- United States

- /

- Metals and Mining

- /

- NYSE:NUE

How Do Tariffs and Oversupply Affect Nucor’s Stock Outlook in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Nucor stock right now? You are definitely not alone. Whether you have been holding on through the ups and downs, or you are sizing up an entry, Nucor has been on quite a ride. Over the past month, shares have slid almost 8%, and after a modest dip in the last week, some investors are wondering whether the momentum from its strong 18.4% year-to-date return is fading. Zoom out, though, and the picture gets more complex. The stock has soared nearly 200% over five years, even after a 9.7% decline in the last year.

Part of the story comes from a rapidly shifting global steel market. Recent government actions, like the United States imposing new tariffs on imported steel and Canada maintaining steep taxes on U.S. steel, have made waves across the whole sector, pushing risk perceptions up and down. Meanwhile, the long-term outlook contends with global oversupply and ever-changing trade dynamics.

So, where does all this leave Nucor’s valuation? If you are looking for a simple score, Nucor gets a 4 out of 6 on key measures of being undervalued. That is not bad. It means the market is still overlooking some of the company’s strengths, but there may be some risks baked in too. Next up, let us walk through those six valuation checks to see where Nucor gets credit, where it comes up short, and, most importantly, how to figure out if traditional approaches really capture the opportunity here or if there is a smarter way to judge value that most investors are missing.

Why Nucor is lagging behind its peers

Approach 1: Nucor Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating all of a company’s future cash flows and then discounting them back to the present using a specific rate. This process helps determine what the business might really be worth today. This approach aims to look beyond short-term swings and focuses on the longer-term earning power of Nucor.

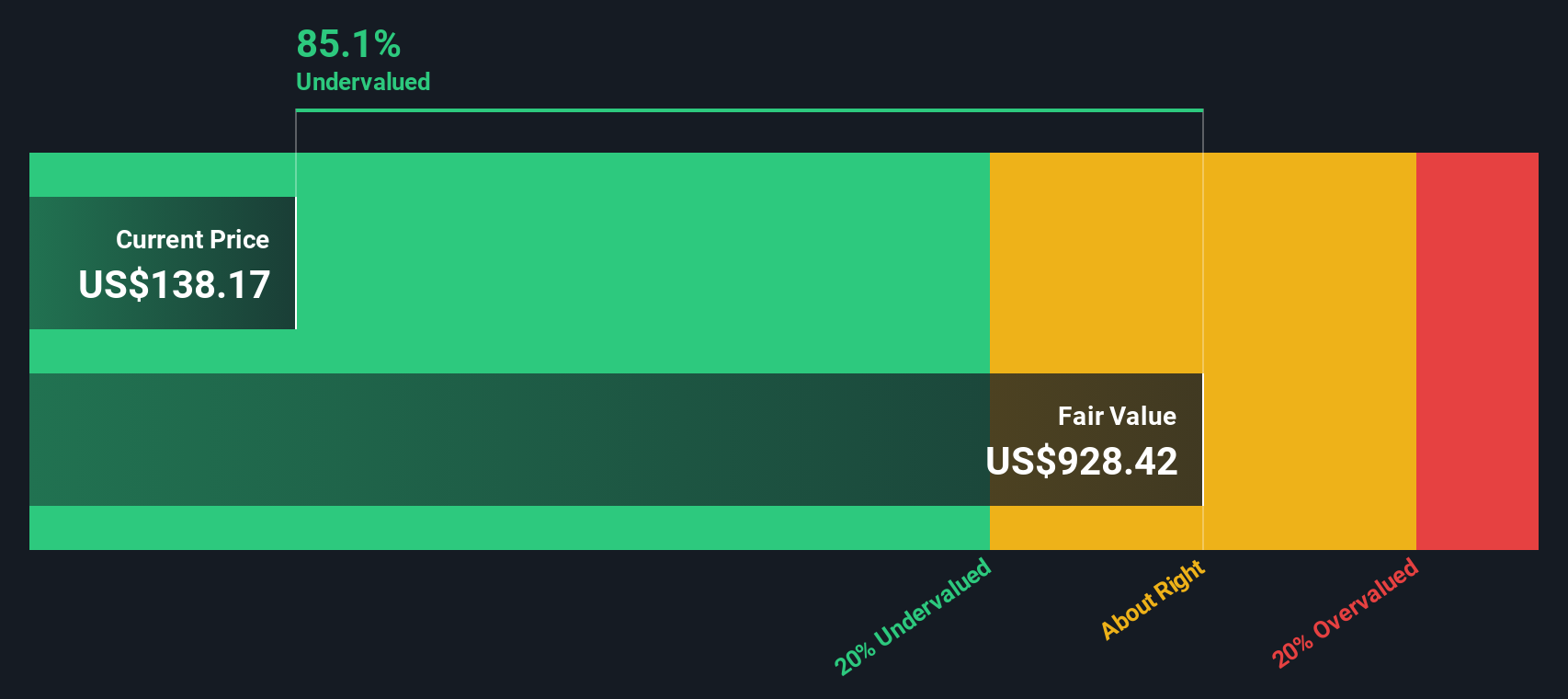

Nucor’s latest reported Free Cash Flow is $622.8 Million. Analysts project that by 2027, annual free cash flows could grow to $3.36 Billion. Longer-range estimates from independent models extrapolate out to $16.2 Billion by 2035. These steady increases reflect expectations for continued growth, while also incorporating some uncertainty for the later years.

Based on these cash flow projections, the DCF model calculates Nucor’s intrinsic value at $935.97 per share. This estimate suggests the stock is currently trading at roughly an 85.5% discount to its calculated fair value. According to this model, Nucor appears deeply undervalued compared to what its future cash flows could be worth today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nucor is undervalued by 85.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Nucor Price vs Earnings (PE)

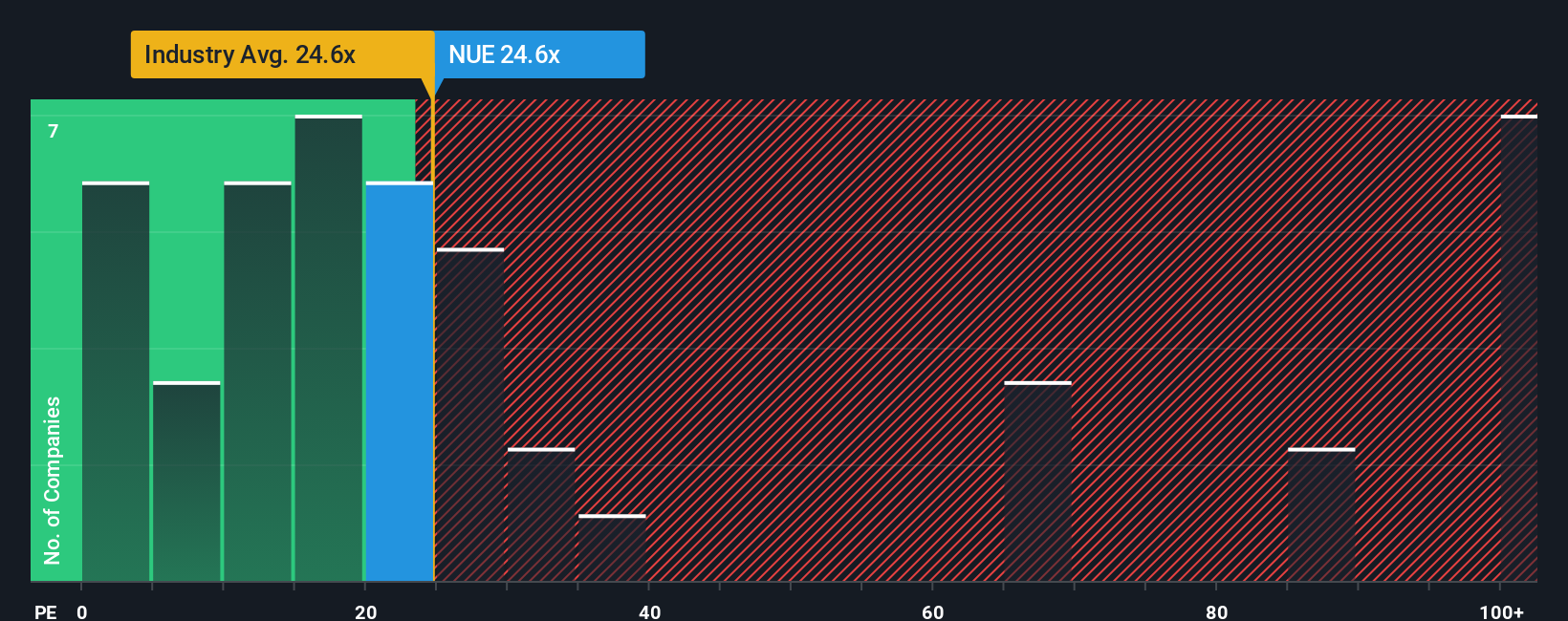

The Price-to-Earnings (PE) ratio is a popular way to judge whether a profitable company like Nucor offers good value for its current share price. It works by comparing the stock’s price to its earnings, making it particularly useful when those earnings are both steady and material, which is the case for Nucor.

Different expectations for future growth and perceived risks have a big influence on what is usually considered a “normal” or “fair” PE ratio. Fast-growing or highly profitable companies often trade at a higher PE, while those facing more uncertainty or slower growth command a lower multiple.

Nucor’s current PE ratio stands at 24.13x. For context, this lines up almost exactly with the average for the Metals and Mining industry, also 24.13x. However, it is well below the average of its peers at 57.51x. At first glance, it might seem that Nucor is undervalued relative to its peers.

This is where Simply Wall St’s proprietary "Fair Ratio" comes in. The Fair Ratio for Nucor, at 37.29x, is calculated using a more nuanced picture of the business. It factors in earnings growth, risks, profit margin, industry specifics, and company size. This approach provides a much clearer signal of whether the stock’s multiple is justified than simply comparing against industry or peer averages.

Comparing Nucor’s actual PE of 24.13x to its Fair Ratio of 37.29x shows that the stock trades well below what would be considered “fair.” This suggests there may be value the market is missing.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

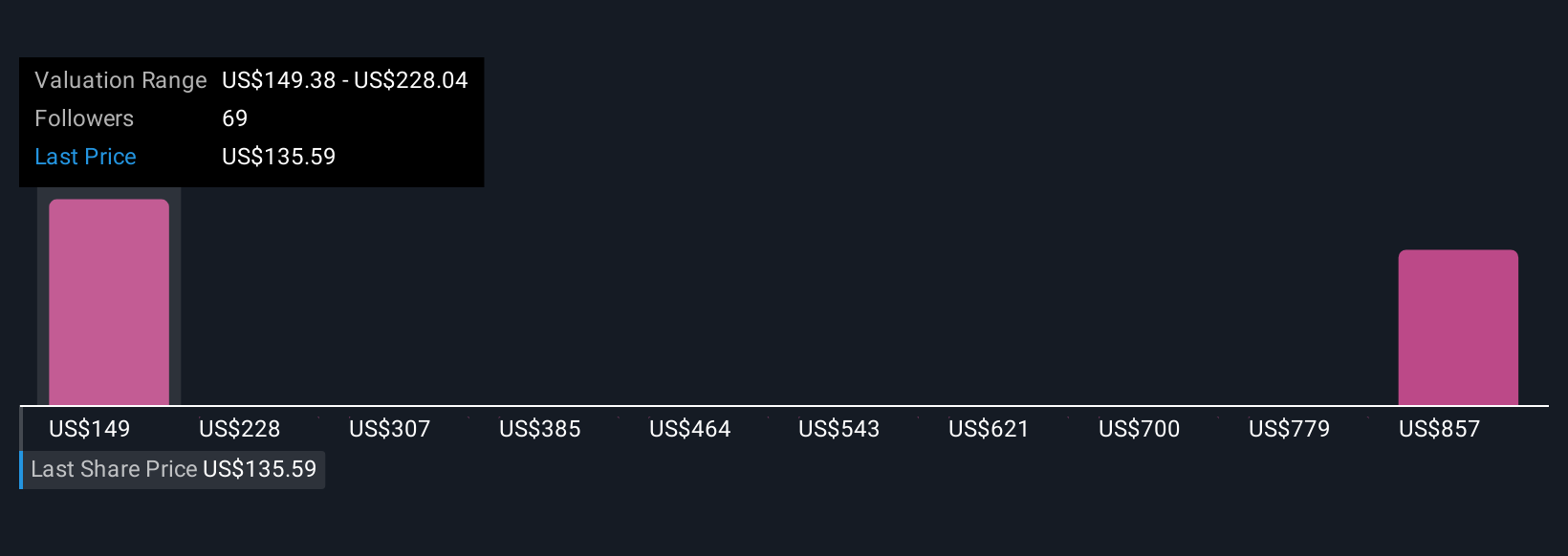

Upgrade Your Decision Making: Choose your Nucor Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your own story about a company, connecting the facts you believe in about its future, such as estimated revenue growth, profit margins, and fair value, to a broader outlook. Narratives make the process of building and sharing your investment perspective simple by linking your vision for a company's future performance directly to a financial forecast and a fair value estimate.

This tool, available on Simply Wall St’s Community page and used by millions of investors, offers an easy, accessible way to make buy or sell decisions that fit your personal view by letting you compare your Narrative’s fair value with the current market price. What truly sets Narratives apart is that they update dynamically whenever new earnings reports or market news come in, ensuring that your investment case always reflects the latest changes.

For Nucor, for example, one Narrative might see its fair value as high as $182.00 based on aggressive assumptions about recovery and tariffs, while another takes a cautious stance with a $145.00 fair value. This showcases how your own assumptions shape your decision making.

Do you think there's more to the story for Nucor? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nucor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUE

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives