- United States

- /

- Chemicals

- /

- NYSE:SQM

How Investors May Respond To SQM’s Record Q3 Lithium Results And Intensified Sustainability Push

Reviewed by Sasha Jovanovic

- Sociedad Química y Minera de Chile recently reported record third-quarter 2025 lithium sales and stronger-than-expected earnings, supported by firmer pricing and an improving supply-demand balance in the lithium market.

- At the same time, the company has intensified its focus on sustainability by deepening dialogue with Indigenous communities and increasing transparency, including public hydrological data, to reduce social tensions around its lithium operations.

- We’ll now explore how these stronger-than-expected lithium results and evolving community engagement efforts influence SQM’s existing investment narrative and risk profile.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Sociedad Química y Minera de Chile Investment Narrative Recap

SQM’s story still rests on investors believing in sustained lithium demand, cost-efficient brine production and a workable long term framework with Chilean authorities. The record Q3 2025 lithium results and firmer pricing directly support the key near term catalyst of volume and margin recovery, while the biggest risk remains lithium price volatility that could quickly reverse earnings momentum. The sustainability outreach helps address long term social and environmental bottlenecks, but does not materially change near term regulatory or price risks.

The most relevant recent development here is SQM’s stronger than expected Q3 2025 earnings, with record lithium sales and better pricing than the market had anticipated. This reinforces the existing catalyst of higher 2025 sales guidance and supports the view that SQM’s low cost position can translate improved lithium market conditions into earnings growth, even as investors continue to watch negotiations around Salar Futuro and potential shifts in Chilean state participation very closely, because if those talks stall or become more onerous...

Read the full narrative on Sociedad Química y Minera de Chile (it's free!)

Sociedad Química y Minera de Chile's narrative projects $6.5 billion revenue and $1.9 billion earnings by 2028. This requires 15.4% yearly revenue growth and about a $1.4 billion earnings increase from $477.5 million today.

Uncover how Sociedad Química y Minera de Chile's forecasts yield a $56.66 fair value, a 10% downside to its current price.

Exploring Other Perspectives

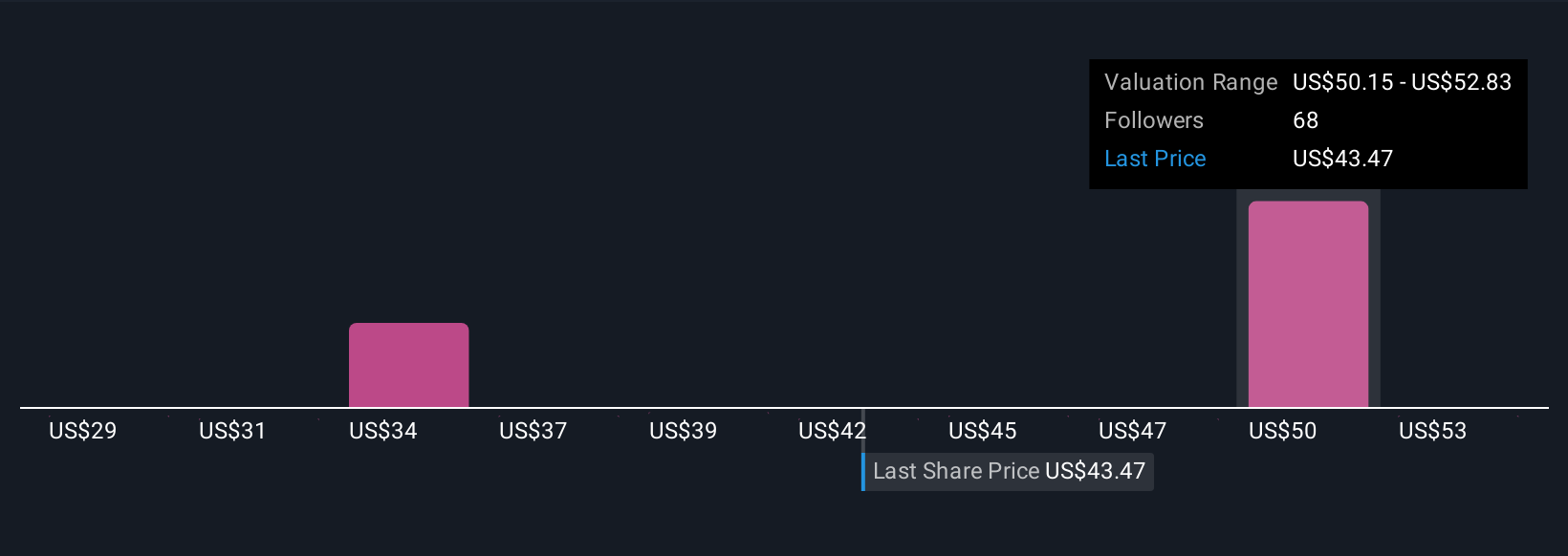

Eight fair value estimates from the Simply Wall St Community span roughly US$31.62 to US$73.79, showing how far apart views on SQM can be. You are weighing those against strong recent lithium earnings that support the current growth catalyst but sit in tension with ongoing concerns about future lithium price volatility and project approvals in Chile.

Explore 8 other fair value estimates on Sociedad Química y Minera de Chile - why the stock might be worth as much as 17% more than the current price!

Build Your Own Sociedad Química y Minera de Chile Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sociedad Química y Minera de Chile research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sociedad Química y Minera de Chile research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sociedad Química y Minera de Chile's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SQM

Sociedad Química y Minera de Chile

Produces and sells specialty plant nutrients, and iodine and its derivatives worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026