Passive investing in index funds can generate returns that roughly match the overall market. But you can significantly boost your returns by picking above-average stocks. For example, the Ingevity Corporation (NYSE:NGVT) share price is up 49% in the last year, clearly besting the market return of around 31% (not including dividends). So that should have shareholders smiling. In contrast, the longer term returns are negative, since the share price is 13% lower than it was three years ago.

See our latest analysis for Ingevity

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last twelve months, Ingevity actually shrank its EPS by 0.3%.

We don't think that the decline in earnings per share is a good measure of the business over the last twelve months. It makes sense to check some of the other fundamental data for an explanation of the share price rise.

Unfortunately Ingevity's fell 5.9% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

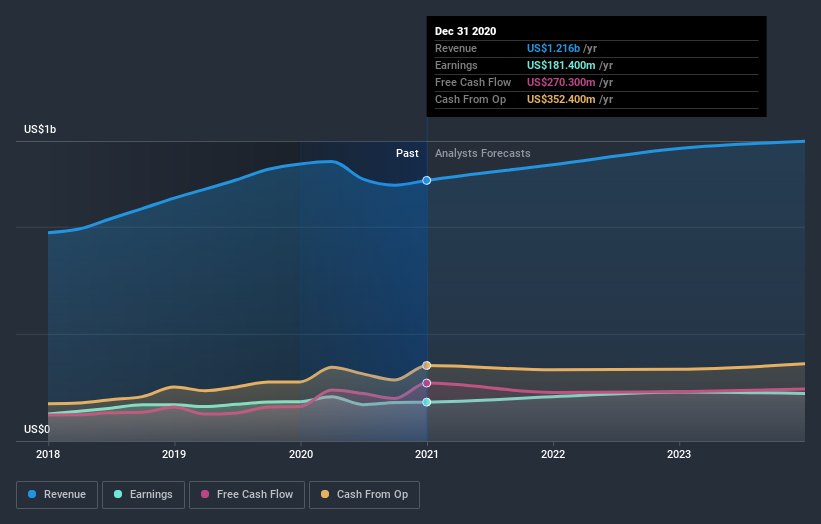

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Ingevity in this interactive graph of future profit estimates.

A Different Perspective

We're pleased to report that Ingevity rewarded shareholders with a total shareholder return of 49% over the last year. That certainly beats the loss of about 4% per year over three years. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Ingevity , and understanding them should be part of your investment process.

Ingevity is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Ingevity, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:NGVT

Ingevity

Manufactures and sells activated carbon products, derivative specialty chemicals, and engineered polymers in North America, the Asia Pacific, Europe, the Middle East, Africa, and South America.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives