- United States

- /

- Basic Materials

- /

- NYSE:VMC

Vulcan Materials (NYSE:VMC) Declares US$0.49 Quarterly Dividend Ahead Of August Record Date

Reviewed by Simply Wall St

Vulcan Materials (NYSE:VMC) affirmed its quarterly cash dividend of $0.49 per share, indicating its commitment to providing shareholder value. Over the last quarter, the company's stock price rose by 11%, a performance that aligns with general market trends, which are up 13% over the past year. This price movement could have been influenced by the consistent dividend strategy, buyback activities, and its notable earnings growth, but the stock's overall trajectory was similar to broader market activity. The company's removal from various indices may have acted as a counterbalance to these positive developments.

Vulcan Materials has 2 possible red flags we think you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

Vulcan Materials' decision to affirm a quarterly cash dividend of US$0.49 per share highlights its emphasis on maintaining shareholder value, aligning well with its focus on consistent cash flow and disciplined capital allocation. Recently, the company's stock has seen an 11% increase over the last quarter, reflecting investor confidence in its strategy. Over a five-year span, the company's total return, including both share price and dividends, was a significant 124.51%, suggesting a strong growth trajectory compared to recent performance. However, in the past year, Vulcan Materials underperformed relative to the broader market and the Basic Materials industry that rose over 11.2%.

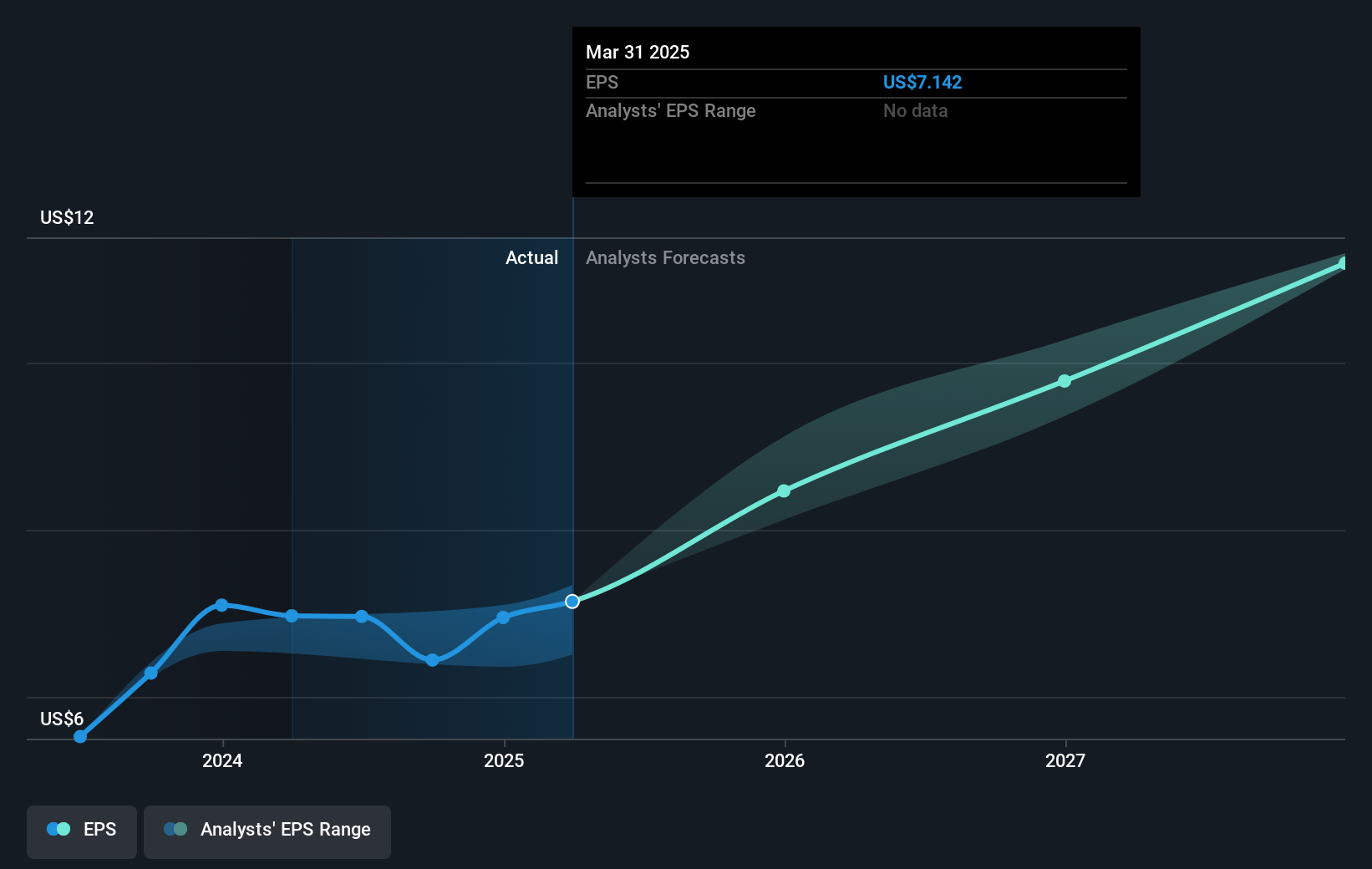

The recent announcement and stock performance may influence expected revenue and earnings, underlined by robust public construction demand and consistent dividend payments. Analysts forecast Vulcan's revenue to reach US$9.5 billion by 2028, with earnings climbing to US$1.5 billion. Despite short-term headwinds, such as macroeconomic volatility and interest rate impacts, strong pricing in aggregates and operational efficiencies could bolster financial results. With a current share price of US$267.24, compared to a consensus price target of US$290.83, the potential upside of 8.1% may indicate that the stock is fairly priced according to analysts' expectations. The company's proactive measures to manage costs and capitalize on public sector demand underpin these positive forecasts.

Understand Vulcan Materials' track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VMC

Vulcan Materials

Produces and supplies construction aggregates in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)