- United States

- /

- Packaging

- /

- NYSE:SW

Smurfit Westrock (NYSE:SW): Analysts Upgrade Stock—What Does It Mean for the Current Valuation?

Reviewed by Kshitija Bhandaru

Smurfit Westrock (NYSE:SW) has drawn fresh attention from investors after several analysts upgraded the stock, citing renewed optimism around its prospects. These upgrades focus on price stabilization in the containerboard market and the company’s dominant industry position following its recent merger.

See our latest analysis for Smurfit Westrock.

Despite a volatile few months for paper and packaging stocks, Smurfit Westrock’s 5.15% one-day share price jump stands out, especially after a sector-wide selloff driven by weak competitor results. While the stock is still down 19% year-to-date, its three-year total shareholder return of 77% points to a much stronger long-term performance. Recent momentum suggests investors are warming to the company’s growth narrative as consolidation and price stabilization trends take hold.

If you’re interested in broadening your investment outlook beyond packaging giants, this could be the perfect time to discover fast growing stocks with high insider ownership.

With analyst upgrades stacking up and price targets rising, the big question now is whether Smurfit Westrock’s shares remain undervalued, or if the recent rally signals that the market has already priced in coming growth.

Most Popular Narrative: 23.6% Undervalued

With Smurfit Westrock closing at $43.30 and the most widely followed narrative pinning its fair value nearly $13 higher, the stock's upside case is on full display. The consensus view stacks future earnings growth and margin recovery against present market skepticism.

Ongoing realization of at least $400 million in identified synergies, with management highlighting a similar or greater opportunity from further commercial and operational improvements, should result in sustained increases in margins and operating leverage, materially boosting future earnings.

What are the bold forecasts and projected margin gains behind this bullish target? Some numbers may surprise you and the profit trajectory is not what you’d expect from a traditional packaging company. Unpack the heart of these assumptions inside the full narrative.

Result: Fair Value of $56.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak packaging demand and ongoing cost challenges, especially in Europe, could undermine margin recovery and temper the bullish case for Smurfit Westrock.

Find out about the key risks to this Smurfit Westrock narrative.

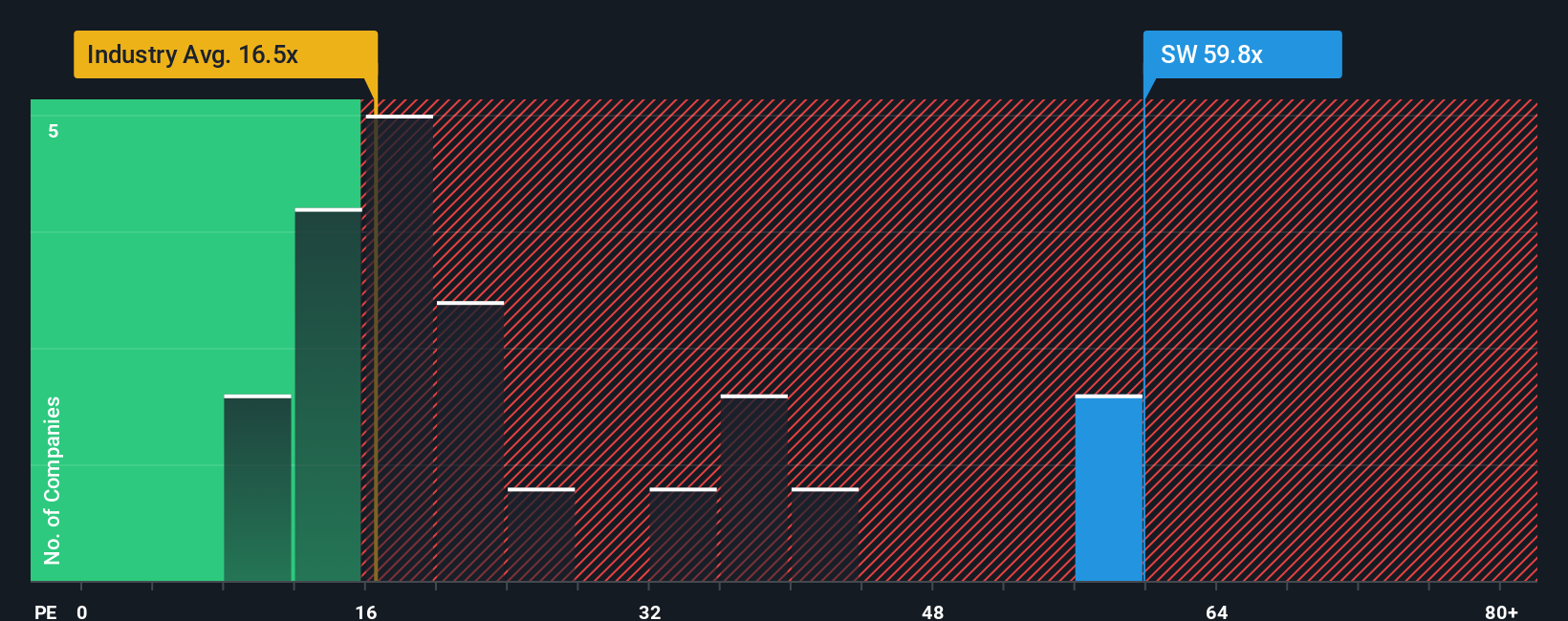

Another View: Risks in the Ratios

While fair value estimates point to Smurfit Westrock being undervalued, its current price-to-earnings ratio tells a very different story. Trading at 64.1x, well above both the global packaging sector average of 16.1x and the peer average of 21.4x, the stock looks expensive by this measure. Even the market’s fair ratio estimate sits at 35.6x, signaling possible downside if multiples revert. Are current forecasts justifying this valuation risk, or is the premium a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Smurfit Westrock Narrative

If the consensus view does not match your expectations, you can quickly analyze the data and craft your own Smurfit Westrock narrative in just a few minutes, all at your own pace. Do it your way

A great starting point for your Smurfit Westrock research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Winning Opportunities?

Every great portfolio needs its hidden gems and fast movers. Go further than the obvious picks. These smart screens each target a different edge that could give you a crucial advantage.

- Unlock the potential of generous income by targeting cash-flow champions through these 19 dividend stocks with yields > 3% with rock-solid yields.

- Catalyze your growth strategy by tapping into emerging breakthroughs via these 25 AI penny stocks that are transforming the world with artificial intelligence.

- Chase high-upside moves by scanning these 3573 penny stocks with strong financials poised for powerful gains and under-the-radar progress.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SW

Smurfit Westrock

Manufactures, distributes, and sells containerboard, corrugated containers, and other paper-based packaging products.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives