- United States

- /

- Packaging

- /

- NYSE:PACK

Ranpak Holdings Corp. (NYSE:PACK) Stock Rockets 33% As Investors Are Less Pessimistic Than Expected

Ranpak Holdings Corp. (NYSE:PACK) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 91%.

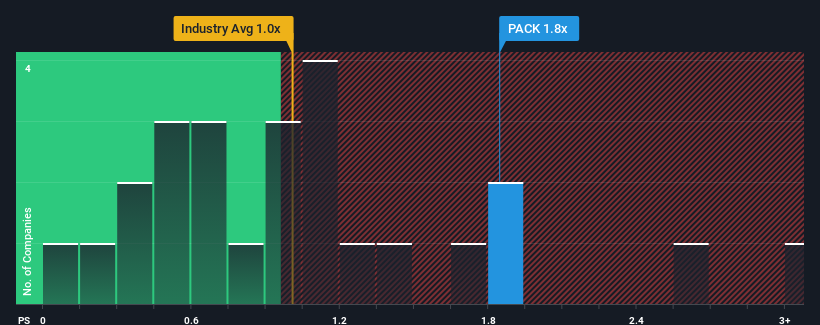

Since its price has surged higher, when almost half of the companies in the United States' Packaging industry have price-to-sales ratios (or "P/S") below 1x, you may consider Ranpak Holdings as a stock probably not worth researching with its 1.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Ranpak Holdings

How Ranpak Holdings Has Been Performing

Recent times have been advantageous for Ranpak Holdings as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ranpak Holdings.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Ranpak Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 8.9%. However, this wasn't enough as the latest three year period has seen an unpleasant 3.4% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 10% during the coming year according to the dual analysts following the company. With the industry predicted to deliver 15% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Ranpak Holdings' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Ranpak Holdings' P/S?

Ranpak Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Ranpak Holdings, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Ranpak Holdings, and understanding should be part of your investment process.

If you're unsure about the strength of Ranpak Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PACK

Ranpak Holdings

Provides product protection solutions and end-of-line automation solutions for e-commerce and industrial supply chains in North America, Europe, and Asia.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives