- United States

- /

- Packaging

- /

- NYSE:PACK

The Market Lifts Ranpak Holdings Corp. (NYSE:PACK) Shares 41% But It Can Do More

Those holding Ranpak Holdings Corp. (NYSE:PACK) shares would be relieved that the share price has rebounded 41% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 58% share price decline over the last year.

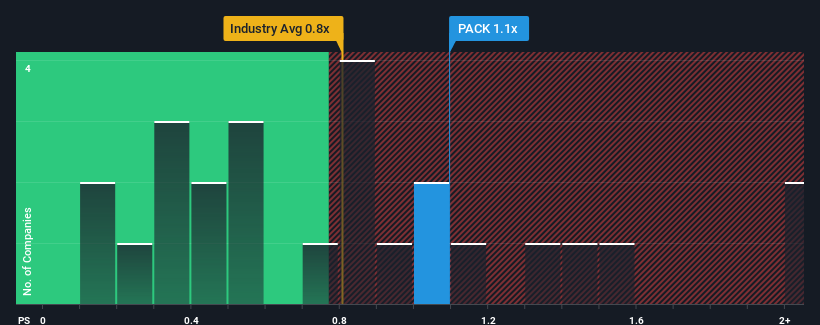

Although its price has surged higher, you could still be forgiven for feeling indifferent about Ranpak Holdings' P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Packaging industry in the United States is also close to 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Ranpak Holdings

What Does Ranpak Holdings' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Ranpak Holdings' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Ranpak Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Ranpak Holdings' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Ranpak Holdings' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. Regardless, revenue has managed to lift by a handy 22% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 7.4% during the coming year according to the three analysts following the company. With the industry only predicted to deliver 1.3%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Ranpak Holdings' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Ranpak Holdings' P/S Mean For Investors?

Its shares have lifted substantially and now Ranpak Holdings' P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Ranpak Holdings' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you settle on your opinion, we've discovered 2 warning signs for Ranpak Holdings that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PACK

Ranpak Holdings

Provides product protection solutions and end-of-line automation solutions for e-commerce and industrial supply chains in North America, Europe, and Asia.

Adequate balance sheet and fair value.