- United States

- /

- Consumer Durables

- /

- NYSE:WOR

These 4 Measures Indicate That Worthington Industries (NYSE:WOR) Is Using Debt Reasonably Well

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Worthington Industries, Inc. (NYSE:WOR) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Worthington Industries

How Much Debt Does Worthington Industries Carry?

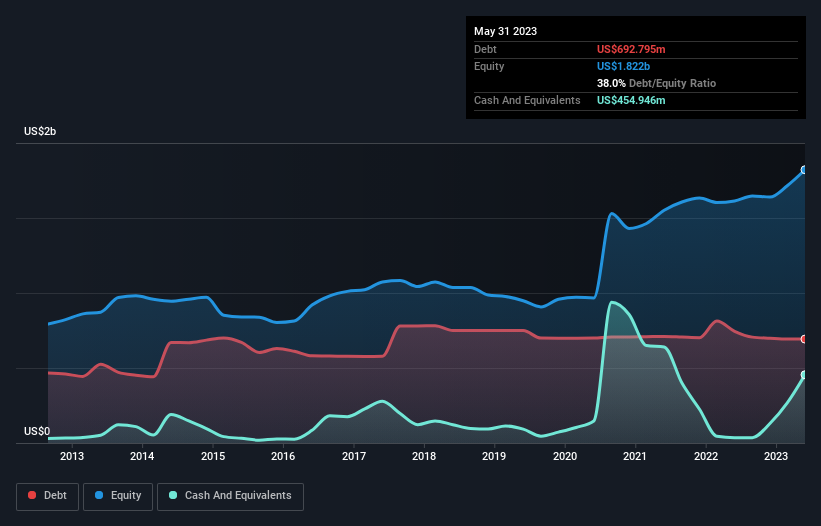

As you can see below, Worthington Industries had US$692.8m of debt at May 2023, down from US$744.6m a year prior. However, because it has a cash reserve of US$454.9m, its net debt is less, at about US$237.8m.

A Look At Worthington Industries' Liabilities

The latest balance sheet data shows that Worthington Industries had liabilities of US$717.6m due within a year, and liabilities of US$1.11b falling due after that. On the other hand, it had cash of US$454.9m and US$697.1m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$677.3m.

Given Worthington Industries has a market capitalization of US$3.43b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With net debt sitting at just 0.68 times EBITDA, Worthington Industries is arguably pretty conservatively geared. And this view is supported by the solid interest coverage, with EBIT coming in at 8.8 times the interest expense over the last year. The modesty of its debt load may become crucial for Worthington Industries if management cannot prevent a repeat of the 26% cut to EBIT over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Worthington Industries's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Worthington Industries generated free cash flow amounting to a very robust 84% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

Worthington Industries's EBIT growth rate was a real negative on this analysis, although the other factors we considered were considerably better. There's no doubt that its ability to to convert EBIT to free cash flow is pretty flash. When we consider all the elements mentioned above, it seems to us that Worthington Industries is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. We'd be motivated to research the stock further if we found out that Worthington Industries insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Worthington Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WOR

Flawless balance sheet average dividend payer.