- United States

- /

- Basic Materials

- /

- NYSE:VMC

Should Analyst Upgrades and Texas Asset Sales Prompt a Closer Look at Vulcan Materials' (VMC) Valuation?

Reviewed by Sasha Jovanovic

- In the past week, Vulcan Materials saw heightened analyst activity, with Wells Fargo initiating coverage and Citi raising its outlook ahead of the company’s upcoming earnings announcement and recent asset sales in Texas.

- This renewed analyst focus comes as Vulcan Materials continues to trade at a premium valuation, reflecting investor expectations of above-market earnings growth despite periods of slower sales performance and regional shifts.

- We'll explore how analyst confidence in Vulcan Materials’ future earnings potential may influence the company's investment narrative and outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Vulcan Materials Investment Narrative Recap

To own Vulcan Materials, you must have confidence in the long-term infrastructure boom across the Sunbelt and other key U.S. regions, believing that steady public and private construction demand will outweigh periods of flat sales and local shifts like the recent Texas asset sale. While the recent divestment in Houston reflects a subtle change in geographic footprint, it does not materially alter the primary short-term catalyst, surging government-driven infrastructure spending, nor does it address the persistent risk of weather-related disruptions in key Southeast markets.

Among recent developments, Vulcan’s upcoming Q3 2025 earnings release stands out, with analysts anticipating strong double-digit bottom-line growth year-over-year, supported by robust federal and state project funding and improving cost discipline. These trends may further reinforce investor faith in near-term margin improvement despite the company’s exposure to regional volume volatility.

By contrast, investors should be particularly aware of Vulcan's heightened exposure to weather risk in the Southeast, as...

Read the full narrative on Vulcan Materials (it's free!)

Vulcan Materials is projected to reach $9.6 billion in revenue and $1.5 billion in earnings by 2028. This outlook implies an annual revenue growth rate of 8.1% and an earnings increase of $541.9 million from current earnings of $958.1 million.

Uncover how Vulcan Materials' forecasts yield a $304.05 fair value, in line with its current price.

Exploring Other Perspectives

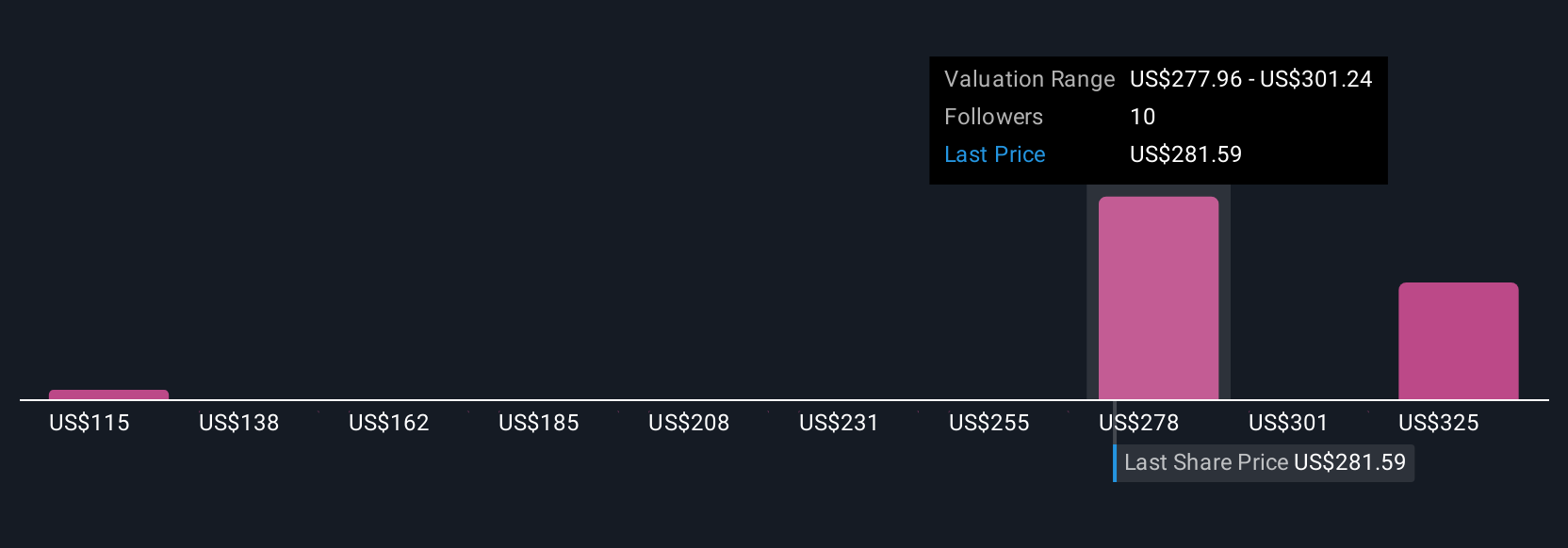

Simply Wall St Community members posted four fair value estimates for Vulcan Materials ranging from US$115 to US$314. Analysts project accelerating infrastructure spending as a crucial catalyst, highlighting how widely your peers’ outlooks can vary and suggesting multiple viewpoints to consider.

Explore 4 other fair value estimates on Vulcan Materials - why the stock might be worth as much as $314.12!

Build Your Own Vulcan Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vulcan Materials research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vulcan Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vulcan Materials' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VMC

Vulcan Materials

Produces and supplies construction aggregates in the United States.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives