- United States

- /

- Packaging

- /

- NYSE:SEE

Will Sealed Air's (SEE) Analyst Upgrades Reveal a Lasting Shift in Its Business Resilience?

Reviewed by Sasha Jovanovic

- In recent days, Sealed Air received multiple analyst upgrades, with RBC Capital and JPMorgan citing cost reductions exceeding US$100 million and stabilization in its Protective and Food segments as key drivers. These favorable assessments highlighted Sealed Air's progress in operational efficiency and division performance, influencing increased market confidence.

- One unique insight is that the company's projected savings and segment recovery are being recognized as tangible improvements, shifting perceptions among industry analysts who now see a more resilient path forward for Sealed Air's business model.

- We'll examine how analyst confidence in Sealed Air's cost cutting and division recovery impacts the company's overall investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Sealed Air Investment Narrative Recap

To own Sealed Air, an investor needs to believe in the company’s ability to deliver sustained cost savings while recovering volumes in its Food and Protective segments, despite challenges around raw material volatility and end-market demand. The recent analyst upgrades reflect growing confidence in the company’s cost reduction and efficiency narrative, but the key short-term catalyst remains further evidence of margin stability, while the ongoing risk is still a potential prolonged protein market downturn. These analyst upgrades reinforce optimism, but do not materially change the immediate risk profile.

Among recent company announcements, the launch of the AUTOBAG® 850HB Hybrid Bagging Machine is directly relevant to the current focus on efficiency and product innovation highlighted by analysts. This release underscores the company’s ongoing push for flexible, sustainable packaging, which aligns with the broader trend toward environmentally responsible solutions and could support the volume recovery now central to Sealed Air’s investment case.

In contrast, investors should not overlook the possibility that sustained weakness in high-margin protein markets could still...

Read the full narrative on Sealed Air (it's free!)

Sealed Air's narrative projects $5.7 billion in revenue and $534.4 million in earnings by 2028. This requires 2.4% yearly revenue growth and a $235 million earnings increase from the current $299.4 million.

Uncover how Sealed Air's forecasts yield a $39.71 fair value, a 18% upside to its current price.

Exploring Other Perspectives

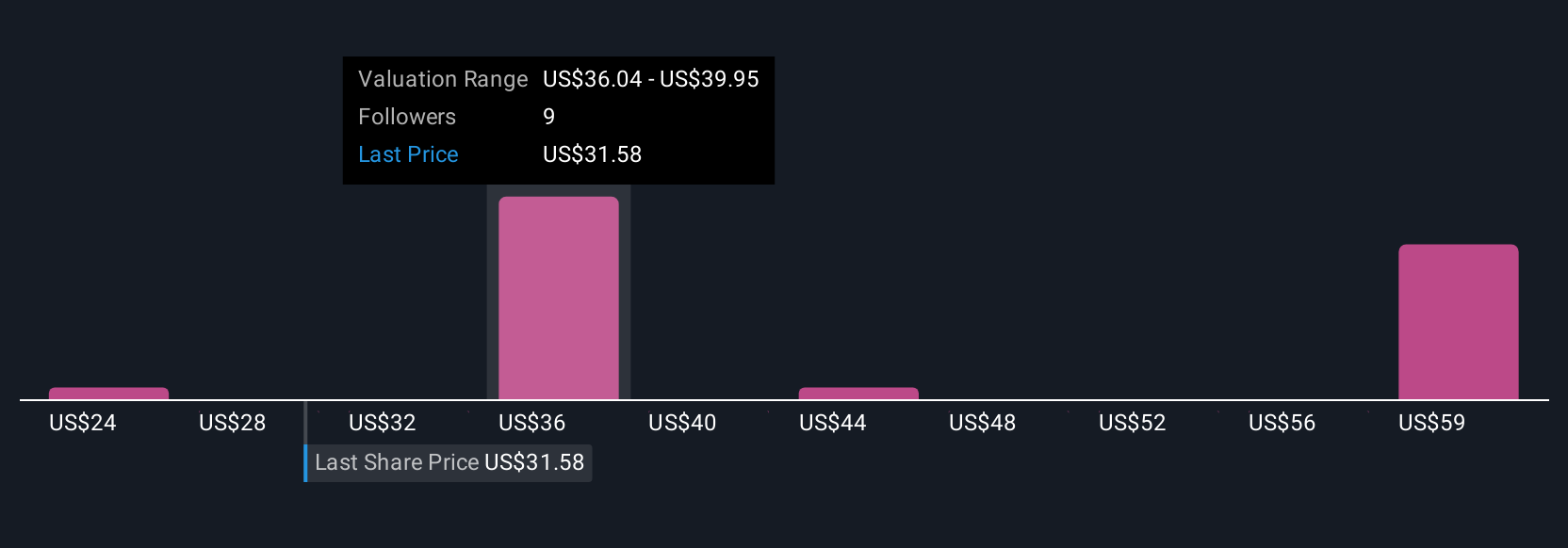

Four fair value estimates from the Simply Wall St Community span US$24.33 to US$63.70, reflecting a wide spread of opinions. While many participants show optimism about product innovation and cost savings, the potential for further margin pressure in protein and food segments remains an important factor to weigh.

Explore 4 other fair value estimates on Sealed Air - why the stock might be worth as much as 89% more than the current price!

Build Your Own Sealed Air Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sealed Air research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sealed Air research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sealed Air's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEE

Sealed Air

Provides packaging solutions in the United States and internationally, Europe, the Middle East, Africa, and Asia Pacific.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives