- United States

- /

- Metals and Mining

- /

- NYSE:RS

Reliance Industries (NYSE:RS): How Do Strong Results and Expansion Efforts Shape Its Current Valuation?

Reviewed by Kshitija Bhandaru

Reliance (NYSE:RS) just released its latest quarterly results, showing a clear uptick in both net profit and revenue compared to last year. The highlight is strong momentum in its oil-to-chemicals, Jio digital, and retail segments.

See our latest analysis for Reliance.

While Reliance’s latest quarter saw headline growth across key businesses and ambitious partnerships in digital and AI, the market’s response has been more muted. The stock is up just 1.9% year-to-date, and its 1-year total shareholder return is down 7%. This suggests investors remain watchful on capital spending and new ventures, even as long-term total returns remain impressive.

If you’re curious about what else is trending in the market, this could be the perfect moment to broaden your outlook and discover fast growing stocks with high insider ownership

With profits and revenues climbing while shares lag behind the broader market, investors are left to wonder if Reliance is trading at a bargain with upside potential, or if today’s price already reflects tomorrow’s growth.

Most Popular Narrative: 17% Undervalued

Reliance’s most followed fair value narrative places the company’s intrinsic worth well above its recent share price, revealing clear optimism about future earnings and strategic drivers. This sets up a debate among investors: are long-term growth levers about to unlock further upside?

Heightened data center construction, electrification projects, and publicly funded infrastructure spending (schools, hospitals, airports) are driving robust demand for Reliance's specialty steels and engineered materials. This is resulting in market share gains and recurring volume growth, and is poised to benefit both revenue and operating leverage.

Wondering what numbers are behind that bullish valuation? The narrative’s fair value hangs on bold assumptions for long-term sales acceleration and margin improvement, as well as a multiple that beats the industry. Don’t miss which forecasts set the stage for a sharp upside re-rating.

Result: Fair Value of $329.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade uncertainty or cost inflation could diminish Reliance’s margin gains. This may make future revenue and profit forecasts less certain.

Find out about the key risks to this Reliance narrative.

Another View: Multiples Paint a Favorable Picture

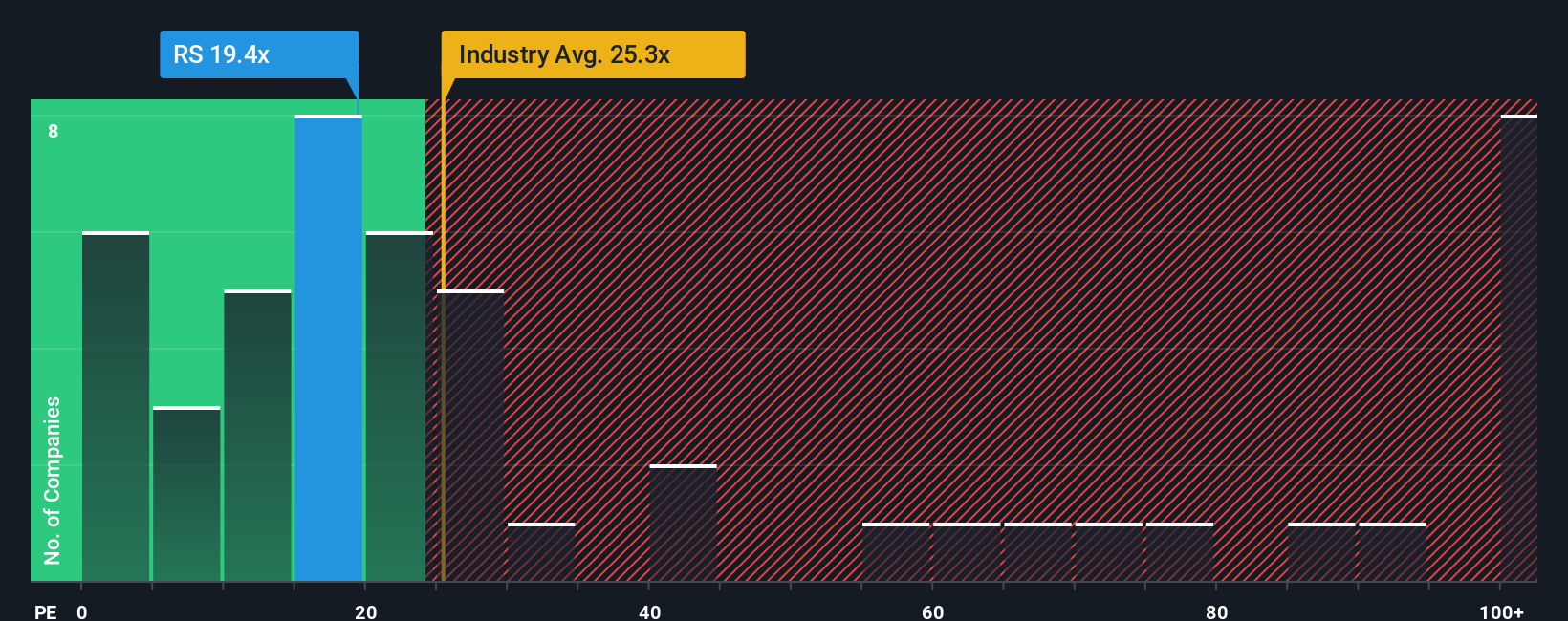

Looking at Reliance through the lens of its price-to-earnings ratio, the shares look attractively valued compared to both peers and industry averages. At 19.4x earnings, the company trades well below industry (25.3x) and peer averages (32.6x), and even below the market’s fair ratio of 20.8x. This suggests investors may have more upside than risk if sentiment improves. However, it is worth considering whether these lower multiples indicate the market is pricing in caution for valid reasons.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Reliance for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Reliance Narrative

If you see things differently or want to reach your own conclusions, it takes just a few minutes to build a custom perspective using your own research. Do it your way.

A great starting point for your Reliance research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know the next big opportunity could be just a click away. Take action now and boost your edge with these hand-picked strategies from Simply Wall Street:

- Tap into income growth by reviewing these 18 dividend stocks with yields > 3%. See which companies are paying yields above 3% and showing sustainable practices.

- Uncover breakthrough technology trends by spotting these 24 AI penny stocks, where artificial intelligence is reshaping entire industries with rapid innovation.

- Supercharge your search for value with these 878 undervalued stocks based on cash flows and find attractively priced stocks that the market may be overlooking today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RS

Reliance

Operates as a diversified metal solutions provider and metals service center company primarily in the United States and Canada.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives