- United States

- /

- Packaging

- /

- NYSE:SEE

Sealed Air (SEE): Assessing Valuation Following Analyst Upgrades and Improved Operational Outlook

Reviewed by Kshitija Bhandaru

Sealed Air (SEE) has drawn fresh attention as both RBC Capital and JPMorgan upgraded the stock, pointing to meaningful progress on cost savings and improvements across the Protective and Food segments. These updates highlight growing confidence in Sealed Air’s operational direction.

See our latest analysis for Sealed Air.

Despite some recent volatility, Sealed Air’s share price has rebounded 8.9% over the past three months. This suggests momentum may be building as investors warm to its turnaround strategy. However, its one-year total shareholder return remains slightly negative, reflecting the challenges faced earlier in the cycle.

If you’re seeking more ideas beyond packaging, now could be the perfect time to discover fast growing stocks with high insider ownership.

With analyst upgrades and signs of turnaround, the question now is whether Sealed Air is genuinely undervalued, or if its improved outlook and growth prospects are already reflected in its current share price.

Most Popular Narrative: 15% Undervalued

Sealed Air’s current share price of $33.76 stands well below the narrative’s fair value estimate of $39.71, highlighting a gap that could become a catalyst for price movement if expectations are met. Market watchers are eyeing whether optimistic earnings projections and margin expansion will play out as expected.

Ongoing investments in network optimization (new manufacturing facilities, supply chain streamlining, leveraging external R&D/production partners) are expected to improve efficiency and customer service while reducing capital intensity, supporting both future margin expansion and free cash flow generation.

Curious what financial moves underlie that bold fair value? The narrative hinges on ambitious forecasts, including a sharp uptick in profit margins and an earnings surge not seen in years. The actual numbers behind these projections might surprise you. See how they shape the valuation and challenge consensus.

Result: Fair Value of $39.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressures or a prolonged downturn in key food segments could dampen Sealed Air’s growth narrative in the quarters ahead.

Find out about the key risks to this Sealed Air narrative.

Another View: What Do the Numbers Say?

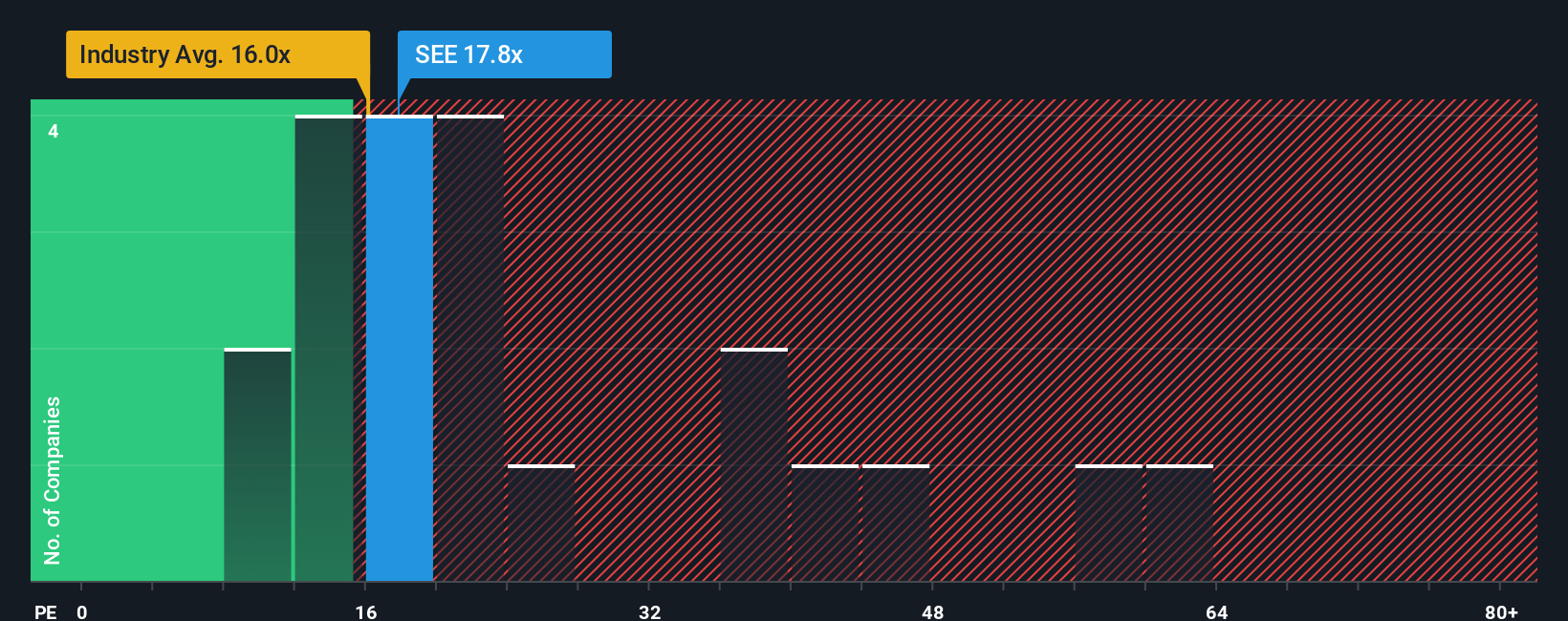

Looking from a multiples perspective, Sealed Air appears attractively valued. Its price-to-earnings ratio of 16.6x is below the peer average of 26.2x and well under the “fair ratio” of 20.5x. Even so, it remains just above the industry average of 16.4x. This gap suggests the market could be underestimating the company's recovery potential, but it may also indicate possible risk if expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sealed Air Narrative

If you have a different perspective, or want to dig deeper into the numbers, you can craft your own analysis in under three minutes with Do it your way.

A great starting point for your Sealed Air research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your edge. Finding fresh opportunities now could mean big rewards later. Use these handpicked lists to uncover high-potential stocks before the crowd catches on.

- Tap into strong recurring income streams by checking out these 19 dividend stocks with yields > 3% with yields above 3% for reliable passive returns.

- Capitalize on advanced technology by starting with these 33 healthcare AI stocks featuring companies harnessing artificial intelligence to transform healthcare.

- Target new value plays and get ahead using these 891 undervalued stocks based on cash flows highlighting stocks priced attractively based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEE

Sealed Air

Provides packaging solutions in the United States and internationally, Europe, the Middle East, Africa, and Asia Pacific.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives