- United States

- /

- Packaging

- /

- NYSE:SW

How Mondi’s Profit Warning Could Influence Smurfit Westrock's (SW) Investment Outlook

Reviewed by Sasha Jovanovic

- Earlier this month, shares across the paper and packaging sector declined after competitor Mondi issued a profit warning and reported quarterly earnings that fell below expectations, citing challenging market conditions expected to persist through the end of the year.

- This sector-wide reaction highlights how interconnected industry sentiment remains, as news from one major player has the power to influence perceived prospects and pricing across peer companies like Smurfit Westrock.

- With Mondi’s profit warning triggering broad investor caution, we’ll assess what this means for Smurfit Westrock’s current investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Smurfit Westrock Investment Narrative Recap

To own Smurfit Westrock, you have to believe in a recovery in box and consumer packaging volumes, resilient pricing, and strong operational efficiency despite structural cost pressures, particularly in Europe and North America. The recent profit warning from Mondi has fueled market-wide caution, but this news does not fundamentally alter the fact that near-term margin recovery at Smurfit Westrock still hinges on capacity rationalization and execution on cost synergies; risks from sluggish demand and ongoing margin compression remain front and center.

Among recent announcements, the permanent closure of underperforming US mills stands out as most relevant to today’s concerns. This move directly addresses industry overcapacity and loss-making contracts, which have been key levers for improving profit margins and stabilizing earnings, making operational discipline a critical short-term and strategic catalyst for investors keeping an eye on margin trends.

But for all the optimism, investors should be aware that structural price and cost headwinds in Europe have yet to...

Read the full narrative on Smurfit Westrock (it's free!)

Smurfit Westrock's narrative projects $33.9 billion revenue and $2.2 billion earnings by 2028. This requires 3.2% yearly revenue growth and an increase of $1.85 billion in earnings from $352.0 million today.

Uncover how Smurfit Westrock's forecasts yield a $56.69 fair value, a 38% upside to its current price.

Exploring Other Perspectives

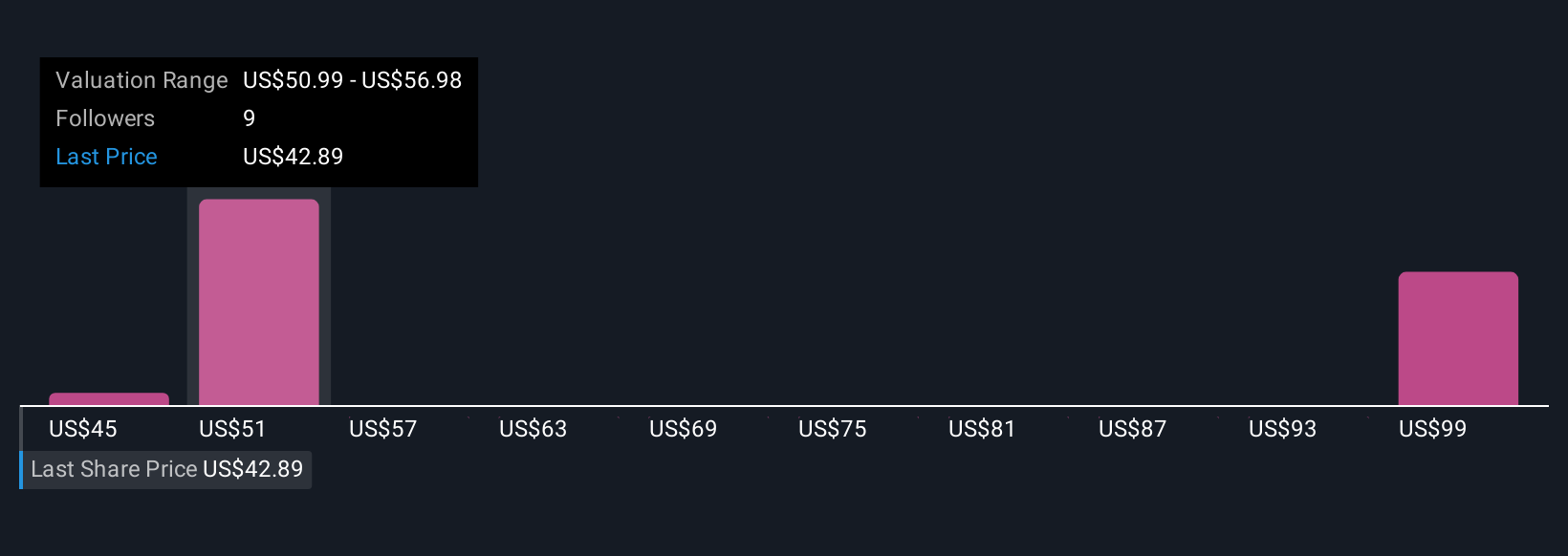

Three community valuations for Smurfit Westrock range from US$45 to US$104, illustrating significant gaps in price expectations. With ongoing pressure on European segment margins, consider how widely opinions can differ before making any conclusions.

Explore 3 other fair value estimates on Smurfit Westrock - why the stock might be worth just $45.00!

Build Your Own Smurfit Westrock Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Smurfit Westrock research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Smurfit Westrock research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Smurfit Westrock's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SW

Smurfit Westrock

Manufactures, distributes, and sells containerboard, corrugated containers, and other paper-based packaging products.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives