- United States

- /

- Chemicals

- /

- NYSE:OLN

Olin (OLN) Valuation in Focus After Citigroup Downgrade Over Debt and Demand Concerns

Reviewed by Kshitija Bhandaru

Citigroup’s recent downgrade of Olin highlights investor worries about weak demand for chlorine derivatives and persistent challenges in the epoxy segment. The move also underscores concerns about Olin’s elevated debt levels and negative earnings growth trends.

See our latest analysis for Olin.

Olin’s share price momentum has been running out of steam, with lackluster returns despite news like Citigroup’s downgrade and persistent demand headwinds. Over the past year, the stock’s total shareholder return slipped nearly half a percent, reinforcing the sense that both growth prospects and market sentiment remain tepid even after earlier efficiency improvements and asset sales.

If you’re weighing your next move, now is a great time to see what is trending beyond chemicals and discover fast growing stocks with high insider ownership

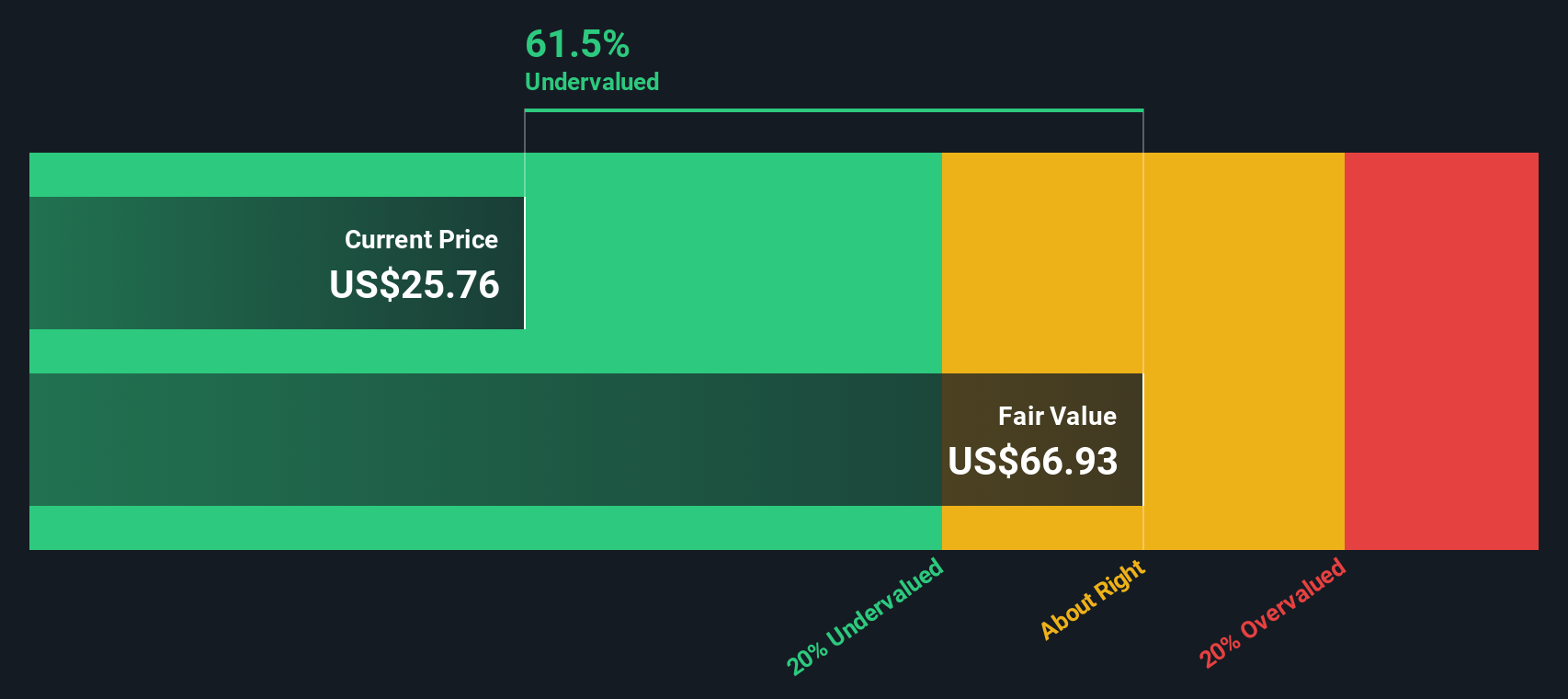

With the share price down notably over the past year and mixed signals in recent company performance, investors are left to consider whether Olin is undervalued at current levels or if the market is already accounting for lackluster growth ahead.

Most Popular Narrative: 7.3% Overvalued

Compared to Olin’s last closing price of $25.19, the most followed narrative calculates a fair value of $23.47, setting the backdrop for some surprisingly ambitious operational shifts that could shape the company’s future.

Structural cost reduction initiatives (Beyond250 and Epoxy cost optimization) are expected to deliver significant operational savings, yielding an estimated $70 to $90 million run-rate benefit by the end of 2025 and additional structural cost reductions from the Stade, Germany facility in 2026. This should improve net margins and boost earnings quality.

Curious what bold moves underpin this narrative’s price outlook? Behind the projection are assumptions about massive cost savings and a sharp, qualitative improvement in earnings power. There’s a big reveal in how these levers are expected to transform margins and profitability. Ready to see what’s driving this call?

Result: Fair Value of $23.47 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global overcapacity and rising competition from low-cost international producers could quickly undermine margin recovery and reignite pressure on Olin’s earnings outlook.

Find out about the key risks to this Olin narrative.

Another View: Our DCF Model Points to Undervaluation

While analyst consensus prices Olin around $23.47 per share, our SWS DCF model offers a different perspective. Using cash flow forecasts, the DCF suggests fair value is as high as $66.94, indicating Olin might be significantly undervalued at current prices. Which approach best captures real investor opportunity here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Olin Narrative

If you have a different take or want to dive deeper, you can craft your own narrative in just a few minutes: Do it your way

A great starting point for your Olin research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Big Investing Move?

Don’t stick to the same stock ideas. Broaden your strategy with fresh opportunities you won’t want to miss. Check these out and take action now:

- Boost steady income and resilient returns by zeroing in on top picks among these 19 dividend stocks with yields > 3% with yields above 3%.

- Get ahead of market trends by targeting the innovators behind these 24 AI penny stocks, where AI breakthroughs are reshaping entire industries.

- Seize hidden gem opportunities with these 909 undervalued stocks based on cash flows that offer compelling value based on strong cash flows and market mispricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OLN

Olin

Manufactures and distributes chemical products in the United States, Europe, Asia Pacific, Latin America, and Canada.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives