- United States

- /

- Packaging

- /

- NYSE:SON

Sonoco Products (SON) Is Up 5.2% After $30M Capacity Boost and Dividend Announcement – What's Changed

Reviewed by Simply Wall St

- In July 2025, Sonoco Products announced a US$30 million investment to boost its adhesives and sealants production by 100 million units annually, along with a quarterly dividend of US$0.53 per share to be paid in September.

- This move spreads out new capacity across three facilities, enhancing supply reliability and strengthening Sonoco's ability to serve growing market demand.

- Next, we'll examine how Sonoco's expanded adhesives and sealants capacity could reinforce its growth narrative and operational resilience.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

Sonoco Products Investment Narrative Recap

To invest in Sonoco Products, shareholders typically need to believe in the company’s ability to capture growth from core packaging markets while adapting to shifts in industrial volumes and consumer demand. The July 2025 announcement of a US$30 million expansion in adhesives and sealants production may enhance operational efficiency and address supply reliability, a key short-term catalyst, but does not directly offset exposure to softness in the company’s Industrial and European segments, which remain areas of risk.

Among recent updates, Sonoco’s US$0.53 per share quarterly dividend declaration stands out, reinforcing the company’s long-standing emphasis on shareholder returns. While dividends bolster confidence, the most important catalyst remains how expansion in adhesives and sealants could offset challenges from sluggish industrial volumes and ongoing portfolio adjustments.

In contrast, investors should be aware of the potential financial drag from slower European demand and...

Read the full narrative on Sonoco Products (it's free!)

Sonoco Products is projected to achieve $8.2 billion in revenue and $603.8 million in earnings by 2028. This outlook assumes a 12.8% annual revenue growth and an earnings increase of about $522 million from current earnings of $81.5 million.

Uncover how Sonoco Products' forecasts yield a $55.36 fair value, a 16% upside to its current price.

Exploring Other Perspectives

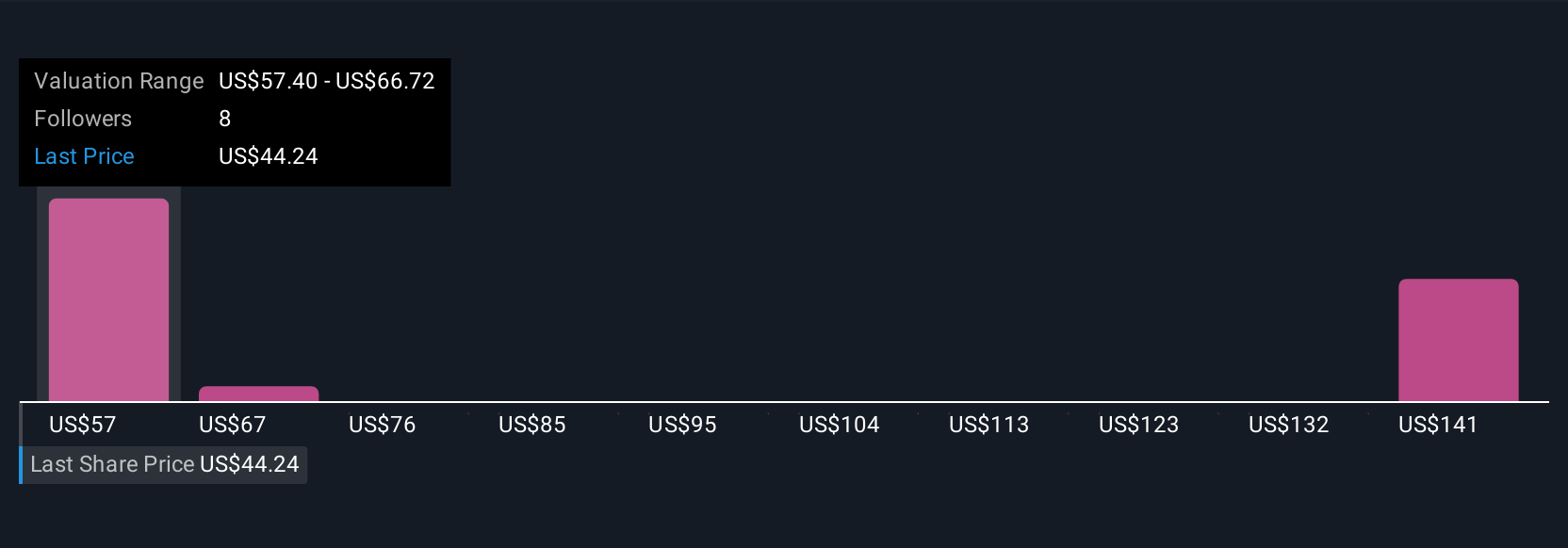

The Simply Wall St Community's three fair value estimates for Sonoco range from US$55.36 to US$95.77, reflecting mixed opinions on the stock’s potential. Amid these varied outlooks, recent capacity investments could reshape future performance, making it important to compare multiple viewpoints before deciding what the numbers really mean for you.

Build Your Own Sonoco Products Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sonoco Products research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Sonoco Products research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sonoco Products' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SON

Sonoco Products

Designs, develops, manufactures, and sells various engineered and sustainable packaging products in the United States, Europe, Canada, the Asia Pacific, and internationally.

Slight with moderate growth potential.

Similar Companies

Market Insights

Community Narratives