- United States

- /

- Metals and Mining

- /

- NYSE:RS

Assessing Reliance Steel & Aluminum (RS) Valuation Following JP Morgan’s Positive Analyst Coverage Launch

Reviewed by Simply Wall St

Reliance (NYSE:RS) just caught the spotlight after JP Morgan launched coverage on the stock with an "Overweight" rating. Moves like this from a major brokerage can grab the attention of both long-term investors and those scanning for momentum opportunities. The fact that JP Morgan is starting its research with a positive stance adds significance, potentially bringing new eyes and a burst of trading activity to the name.

This latest development comes as Reliance’s shares have delivered steady returns over the past year, with a 6% total gain. While the past month has seen a modest pullback, the long-term story shows substantial price appreciation. The stock has climbed significantly over the past five years. Recent months have also seen Reliance added to several broker “top pick” lists, which may have contributed to changing perceptions around its growth and risk profile.

With major analysts increasing their coverage and momentum shifting, investors may be considering whether Reliance offers a window to buy into future growth at a reasonable value, or if the market is already factoring in this story.

Most Popular Narrative: 11.7% Undervalued

The prevailing view is that Reliance is trading below its fair value. The narrative suggests considerable upside potential based on future growth, margin expansion, and return of capital to shareholders.

Consistently high cash flow generation and ongoing share repurchases are reducing share count and supporting shareholder returns. Together with strong organic growth, these factors can drive higher earnings per share (EPS) even if top-line growth is moderate.

Want to know what’s fueling this bullish target? The narrative hinges on a set of bold financial assumptions and future benchmarks few would expect for this industry. Wondering which surprising growth levers, margin improvements, and capital actions analysts are betting on? The full story is packed with the key forecasts that put Reliance’s fair value well above today’s price.

Result: Fair Value of $329.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, trade policy uncertainty and ongoing inflation could pressure Reliance's margins. This may potentially challenge the optimistic growth narrative analysts have outlined.

Find out about the key risks to this Reliance narrative.Another View: Our DCF Model Offers a Different Perspective

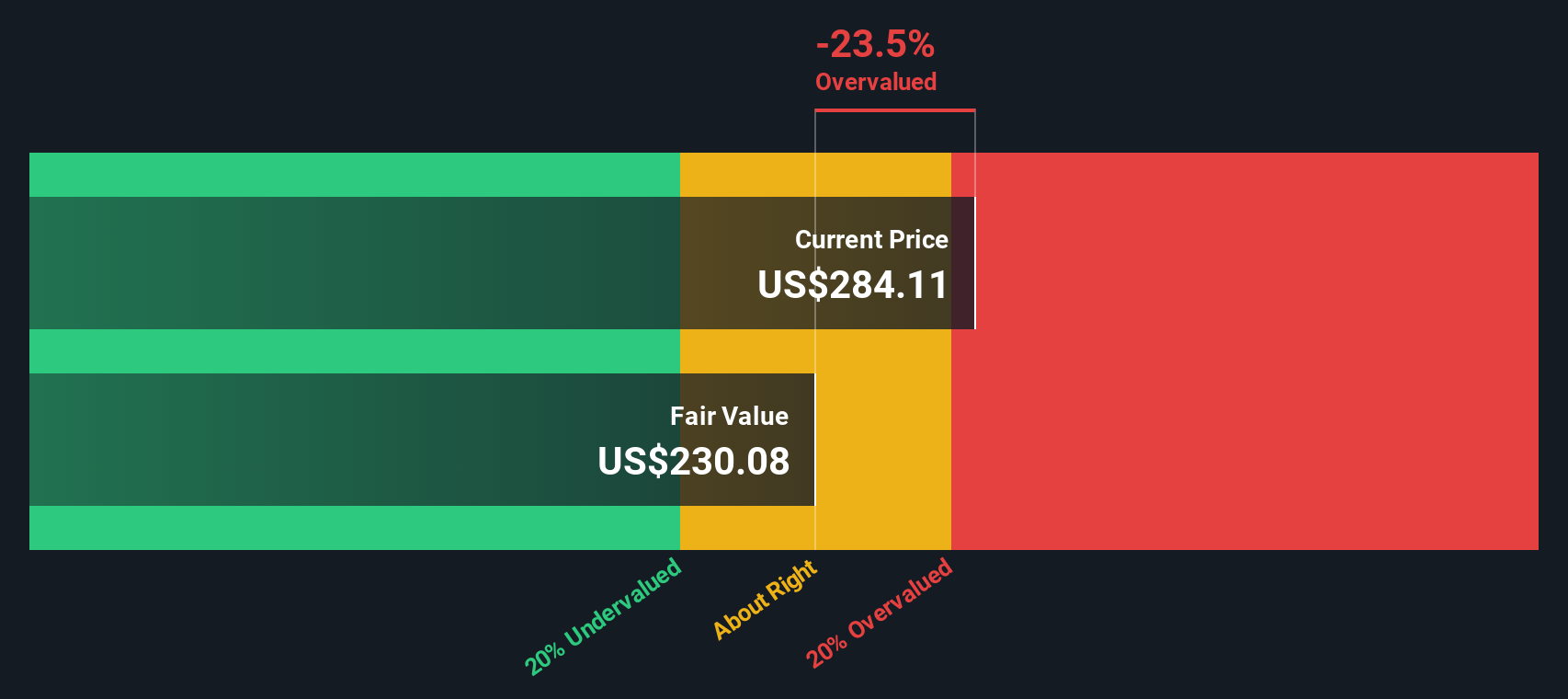

Looking from another angle, our SWS DCF model reaches a different conclusion. This approach weighs Reliance’s future cash flows and suggests the shares may not be as cheap as the market thinks. Which method truly reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Reliance Narrative

If you have a different take or want to dive deeper into the numbers yourself, you can shape your own narrative in just a few minutes. Do it your way

A great starting point for your Reliance research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Ideas to Power Your Portfolio?

Broaden your horizons and catch opportunities most investors miss. Use the right tools now and you could get ahead of the next big move.

- Unlock wealth-building potential by tapping into undervalued stocks based on cash flows, a selection of companies priced below their true worth and ready for savvy investors to act before the crowd.

- Access reliable income streams by zeroing in on dividend stocks with yields > 3%, featuring investments that boast robust yields above 3% and offer stability in any market climate.

- Step into the frontier of innovation with quantum computing stocks to keep pace with the pioneers reshaping technology, computing, and the future of industry.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RS

Reliance

Operates as a diversified metal solutions provider and metals service center company primarily in the United States and Canada.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives