- United States

- /

- Metals and Mining

- /

- NYSE:NEM

Newmont (NYSE:NEM) Reports Strong Earnings with Net Income Turnaround

Reviewed by Simply Wall St

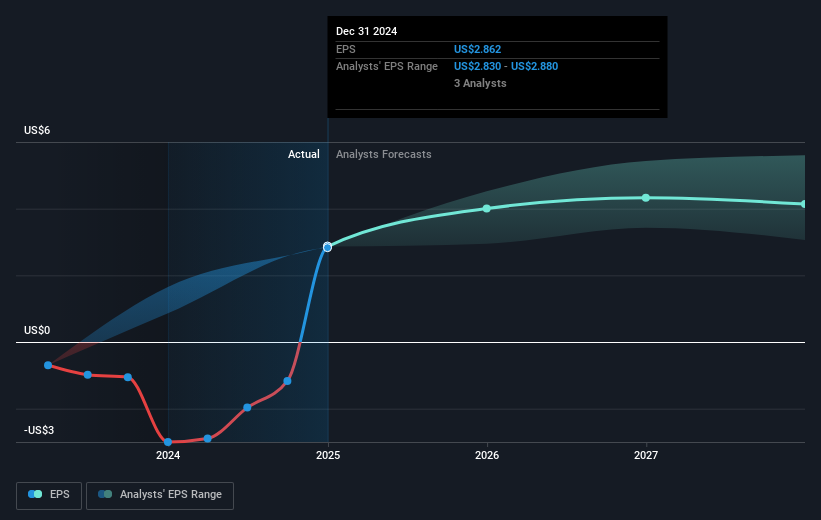

Newmont (NYSE:NEM) recently announced the impending retirement of two board members, highlighting an important phase of leadership change. Over the last quarter, Newmont's share price gained 41%, a significant movement when compared to the market's 5% rise in the last 7 days. Positive earnings results, including a turnaround from a net loss to a substantial net income, provided strong support for this growth. Other factors such as dividend declarations and buyback updates complemented the price uptick. However, a class action lawsuit might have created some resistance against the prevailing upward trend. Overall, the company's developments substantially supported Newmont's upward momentum.

Over the last year, Newmont's total return, including share price appreciation and dividends, reached 45.53%. This performance outpaced the US market's 3.6% return and the US Metals and Mining industry, which saw a decline of 7.5%. The company's substantial growth in share price, alongside dividend distributions, reflects strong investor sentiment despite some recent headwinds such as a class action lawsuit.

The introduction of new board members and leadership changes may positively impact Newmont's revenue and earnings forecasts, as these transitions could bring fresh perspectives and strategies. However, the turnaround in net income from a previous loss suggests a recovery under ongoing initiatives. Analysts have set a fair value price target of US$56.65, which is slightly above the current share price, indicating potential room for further price movement. As Newmont executes its dividend and repurchase programs, these actions are likely to continue supporting shareholder returns in the near term.

Understand Newmont's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newmont might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEM

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives