- United States

- /

- Chemicals

- /

- NYSE:OLN

Will Analyst Downgrade Push Olin (OLN) to Rethink Its Position in the Chemical Sector?

Reviewed by Sasha Jovanovic

- Earlier this week, Citigroup downgraded Olin Corporation’s rating from Buy to Neutral, citing weaker market demand for chlorine derivatives and ongoing challenges in the epoxy sector.

- This shift in analyst sentiment highlights heightened concerns about Olin's ability to meet its future projections due to sector-specific and company-level financial risks.

- We'll examine how analyst caution about uncertain chemical sector demand and financial pressures could shift Olin's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Olin Investment Narrative Recap

To own Olin today, an investor needs conviction in the company’s ability to stabilize earnings through cost discipline and core demand resilience despite sector turbulence. Citigroup’s recent downgrade, driven by persistent weakness in chlorine derivatives and epoxy, raises near-term uncertainty but does not materially alter the fact that margin recovery and end-market stabilization remain the main catalysts, while sector demand volatility stands out as the primary risk.

In light of Citi's caution, the upcoming Q3 2025 earnings report scheduled for October 27, 2025, takes on increased significance. Recent quarterly results reflected ongoing challenges, with sales rising but earnings swinging to a net loss, making the next update essential for tracking management’s ability to deliver on margin improvement and cost initiatives.

However, investors should be mindful that, unlike previous periods of weak demand, Olin is now contending with…

Read the full narrative on Olin (it's free!)

Olin's outlook anticipates $7.4 billion in revenue and $375.3 million in earnings by 2028. This projection depends on a 3.6% annual revenue growth rate and a $389.4 million increase in earnings from current earnings of -$14.1 million.

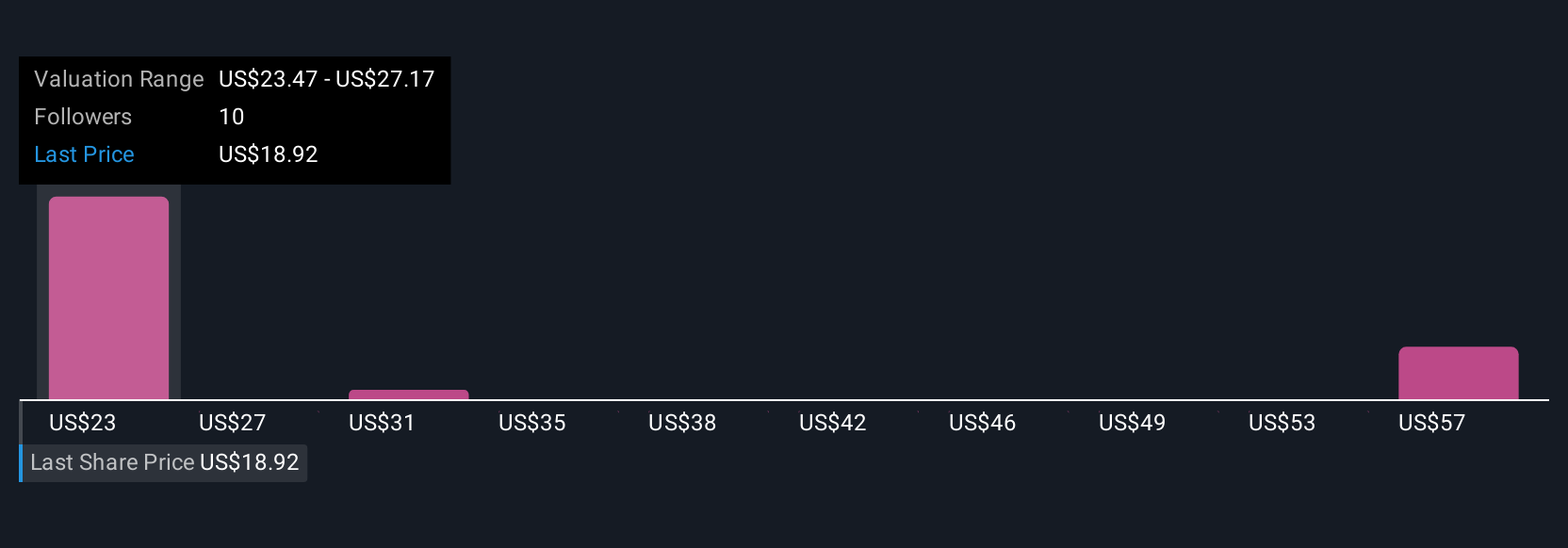

Uncover how Olin's forecasts yield a $23.47 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members posted four fair value targets for Olin ranging from US$23.47 to US$66.93, showing wide divergence. While some see opportunity, ongoing uncertainty about demand in key chemical markets may keep company performance under pressure, explore the full range of views now.

Explore 4 other fair value estimates on Olin - why the stock might be worth 9% less than the current price!

Build Your Own Olin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Olin research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Olin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Olin's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OLN

Olin

Manufactures and distributes chemical products in the United States, Europe, Asia Pacific, Latin America, and Canada.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives