- United States

- /

- Diversified Financial

- /

- NasdaqCM:MBIN

Exploring Three Undiscovered Gem Stocks In The United States

Reviewed by Simply Wall St

The United States market has remained flat over the past week, yet it has experienced a significant 31% rise in the last year, with earnings projected to grow by 15% annually in the coming years. In such a dynamic environment, identifying stocks that are not only resilient but also poised for growth can be key to uncovering potential opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Nanophase Technologies | 40.87% | 24.19% | -9.71% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Merchants Bancorp (NasdaqCM:MBIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Merchants Bancorp is a diversified bank holding company operating in the United States with a market capitalization of $1.66 billion.

Operations: Merchants Bancorp generates revenue primarily through its banking and financial services. The company focuses on interest income from loans and leases, as well as non-interest income from service charges and fees. A key financial metric to note is the net profit margin, which reflects the company's profitability after accounting for all expenses.

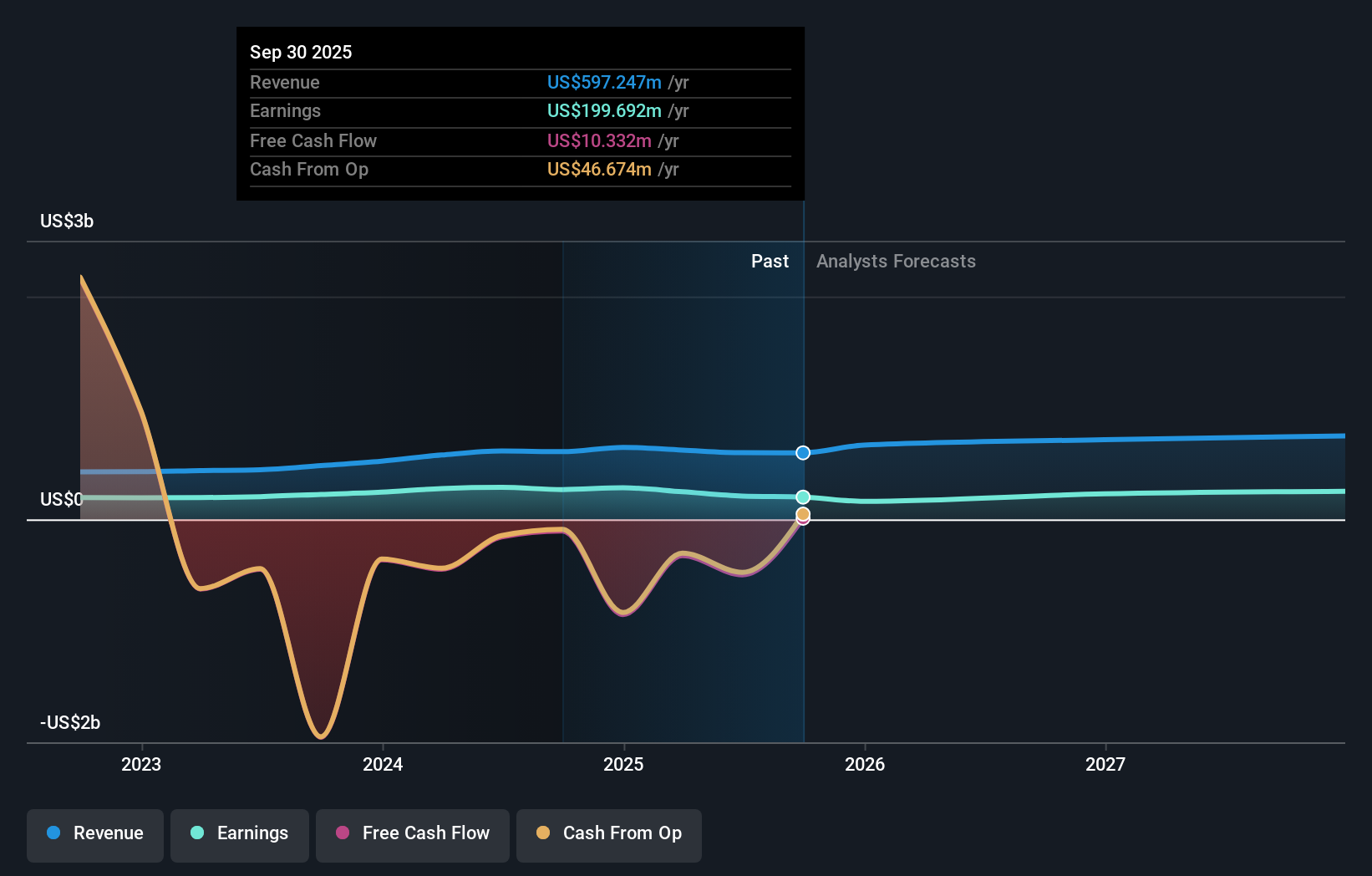

Merchants Bancorp, a financial entity with total assets of US$18.7 billion and equity of US$1.9 billion, has been making waves with its impressive earnings growth of 19.4% over the past year, outpacing the Diversified Financial industry’s 13.6%. With total deposits at US$12.9 billion and loans amounting to US$10.7 billion, it boasts a net interest margin of 3.1%. However, an allowance for bad loans stands at only 40%, which may raise some eyebrows despite having low-risk funding sources covering 77% of liabilities primarily from customer deposits—a less risky avenue than external borrowing.

Hackett Group (NasdaqGS:HCKT)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Hackett Group, Inc. is an intellectual property-based executive advisory, strategic consulting, and digital transformation company with a market cap of $673.32 million.

Operations: Hackett Group generates revenue through its executive advisory, strategic consulting, and digital transformation services. The company's financial performance is reflected in its market cap of $673.32 million.

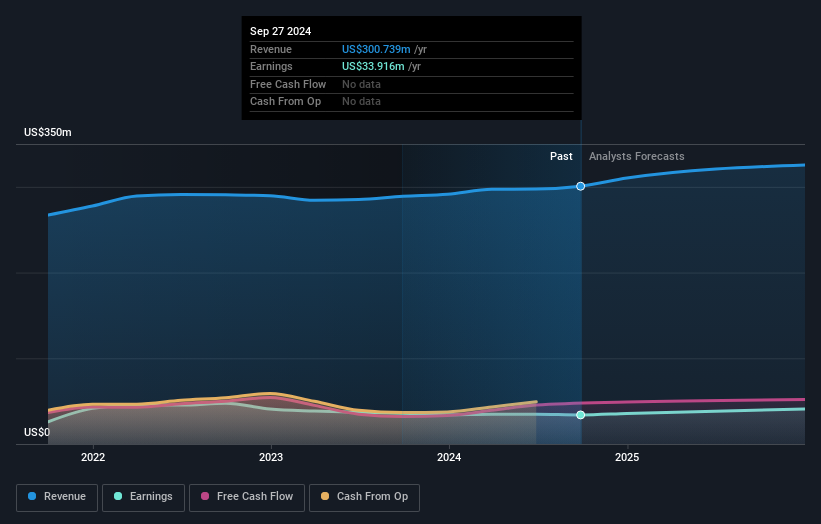

Hackett Group, known for its expertise in enterprise performance management and AI-driven solutions, has been making strategic moves to bolster its market position. With a net debt to equity ratio of 8.8%, the company maintains a satisfactory leverage level while ensuring interest payments are well-covered by EBIT at 27.6 times coverage. Despite recent negative earnings growth of 5.9%, Hackett is trading at an attractive 39% below estimated fair value, offering potential upside as earnings are forecasted to grow annually by 14.67%. The company's focus on Oracle and SAP solutions is likely driving revenue growth prospects further supported by AI investments.

Valhi (NYSE:VHI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Valhi, Inc. operates in the chemicals, component products, and real estate management and development sectors across Europe, North America, the Asia Pacific, and internationally with a market cap of $1.02 billion.

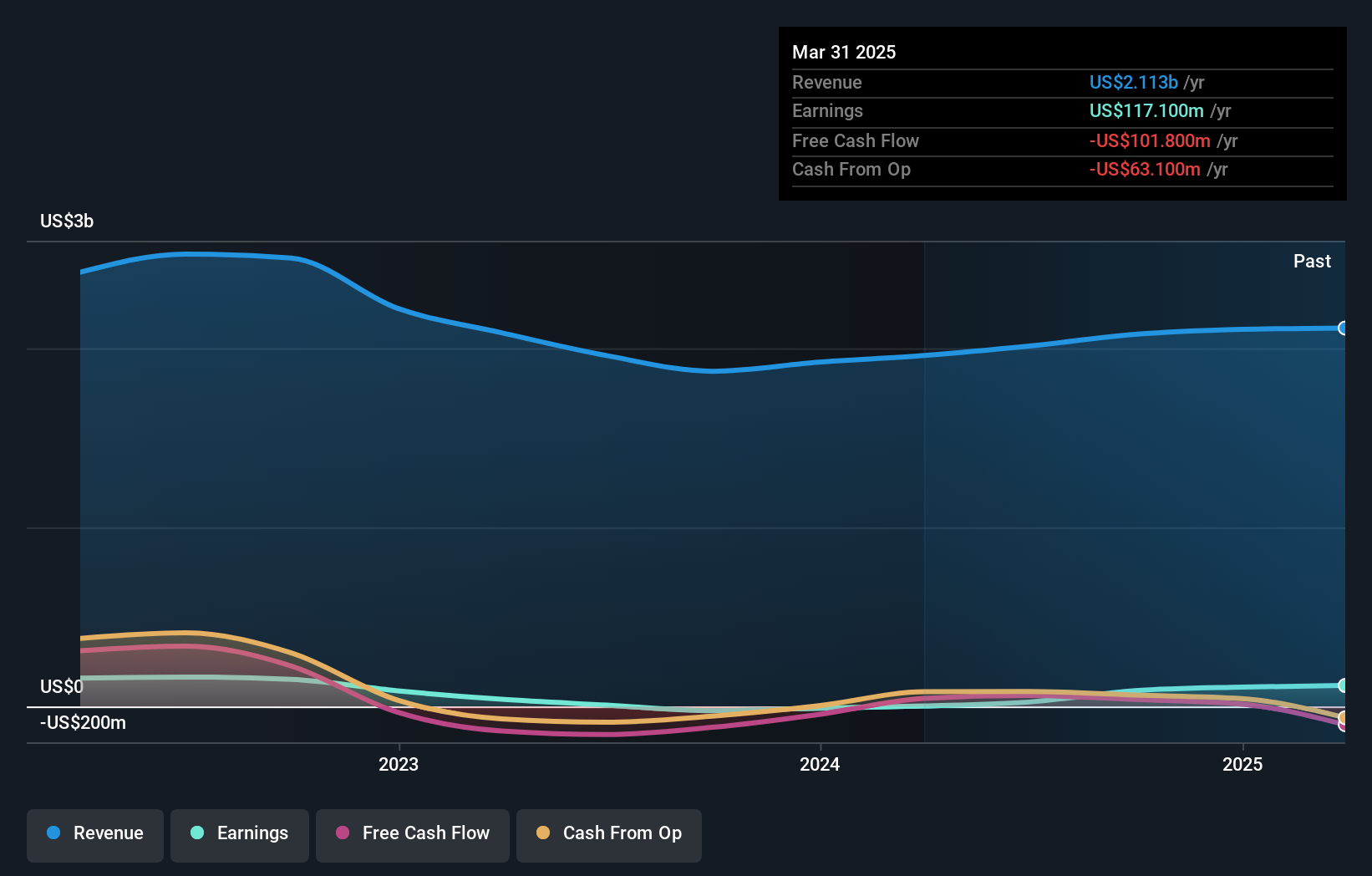

Operations: Valhi generates revenue primarily from its chemicals segment, contributing $1.78 billion, followed by component products at $157.40 million and real estate management and development at $78.50 million. The company's net profit margin reflects its overall financial performance and efficiency in managing costs relative to its revenue streams.

Valhi's recent performance showcases a notable turnaround, with earnings skyrocketing by 215.4% over the past year, outpacing the Chemicals industry which saw a 3.7% drop. The debt to equity ratio has impressively decreased from 78% to 38.7%, reflecting stronger financial health, while interest payments are comfortably covered at 4.7 times by EBIT. Despite a volatile share price in recent months, Valhi remains profitable and free cash flow positive, indicating robust operational efficiency. Additionally, the company declared an $0.08 dividend per share and reported net income of US$19.9 million for Q2 compared to a loss previously.

- Take a closer look at Valhi's potential here in our health report.

Review our historical performance report to gain insights into Valhi's's past performance.

Seize The Opportunity

- Explore the 225 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MBIN

Merchants Bancorp

Operates as the diversified bank holding company in the United States.

Very undervalued with adequate balance sheet.

Market Insights

Community Narratives