- United States

- /

- Basic Materials

- /

- NYSE:VMC

Vulcan Materials (VMC): Is the Stock Fairly Valued After a 25% Shareholder Return?

Reviewed by Kshitija Bhandaru

See our latest analysis for Vulcan Materials.

Vulcan Materials’ share price momentum has been building lately, with a 12.6% gain over the last 90 days pushing its latest close to $302.90. That matches broader strength, as the company has now delivered a 25.1% total shareholder return over the past year and nearly doubled holders’ money over three years.

If you’re wondering what else is gathering steam in the market right now, this is a great moment to broaden your view with fast growing stocks with high insider ownership

But with earnings growth and share price gains moving in lockstep, the key question is whether Vulcan Materials’ stock is now undervalued or if the market has already priced in its future growth. Could there still be a buying opportunity?

Most Popular Narrative: 0.4% Undervalued

Vulcan Materials' widely followed consensus narrative suggests the stock price of $302.90 is right in line with its fair value of $304.05. This sets the stage for a close call on valuation and much debate over what is driving growth expectations.

Accelerating infrastructure spending, driven by the ongoing rollout of IIJA funding, major state initiatives in core Southern and Sunbelt markets, and increasing local spending, is visibly expanding Vulcan's backlogs and contract awards. With over 60% of IIJA funds still to be spent and awards up over 20% in Vulcan-served regions, this points to multi-year growth in volumes and more predictable, compounding revenue.

Curious what is fueling this narrow margin between market price and fair value? The narrative hinges on bold growth bets, future margin expansion, and ambitious profitability assumptions. Dive in to uncover the full story and see which forecasts anchor this razor-thin fair value gap.

Result: Fair Value of $304.05 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent delays in residential construction recovery or increased exposure to regional weather extremes could quickly challenge Vulcan Materials’ optimistic view for long-term growth.

Find out about the key risks to this Vulcan Materials narrative.

Another View: Premium Price Tag Raises Questions

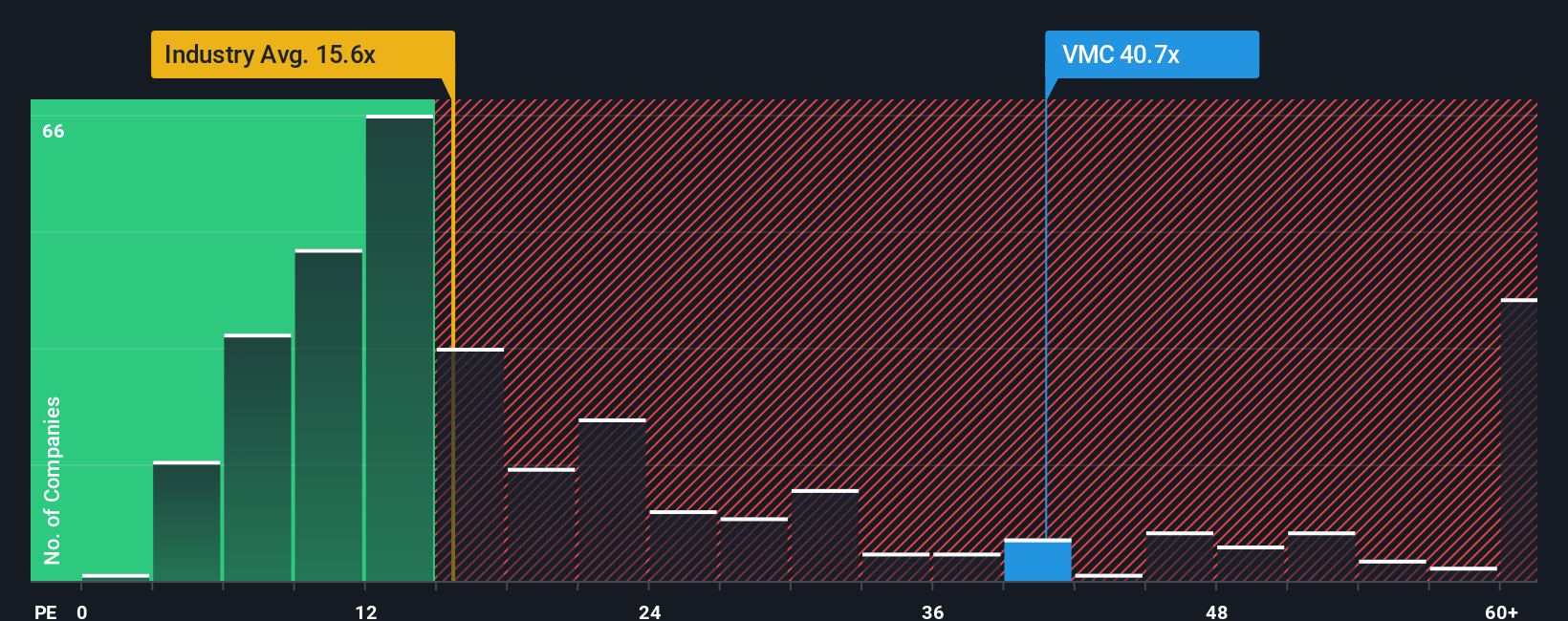

Looking at valuation through the lens of earnings multiples, Vulcan Materials trades at a much higher price compared to both peers and industry averages. Its price-to-earnings ratio stands at 41.8x, noticeably above the industry average of 15.6x and also higher than the estimated fair ratio of 24.1x for this sector. This premium may reflect high expectations, but it also introduces risk if future growth falls short. Is the market overconfident or just pricing in superior performance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vulcan Materials Narrative

If you’re keen to dig deeper or shape your perspective, you can explore the data yourself and build your own narrative in just a few minutes. Do it your way

A great starting point for your Vulcan Materials research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stop waiting for the next big opportunity to pass you by. Take action now and uncover unique stocks that could reshape your investment journey.

- Maximize your potential with steady income by reviewing these 18 dividend stocks with yields > 3%, which offers yields above 3% and a track record of strong dividends.

- Capitalize on tomorrow’s breakthroughs with these 25 AI penny stocks, making waves at the intersection of artificial intelligence and market innovation.

- Seize value often overlooked by the crowd and assess these 892 undervalued stocks based on cash flows, priced below their true worth based on smart analysis of future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VMC

Vulcan Materials

Produces and supplies construction aggregates in the United States.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives