- United States

- /

- Packaging

- /

- NYSE:PACK

Ranpak Holdings Corp. (NYSE:PACK) Looks Just Right With A 40% Price Jump

Ranpak Holdings Corp. (NYSE:PACK) shareholders would be excited to see that the share price has had a great month, posting a 40% gain and recovering from prior weakness. Unfortunately, despite the strong performance over the last month, the full year gain of 4.1% isn't as attractive.

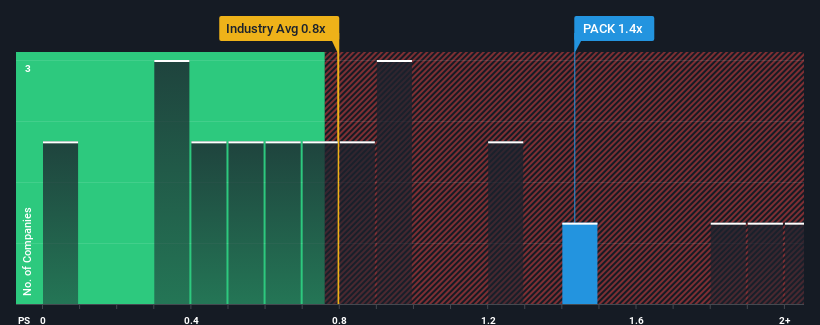

Following the firm bounce in price, you could be forgiven for thinking Ranpak Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.4x, considering almost half the companies in the United States' Packaging industry have P/S ratios below 0.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Ranpak Holdings

What Does Ranpak Holdings' Recent Performance Look Like?

Recent times haven't been great for Ranpak Holdings as its revenue has been falling quicker than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ranpak Holdings.How Is Ranpak Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Ranpak Holdings would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 8.7% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 15% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 6.4% as estimated by the three analysts watching the company. With the industry only predicted to deliver 0.8%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Ranpak Holdings' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Ranpak Holdings' P/S

Ranpak Holdings' P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Ranpak Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Packaging industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Ranpak Holdings.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PACK

Ranpak Holdings

Provides product protection solutions and end-of-line automation solutions for e-commerce and industrial supply chains in North America, Europe, and Asia.

Adequate balance sheet very low.