- United States

- /

- Packaging

- /

- NYSE:PKG

Does PKG’s Wallula Mill Shift And Lower-Cost Focus Change The Bull Case For Packaging Corporation?

Reviewed by Sasha Jovanovic

- Packaging Corporation of America recently announced it will permanently shut down the No. 2 paper machine and kraft pulping facilities at its Wallula, Washington mill, while continuing to run the No. 3 machine and recycled pulping operations, cutting annual capacity by 250,000 tons and incurring about US$205 million in pre-tax restructuring charges.

- The reconfigured mill is expected to focus on 285,000 tons of high-performance recycled linerboard and corrugating medium with production costs about US$125 per ton lower than 2025 levels, while the board’s decision to affirm a US$1.25 quarterly dividend highlights management’s willingness to return cash even as it reduces headcount by about 200 roles.

- We’ll now examine how this mill reconfiguration, and its projected US$125 per ton cost reduction, may reshape Packaging Corporation of America’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Packaging Corporation of America Investment Narrative Recap

To own Packaging Corporation of America, you need to believe in steady demand for corrugated packaging and management’s ability to keep costs in check despite cyclical swings. The Wallula reconfiguration directly targets the biggest near term swing factor, mill-level profitability, but also adds execution risk around shifting 250,000 tons of capacity to other sites and managing restructuring costs without disrupting customer service.

The continued US$1.25 quarterly dividend, affirmed again alongside the Wallula announcement, ties this cost focused mill overhaul to a consistent capital return profile. For shareholders, that mix of ongoing cash returns and a projected US$125 per ton cost reduction makes the core catalyst very clear: can PCA translate mill efficiencies into stable earnings, even as it absorbs US$205 million of restructuring charges and a smaller production footprint at Wallula.

Yet investors should also recognize the risk that higher operational costs and cost inflation could still pressure margins if the Wallula savings are offset by rising expenses elsewhere and...

Read the full narrative on Packaging Corporation of America (it's free!)

Packaging Corporation of America's narrative projects $9.5 billion revenue and $1.1 billion earnings by 2028. This requires 3.2% yearly revenue growth and about a $0.2 billion earnings increase from $898.4 million today.

Uncover how Packaging Corporation of America's forecasts yield a $224.70 fair value, a 14% upside to its current price.

Exploring Other Perspectives

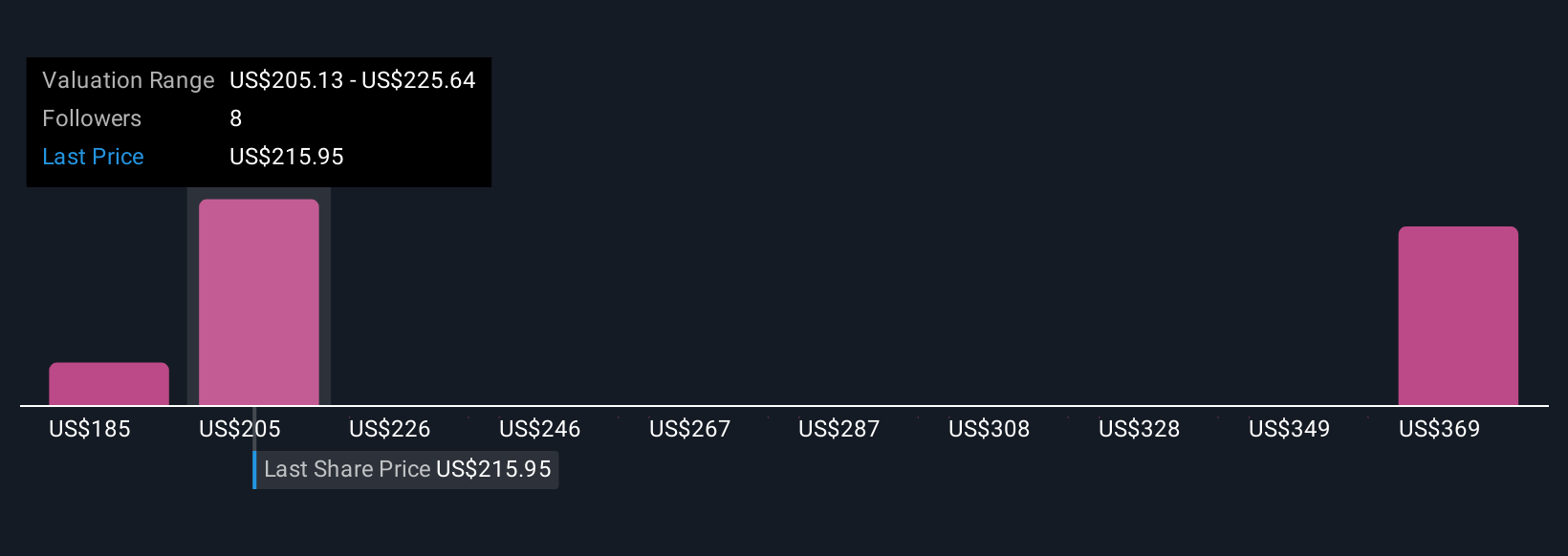

Four fair value estimates from the Simply Wall St Community span roughly US$185 to US$398 per share, underlining how far apart individual views can sit. When you set those opinions against the focus on mill level cost savings as a key earnings driver, it becomes even more important to weigh several viewpoints before deciding how PCA might perform ahead.

Explore 4 other fair value estimates on Packaging Corporation of America - why the stock might be worth over 2x more than the current price!

Build Your Own Packaging Corporation of America Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Packaging Corporation of America research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Packaging Corporation of America research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Packaging Corporation of America's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PKG

Packaging Corporation of America

Manufactures and sells containerboard and uncoated freesheet (UFS) paper products in North America.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026