandaru

Caledonia Mining (NYSEAM:CMCL) just made its way into the S&P/TSX Global Mining Index, a move that often sparks additional attention from funds and institutional investors who track the sector.

See our latest analysis for Caledonia Mining.

Caledonia Mining’s inclusion in the S&P/TSX Global Mining Index comes as the stock’s momentum begins to turn the corner. The company’s share price return year-to-date sits at nearly 3%, while the 1-year total shareholder return is just above 1%, reflecting muted but positive performance amid a quieter period for mining stocks. Investors are showing fresh interest following the index news, which could support a stronger outlook as visibility grows.

If you’re exploring how shifts in the mining sector can spark new opportunities, now is a perfect time to discover See the full list for free..

With attention turning to Caledonia’s fundamentals, the key question is whether the recent uptick represents an undervalued entry point for investors or if the market has already priced in imminent growth.

Most Popular Narrative: 3.2% Undervalued

With Caledonia Mining’s last close at $36.30 and the narrative’s fair value at $37.50, sentiment currently positions the stock slightly ahead. The narrative’s projections hinge on sustainable improvements emerging from operational momentum and capital discipline, factors worth understanding in depth.

Ongoing development of new mining assets, specifically the Bilboes project (with phased, lower-risk development and potential project finance rather than equity), positions Caledonia for significant production and reserve growth, which can meaningfully increase long-term revenues and the company's earnings base.

This valuation rides on a bold blueprint for growth, powered by expansion potential, lean capital moves, and rising margins. Want to know which financial levers underpin this optimism and what future assumptions unlock that target price? The full narrative breaks down all the crucial calculations.

Result: Fair Value of $37.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks linger, including ongoing exposure to Zimbabwe's unpredictable regulatory landscape and Caledonia's reliance on a single core asset for cash flow.

Find out about the key risks to this Caledonia Mining narrative.

Another View: Multiples Tell a Different Story

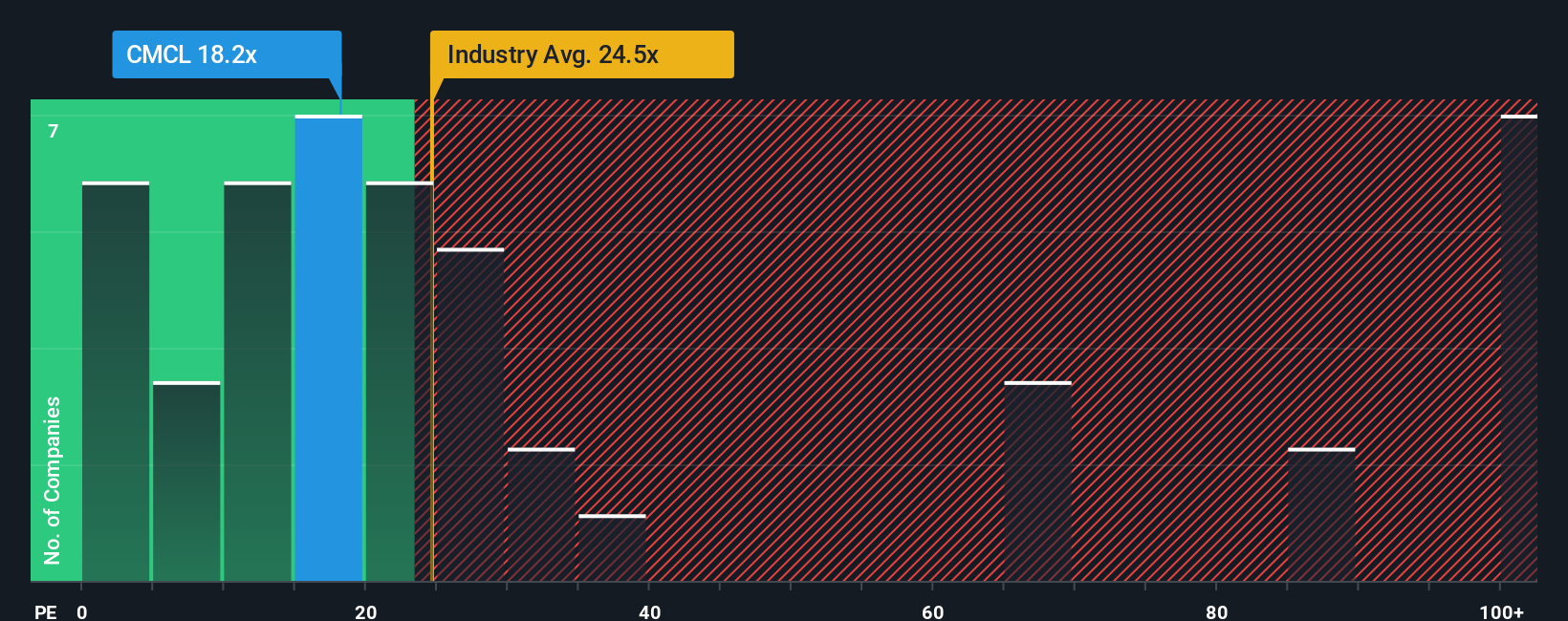

While the fair value narrative sees upside based on operational catalysts, the company’s P/E ratio of 18.9x paints a more cautious picture. This is higher than its fair ratio of 14.6x, which signals shares might be on the expensive side. Notably, while the ratio is lower than peers and the broader industry, the gap compared to the fair ratio hints at valuation risk if growth does not keep up. Does this put a cap on potential gains, or could results surprise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Caledonia Mining Narrative

If you see things differently, or want to dig into the numbers your way, you can shape your own story from the data in just a few minutes. Do it your way.

A great starting point for your Caledonia Mining research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let fresh opportunities pass you by. Grow your watchlist and strengthen your strategy by checking out stock ideas that can give your portfolio an edge.

- Capture underpriced growth by targeting these 914 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Supercharge your returns with these 19 dividend stocks with yields > 3% offering yields above 3% for powerful income potential.

- Ride the next wave of innovation by backing these 23 AI penny stocks transforming industries with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:CMCL

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives