- United States

- /

- Packaging

- /

- NYSE:SW

Smurfit Westrock (NYSE:SW) Drops 12% Despite US$7,539 Million Q4 Earnings

Reviewed by Simply Wall St

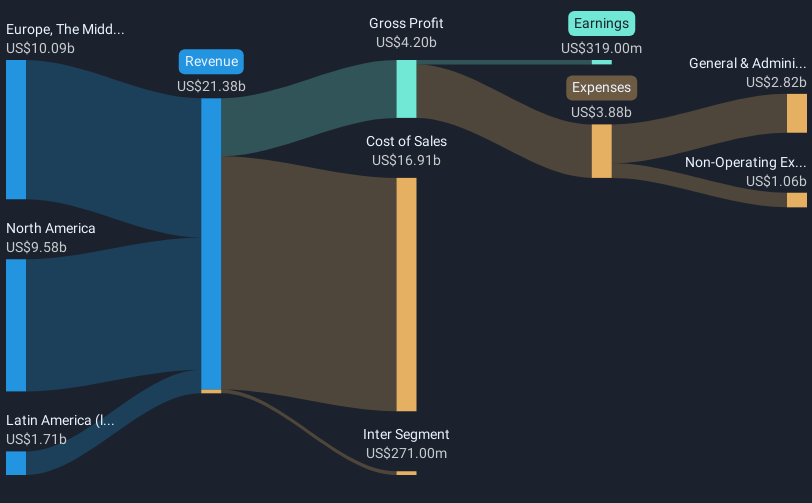

Smurfit Westrock (NYSE:SW) recently experienced an 11.89% decline over the past week, a movement influenced by several factors. Dmitri Stockton's announcement of his resignation from the Board ahead of the May 2025 Annual General Meeting creates a shift in leadership that may have caused investor concern. Similarly, despite reporting significant growth in fourth-quarter earnings, with sales reaching USD 7,539 million, there might be apprehensions around future performance amidst strategic M&A pursuits. Meanwhile, market conditions have been turbulent, with major indexes like the S&P 500 experiencing recent declines in response to tariff implementations and mixed economic data. The general market drop of 3.1% over the same period suggests external economic pressures and investor sentiment might be impacting the company's stock performance. As automakers' shares gained from potential tariff relief, the broader economic environment continues to present challenges for companies including Smurfit Westrock.

Click here to discover the nuances of Smurfit Westrock with our detailed analytical report.

Over the past five years, Smurfit Westrock has achieved a total shareholder return of 36.45%, including dividends. This period has seen several developments that have shaped its trajectory. Key among these was the June 2024 merger announcement between Smurfit Kappa Group and WestRock, creating a combined entity valued at a remarkable $20 billion. This merger may have significantly influenced investor sentiment, especially given the substantial stake retained by Smurfit Kappa shareholders. Furthermore, ongoing M&A activities, as reiterated by CEO Ken Bowles in February 2025, reassure investors of potential long-term shareholder value creation.

However, challenges have emerged, such as the financial strain from the large one-off loss impacting 2024's financial results. Additionally, Primestone Capital's December 2023 reservations regarding the merger highlight ongoing strategic scrutiny. Smurfit Westrock's recent underperformance relative to the US market over the past year serves as a reminder of external market pressures despite its steady progress over the longer term.

- Learn how Smurfit Westrock's intrinsic value compares to its market price with our detailed valuation report.

- Assess the downside scenarios for Smurfit Westrock with our risk evaluation.

- Shareholder in Smurfit Westrock? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SW

Smurfit Westrock

Manufactures, distributes, and sells containerboard, corrugated containers, and other paper-based packaging products.

Medium-low with reasonable growth potential.