The Scotts Miracle-Gro Company (NYSE:SMG) has announced that it will pay a dividend of $0.66 per share on the 6th of September. The dividend yield will be 3.7% based on this payment which is still above the industry average.

See our latest analysis for Scotts Miracle-Gro

Scotts Miracle-Gro's Payment Has Solid Earnings Coverage

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Even though Scotts Miracle-Gro isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Analysts expect a massive rise in earnings per share in the next year. Assuming the dividend continues along recent trends, we think the payout ratio will be 41%, which makes us pretty comfortable with the sustainability of the dividend.

Scotts Miracle-Gro Has A Solid Track Record

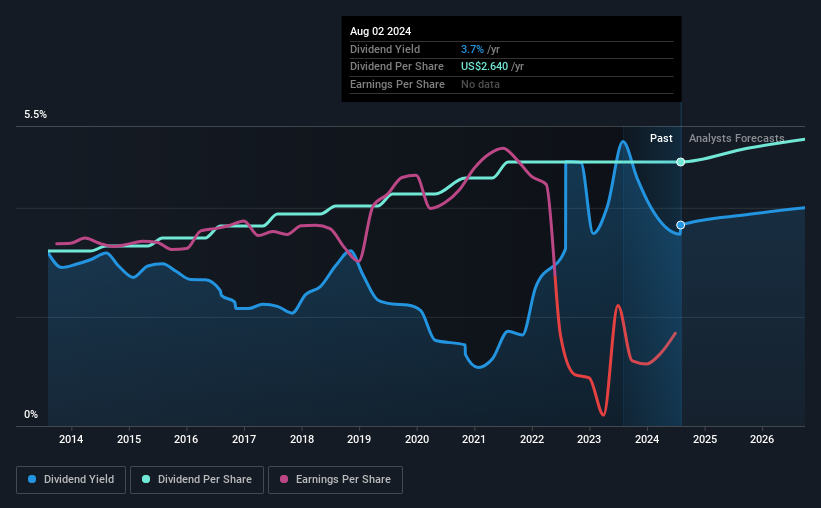

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2014, the annual payment back then was $1.75, compared to the most recent full-year payment of $2.64. This means that it has been growing its distributions at 4.2% per annum over that time. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

The Dividend Has Limited Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Unfortunately things aren't as good as they seem. Scotts Miracle-Gro's earnings per share has shrunk at 52% a year over the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

Our Thoughts On Scotts Miracle-Gro's Dividend

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Scotts Miracle-Gro's payments, as there could be some issues with sustaining them into the future. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 2 warning signs for Scotts Miracle-Gro (1 makes us a bit uncomfortable!) that you should be aware of before investing. Is Scotts Miracle-Gro not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMG

Scotts Miracle-Gro

Engages in the manufacture, marketing, and sale of products for lawn, garden care, and indoor and hydroponic gardening in the United States and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.