The recent 26% drop in Orion S.A.'s (NYSE:OEC) stock could come as a blow to insiders who purchased US$536.3k worth of stock at an average buy price of US$22.35 over the past 12 months. Insiders invest with the hopes of seeing their money grow in value over time. However, as a result of recent losses, their initial investment is now only worth US$429.1k, which is not what they expected.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

Check out our latest analysis for Orion

The Last 12 Months Of Insider Transactions At Orion

Over the last year, we can see that the biggest insider purchase was by CEO & Executive Director Corning Painter for US$324k worth of shares, at about US$21.59 per share. So it's clear an insider wanted to buy, even at a higher price than the current share price (being US$17.88). While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. In our view, the price an insider pays for shares is very important. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels.

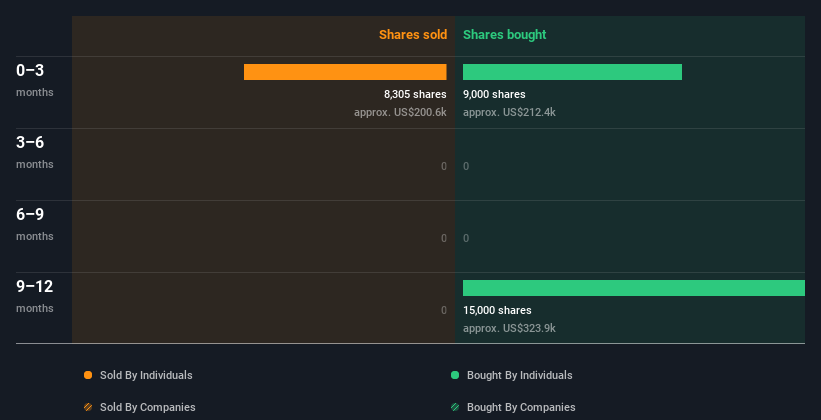

Over the last year, we can see that insiders have bought 24.00k shares worth US$536k. But insiders sold 8.31k shares worth US$201k. In total, Orion insiders bought more than they sold over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

Orion is not the only stock that insiders are buying. For those who like to find small cap companies at attractive valuations, this free list of growing companies with recent insider purchasing, could be just the ticket.

Insiders At Orion Have Bought Stock Recently

Over the last three months, we've seen a bit of insider buying at Orion. They bought US$212k worth in that time. On the other hand, Senior VP of Global Specialty Carbon Black & EMEA Region Sandra Niewiem sold US$201k worth of shares. It is nice to see that insiders have bought, but the quantum isn't large enough to get us excited.

Does Orion Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. It appears that Orion insiders own 2.4% of the company, worth about US$25m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Orion Insiders?

We note a that there has been a bit of insider buying recently (but no selling). That said, the purchases were not large. On a brighter note, the transactions over the last year are encouraging. Overall we don't see anything to make us think Orion insiders are doubting the company, and they do own shares. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Orion. Every company has risks, and we've spotted 2 warning signs for Orion you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OEC

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion