- United States

- /

- Chemicals

- /

- NYSE:PPG

Assessing PPG Industries Stock After 21% Drop and Guidance Cut in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with PPG Industries stock? You are definitely not alone. After all, it is a long-standing leader in paints, coatings, and specialty materials. Right now, a glance at the chart might have you scratching your head. PPG’s share price has stumbled this year, slipping 14.3% year to date and a notable 21.2% over the last twelve months. Investors have seen more red in recent weeks too, with a 4.5% dip just this past week and an overall drop of 10.7% in the last month.

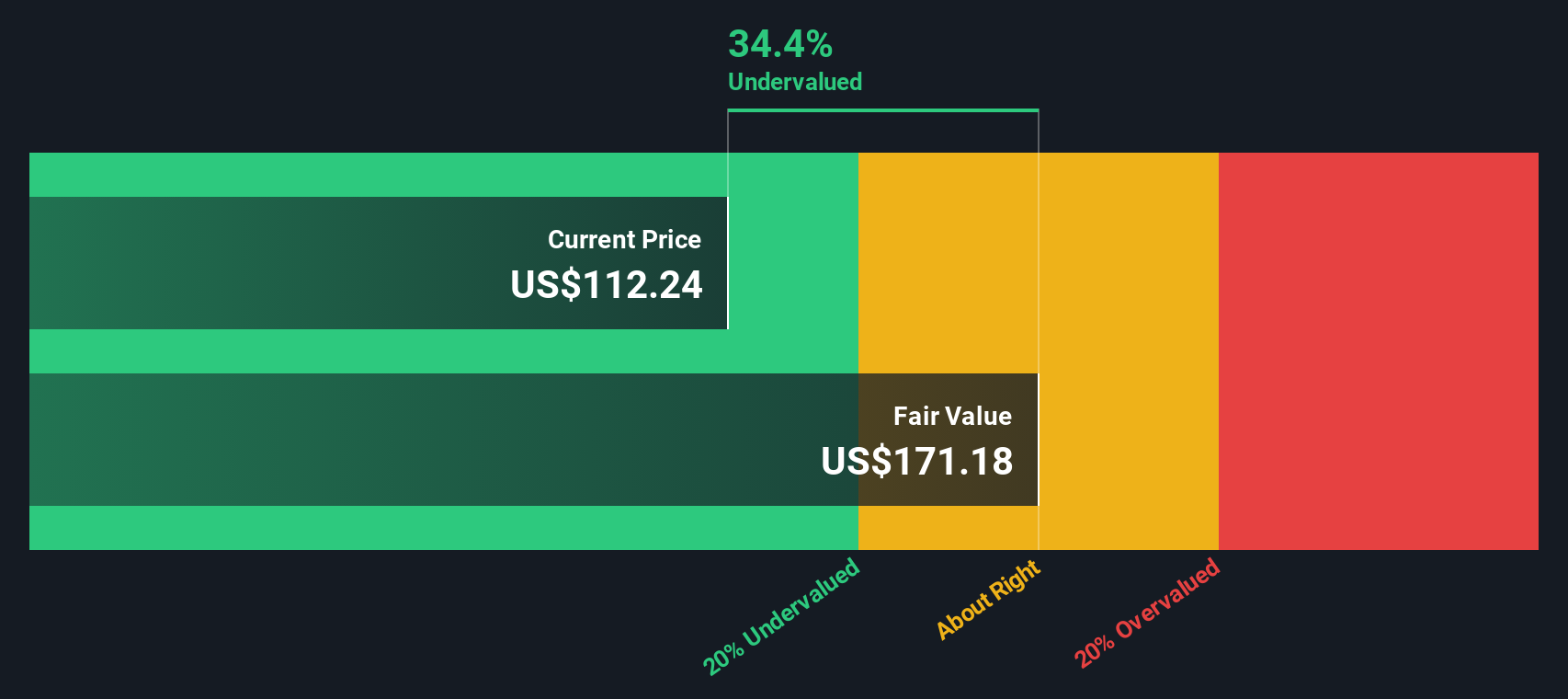

Why the downward drift? It is a combination of market jitters, shifts in demand expectations, and general economic uncertainty that has many industrial stocks trading at cheaper-looking levels. Here is where things get interesting: on paper, PPG Industries looks downright undervalued. Based on our thorough review using six different valuation checks, PPG scores a perfect 6, meaning it is seen as undervalued in every single method we track.

If you are contemplating whether it is time to buy the dip or wait out more volatility, let us take a closer look at what these valuation techniques actually reveal. And at the end, we will share an even sharper way to understand whether PPG’s current price could be an opportunity worth seizing.

Why PPG Industries is lagging behind its peers

Approach 1: PPG Industries Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is truly worth by projecting its future free cash flows and then discounting those figures back to today using a suitable rate. This approach provides a fundamental measure of intrinsic value based on the company's ability to generate cash over time.

For PPG Industries, the most recent annual free cash flow stands at $898 million. Analyst expectations, along with reasonable extrapolations, suggest a solid growth trend. Free cash flow is forecast to reach roughly $1.74 billion by 2028 and is projected to continue growing in subsequent years. These projections are built on historical data and analyst estimates for the first five years, with further years estimated by data providers.

By applying the two-stage free cash flow to equity model, the calculated intrinsic value for PPG Industries’ shares comes out to $153.30. This is based on discounting future cash flows to today’s dollars. Compared to the current stock price, this DCF-derived value indicates that the shares are trading with a 35.5% discount.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PPG Industries is undervalued by 35.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

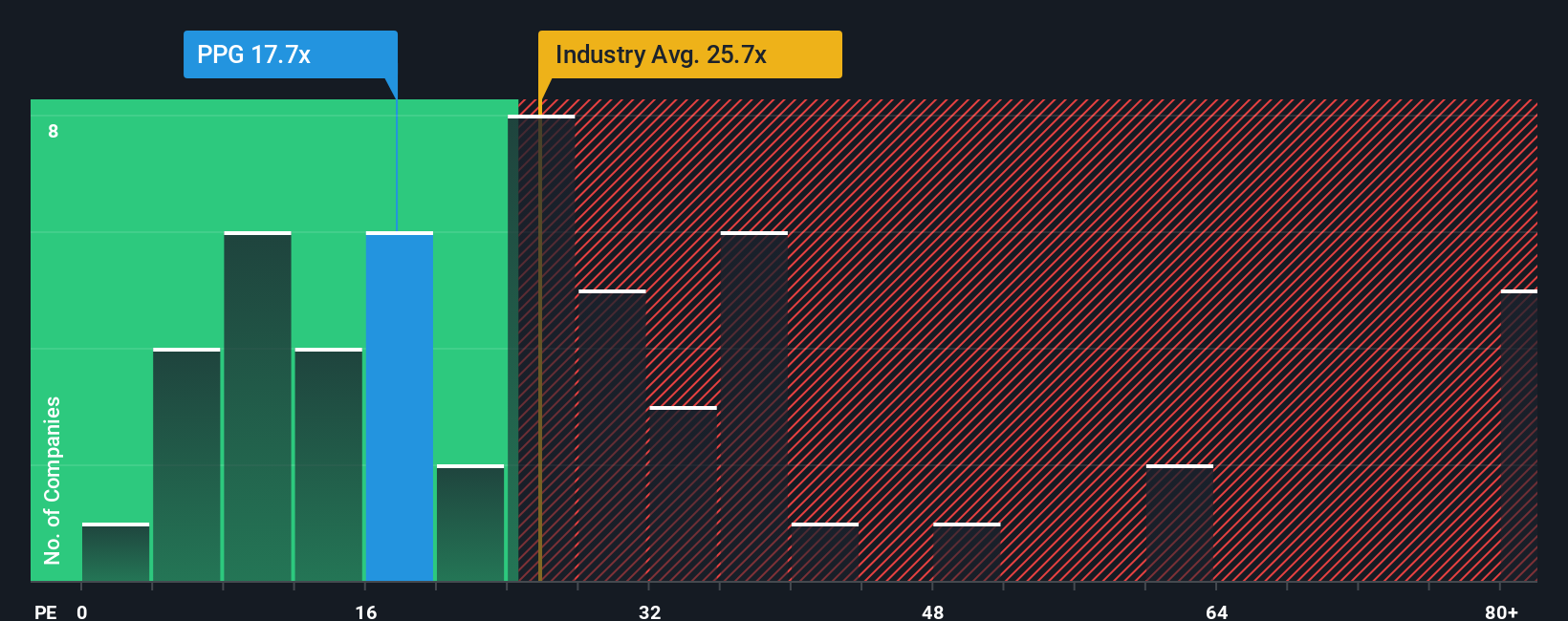

Approach 2: PPG Industries Price vs Earnings

The Price-to-Earnings (PE) ratio is a tried-and-true valuation tool for profitable companies like PPG Industries, because it directly relates the company's current share price to its earnings per share. For investors, a lower PE can suggest more value if the company is expected to grow or at least maintain its profits.

Growth expectations and perceived risk are the two big factors that shape what a “normal” or “fair” PE ratio should look like. Companies with strong, reliable earnings growth typically warrant a higher PE, while riskier or slow-growing firms tend to command a lower ratio.

At the moment, PPG Industries trades at a PE ratio of 17.6x. For context, this is just below the average for its direct peers, which sits at 17.6x, and notably under the chemicals industry average of 25.3x. On the surface, this hints that PPG is more attractively valued than most of its peers and the broader sector.

However, there is a more nuanced way to judge value than just comparing with the crowd. Simply Wall St’s “Fair Ratio” goes deeper by factoring in not only industry and peer benchmarks, but also PPG’s own expected earnings growth, profit margins, market cap, and risk characteristics. Think of it as a comprehensive scorecard for what the company should be worth today.

PPG’s Fair Ratio comes in at 22.3x. Comparing this to the actual PE of 17.6x, the market is currently pricing PPG’s shares well below what would be justified given its outlook and fundamentals. That points toward the stock being undervalued on this measure, not just in isolation, but when all the key factors are considered.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PPG Industries Narrative

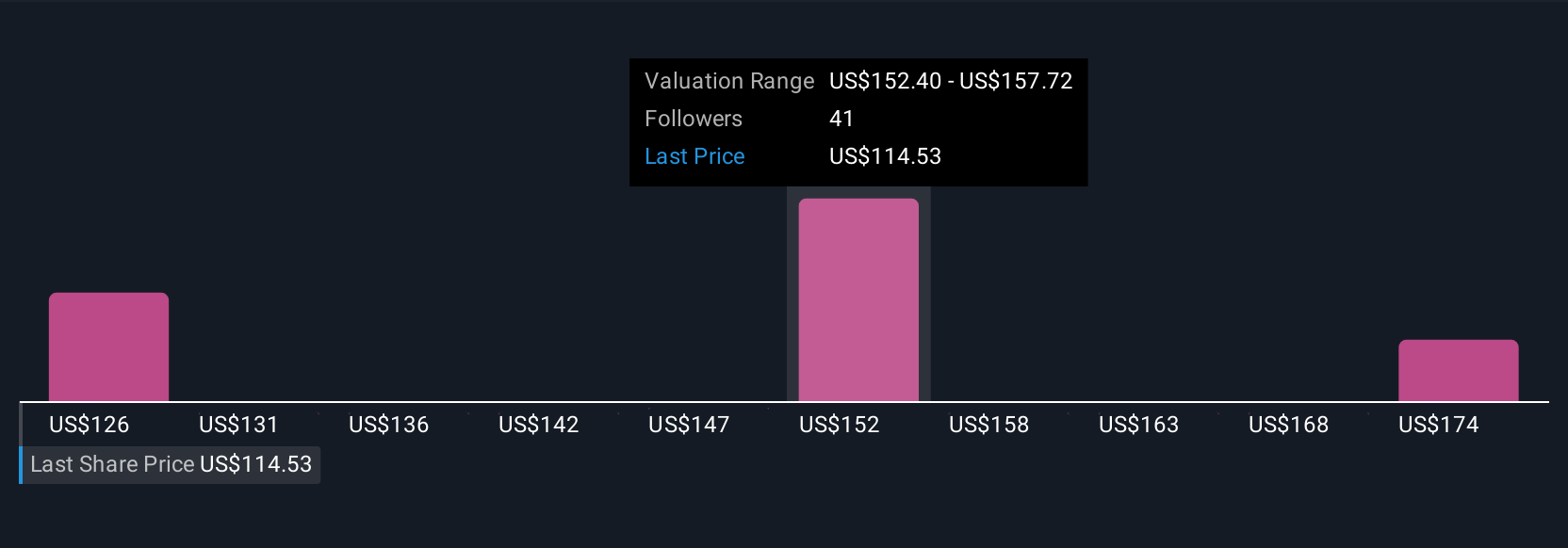

Earlier, we mentioned a better way to understand valuation. Let us introduce you to Narratives, a smarter, more dynamic approach to investing that goes beyond the numbers. A Narrative is your personalized story and perspective on a company, linking what you believe about its future, such as fair value, revenue growth, and profit margins, with the numbers themselves. This approach bridges the gap between what’s happening in the real world and the forecasts powering your investment decisions.

Narratives make it easy to connect your outlook with financial forecasts, automatically generating an up-to-date fair value for any stock, including PPG Industries, and comparing it to the current price. Because Narratives appear on Simply Wall St’s Community page, used by millions of investors, you can quickly build your own or browse others’ perspectives for fresh insights. They update dynamically as new news, earnings results, or data come in, keeping your story current without any extra effort.

For example, one investor’s Narrative for PPG sees it growing revenue by 16 percent and achieving a fair value of $152.76 per share. Another investor expects slower growth at 2.7 percent and assigns a fair value of $125.80, each leading to a different verdict on whether the stock is a buy or a hold right now. Narratives empower you to make better-timed, more confident investment moves as new information emerges.

Do you think there's more to the story for PPG Industries? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PPG

PPG Industries

Manufactures and distributes paints, coatings, and specialty materials in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives