- United States

- /

- Metals and Mining

- /

- NYSE:SCCO

Southern Copper (SCCO) Is Up 9.6% After $800 Million Growth Commitment Amid Copper Supply Disruptions—What’s Changed

Reviewed by Sasha Jovanovic

- In the past week, Southern Copper benefited from a rally in copper prices triggered by supply disruptions at Freeport-McMoRan’s Grasberg mine, while confirming stable production in Peru and committing US$800 million to upcoming projects such as Tía María and Michiquillay.

- This combination of stable production and significant new investments underlines Southern Copper’s approach to addressing long-term global copper demand amid tight supply conditions.

- We’ll now examine how Southern Copper’s new US$800 million investment commitment influences its investment outlook and future growth narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Southern Copper Investment Narrative Recap

For investors interested in Southern Copper, the long-term narrative relies on robust global copper demand, consistent production, and continued expansion through new projects. The recent rally in copper prices supports the positive demand thesis but does not materially change the near-term catalyst: future production growth from pipeline projects. The biggest risk remains potential disruptions from US-China trade tensions or tariffs, which could significantly affect revenue if export conditions change.

The company's commitment of US$800 million to the Tía María and Michiquillay projects stands out among its recent announcements, directly supporting the expansion catalyst that underpins many growth projections. This allocation highlights Southern Copper’s focus on maximizing production capacity and securing supply in a tightening global copper market, themes that matter to anyone watching potential price or revenue upside. Despite this focus on growth, investors must also keep in mind that issues such as trade policy uncertainty could still play a significant role in shaping outcomes…

Read the full narrative on Southern Copper (it's free!)

Southern Copper's outlook anticipates $13.0 billion in revenue and $4.3 billion in earnings by 2028. This projection is based on a 3.1% annual revenue growth rate and a $0.7 billion increase in earnings from the current $3.6 billion.

Uncover how Southern Copper's forecasts yield a $97.31 fair value, a 24% downside to its current price.

Exploring Other Perspectives

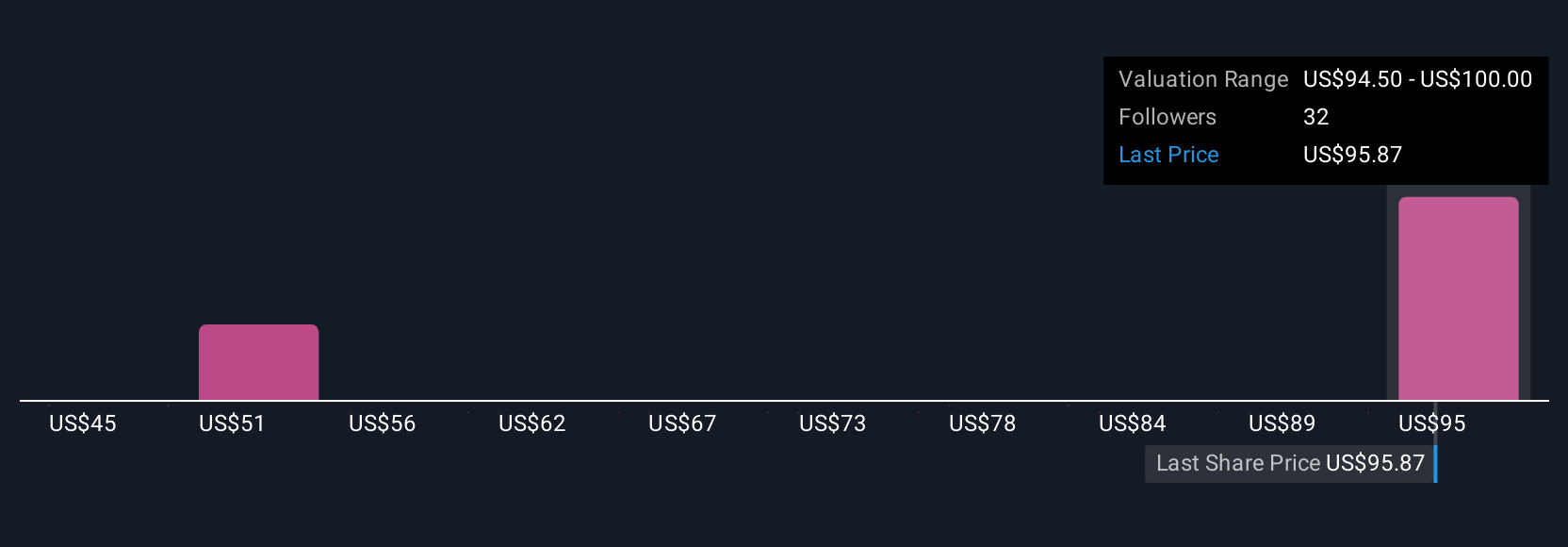

Six different investors in the Simply Wall St Community placed Southern Copper’s estimated fair value between US$45 and US$124.57 per share. Revenue sensitivity to trade policy changes remains a key point of debate with broader implications for future profitability, so check out several views for context.

Explore 6 other fair value estimates on Southern Copper - why the stock might be worth less than half the current price!

Build Your Own Southern Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southern Copper research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southern Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southern Copper's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCCO

Southern Copper

Engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives